February 03, 2015

News that's news: Kenya's M-Kopa Solar Closes $12.45m

If there's any news worth blogging about, it is this:

If there's any news worth blogging about, it is this:

Breaking: Kenya's M-Kopa Solar Closes $12.45 million Fourth Funding Round

M-KOPA Solar has today closed its fourth round of investment through a $12.45 million equity and debt deal, led by LGT Venture Philanthropy. The investment will be used to expand the company's product range, grow its operating base in East Africa and license its technology to other markets.

Lead investor LGT Venture Philanthropy has backed M-KOPA since 2011 and is making its biggest investment yet in the fourth round, which also includes reinvestments from Lundin Foundation and Treehouse Investments (advised by Imprint Capital)and a new investment from Blue Haven Initiative.

In less than two and a half years since launch, M-KOPA Solar has installed over 150,000 residential solar systems in Kenya, Uganda and Tanzania, and is now connecting over 500 new homes each day. The company plans to further expand its distribution and introduce new products to reach an even larger customer base.

Jesse Moore, Managing Director and Co-Founder M-KOPA Solar says, "Our investors see innovation and scale in what M-KOPA does. And we see a massive unmet market opportunity to provide millions of off-gridhouseholds with affordable, renewable energy. We are just getting started in terms of the scale and impact of what we will achieve.

Oliver Karius, Partner, LGT Venture Philanthropy says, "We believe that we are at the dawn of a multi-billion dollar 'pay-as-you-go' energy industry. LGT Venture Philanthropy is a long-term investor in M-KOPA Solar because they've proven to be the market leaders,both in terms of innovating and delivering scale. We have also seen first-hand what positive impacts their products have on customers lives - making low-income households wealthier and healthier."

This deal follows the successful $20 million (KES1.8 billion) third round funding closed in December 2013 - which featured a working capital debt facility, led by the Commercial Bank of Africa.

The reason this is real news in the "new" sense is that indigenous solutions can work because they are tailored to the actual events and activities on the ground. In contrast, the western aid / poverty agenda typically doesn't work and does more harm than good, because it is an export of western models to countries that aren't aligned to those assumptions. Message to the west: Go away, we've got this ourselves.

August 24, 2014

On how to interface to regulation and law: follow Michael Jackson of Skype's advice

If you've ever wondered how to deal with the legal side of business, here's the answer, written out by someone who's done it:

To put it bluntly – every bitcoin actor should be reading the law very carefully and finding the loopholes. You should all invest a great deal of time in this – it is hugely important. For example, are you really moving ‘currency’ or are you simply exchanging some sort of token?Life is going to be a lot easier if we take the latter position, as there are no rules that prevent the exchanging of keys. Likewise there are no rules that say keeping a string of data in a cold storage vault makes a business a bank.

So far, many of the proponents of bitcoin have been taking entirely the wrong approach – making claims that attract a raft of unwanted rules and regulations.

Michael Jackson (former COO of Skype and current venture capital investor at Mangrove Capital Partners) has got Bitcoin community's number. I mean that in the sense that he understands, whereas they don't.

Don’t ask permissionCompanies need to just carry on doing what they are doing, if they can make a case for themselves that they don’t need regulation, they shouldn’t even go near it.

People do what they love best: regulators like regulations and want to apply them. If they didn’t, they would have a different job. So, asking for advice is framing the discussion. Once again, companies should read the rules, argue why they are not covered by the rules and use that analysis as a defence, but they should only ask for permission if they are sure it is necessary.

Furthermore, companies shouldn’t ask a lawyer. Expecting a lawyer to find a loophole in the law and to state it on paper simply won’t happen. People should read, understand and learn it themselves. They can test their argument on a lawyer, indeed on anyone, but should not expect anyone else to come up with it.

I feel so much less alone. If you're in a cryptocurrency startup, read that article.

May 11, 2014

(B) The Business Choice of making a Business Investment in Bitcoin (part B of ABC)

Last month, I launched a rocket at those who invest in Bitcoin as the Coin or the Currency. It's bad, but I won't repeat the arguments against it.

For those of you who've survived the onslaught on your sensitivities, and are genuinely interested in how to make an investment into the cryptocurrency world, here is part B: the Business! The good news is that it is shorter.

If one was to look for a good Bitcoin investment in a business, what would it be? I think you should be asking questions like these:

- The business in question has a regulatory model. It doesn't need to be right or sustainable, more that the business owners just need to understand the word. That's because, whether they know it or not, the word is coming for them one day.

- hey have a governance model. Ditto.

- You as investor understand the difference. This is where it gets messy. Most people think the above two terms are the same thing, but they are not. A regulatory model is imposed by a regulator, and is mostly about compliance with something that protects others such as the regulator or their flock (banks). Whereas a governance model is imposed by yourself, over your own operations, to protect your assets and the assets of the customer. Completely different, and completely misunderstood in the eyes of the external stakeholder community. Therefore, likely misaligned in the eyes of the Bitcoin CEO. Do you see where this is going?

- They have a Sean Parker. By this, I mean the person with real experience of this broad Internet / money / social networking business space, the guy who's been there twice before, and this time, *he's there* at the critical juncture to that 2 kids and a fridge full of beer all the way to a big business. See the Facebook movie if this doesn't make any sense.

Signs of a bad investment:

- Wanting to be the next big exchange.

- No relevant experience in the chosen direct business model. This is distinct from the Sean Parker point above. By this I mean, if wanting to do an exchange, the people have / do not have (select one) prior experience in what a daily trading model is, what 5PM is, what governance is, what an internet security model is. E.g., Mt Gox, which traded without understanding any of these things.

- Belief that tech solves all problems.

- No knowledge of what came before the Bitcoin paper.

- Deal hinges in part on banks or regulators. For example, these guys are DITW:

Part of laying the groundwork is bringing the establishment on board, Malka said. “We need more banks participating in this. We need regulators. I’m part of the Bitcoin Foundation – we are out there trying to educate regulators.” Getting regulators on board will help get the banks to come along, Liew predicted. “If the regulators explicitly set forth rules that say, ‘Bright line, do this, you will find a bank that is willing to take on bitcoin customers,’” Liew said.

That's my B list so far. You'll note that it includes no conventional things, because you already have those. All it includes is pointers to the myths-of-doom peddled in the current bitcoin world as business talk. It's designed to separate out the happy hopefuls from the actual business possibilities, in a world where talking is deeper than walking.

Next up, when I get to it, is my A list: a point I believe so important I saved it for another post. Watch this space.

February 03, 2014

FC++ -- Bitcoin Verification Latency -- The Achilles Heel for Time Sensitive Transactions

New paper for circulation by Ken Griffith and myself:

Bitcoin Verification Latency

The Achilles Heel for Time Sensitive TransactionsAbstract.Bitcoin has a high latency for verifying transactions, by design. Averaging around 8 minutes, such high latency does not resonate with the needs of financial traders for speed, and it opens the door for time-based arbitrage weaknesses such as market timing attacks. Although perhaps tractable in some markets such as peer to peer payments, the Achilles heel of latency makes Bitcoin unsuitable for direct trading of financial assets, and ventures seeking to exploit the market for financial assets will need to overcome this burden.

As with the Gresham's paper, developments moved fast on this question, and there are now more ventures looking at the contracts and trading question. For clarification, I am the secondary author, Ken is lead.

October 29, 2013

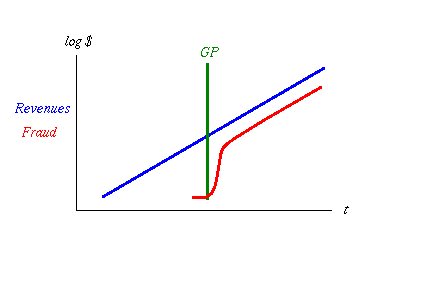

Confirmed: the US DoJ will not put the bankers in jail, no matter how deep the fraud

I've often asked the question why no-one went to jail for the frauds of the financial crisis, and now the US government has answered it: they are complicit in the cover-up, which means that the financial rot has infected the Department of Justice as well. Bill Black writes about the recent Bank of America verdict:

I've often asked the question why no-one went to jail for the frauds of the financial crisis, and now the US government has answered it: they are complicit in the cover-up, which means that the financial rot has infected the Department of Justice as well. Bill Black writes about the recent Bank of America verdict:

The author of the most brilliantly comedic statement ever written about the crisis is Landon Thomas, Jr. He does not bury the lead. Everything worth reading is in the first sentence, and it should trigger belly laughs nationwide.

Bank of America, one of the nation’s largest banks, was found liable on Wednesday of having sold defective mortgages, a jury decision that will be seen as a victory for the government in its aggressive effort to hold banks accountable for their role in the housing crisis."

“The government,” as a statement of fact so indisputable that it requires neither citation nor reasoning, has been engaged in an “aggressive effort to hold banks accountable for their role in the housing crisis.” Yes, we have not seen such an aggressive effort since Captain Renault told Rick in the movie Casablanca that he was “shocked” to discover that there was gambling going on (just before being handed his gambling “winnings” which were really a bribe).

There are four clues in the sentence I quoted that indicate that the author knows he’s putting us on, but they are subtle. First, the case was a civil case. “The government’s” “aggressive effort to hold banks accountable” has produced – zero convictions of the elite Wall Street officers and banks whose frauds drove the crisis. Thomas, of course, knows this and his use of the word “aggressive” mocks the Department of Justice (DOJ) propaganda. The jurors found that BoA (through its officers) committed an orgy of fraud in order to enrich those officers. That is a criminal act. Prosecutors who are far from “aggressive” prosecute elite frauds criminally because they know it is essential to deter fraud and safeguard our financial system. The DOJ refused to prosecute the frauds led by senior BoA officers. The journalist’s riff is so funny because he portrays DOJ’s refusal to prosecute frauds led by elite BoA officers as “aggressive.” Show the NYT article to friends you have who are Brits and who claim that Americans are incapable of irony. The article’s lead sentence refutes that claim for all time.

The twin loan origination fraud epidemics (liar’s loans and appraisal fraud) and the epidemic of fraudulent sales of the fraudulently originated mortgages to the secondary market would each – separately – constitute the most destructive frauds in history. These three epidemics of accounting control fraud by loan originators hyper-inflated the real estate bubble and drove our financial crisis and the Great Recession. By way of contrast, the S&L debacle was less than 1/70 the magnitude of fraud and losses than the current crisis, yet we obtained over 1,000 felony convictions in cases DOJ designated as “major.” If DOJ is “aggressive” in this crisis what word would be necessary to describe our approach?

Read on for the details of how Bill Black forms his conclusion.

May 01, 2013

MayDay! MayDay! British Banking Launches new crisis of titanic proportions...

Yes, it's the first of May, also known as May Day, and the communist world's celebration of the victory over capitalism. Quite why MayDay became the international distress message over radio is not known to me, but I'd like to know!

Yes, it's the first of May, also known as May Day, and the communist world's celebration of the victory over capitalism. Quite why MayDay became the international distress message over radio is not known to me, but I'd like to know!

Meanwhile, the British Banking sector is celebrating its own version of MayDay:

The bank went through their customer base and identified which businesses were asset rich and cash poor.Typically, the SME (small to medium enterprise) would require funding for expansion or to cover short term exposures, and the bank’s relationship manager would work with the business owner on a loan funding cover.

The loan may be for five or ten years, and the relationship manager would often call the client after a short time and say “congratulations, you’ve got the funding”.

The business owner would be delighted and would start committing the funds.

Only then would the relationship manager call them back and say, “ah, we have a concern here about interest rates”.

This would start the process of the disturbance sale of the IRSA.

The rest you can imagine - the bank sold an inappropriate derivative with false information, and without advising the customer of the true costs. This time however the costs were more severe, as it seems that many such businesses went out of business in whole or in part because of the dodgy sale.

In particular, the core issue is that no-one has defined whether the bank will be responsible for contingent liabilities.The liabilities are for losses made by those businesses that were mis-sold these products and, as a result, have now gone into bankruptcy or been constrained so much that they have been unable to compete or grow their business as they would have if they had not taken these products.

Ouch! I have to applaud Chris Skinner and the Financial Services Club here for coming forth with this information. It is time for society to break ranks here and start dealing with the banks. If this is not done, the banks will bring us all down, and it is not clear at all that the banks aren't going to do just that.

Ouch! I have to applaud Chris Skinner and the Financial Services Club here for coming forth with this information. It is time for society to break ranks here and start dealing with the banks. If this is not done, the banks will bring us all down, and it is not clear at all that the banks aren't going to do just that.

Meanwhile back to the scandal du jour. We are talking about 40k businesses, with average suggested compensation of 2.5 million quid - so we are already up to a potential exposure of 100 billion pounds. Given this, there is no doubt that even the most thickest of the dumbest can predict what will happen next:

Mainly because of the Parliamentary investigation, the Financial Services Authority was kicked into action and, on June 29 2012, announced that it had found "serious failings in the sale of IRSAs to small and medium sized businesses and that this has resulted in a severe impact on a large number of these businesses.”However, it then left the banks to investigate the cases and work out how to compensate and address them .

The banks response was released on January 31 2013, and it was notable that between the June announcement and bank response in January that the number of cases rose from 28,000 to 40,000. It was also noteworthy that of those 40,000 cases investigated, over 90% were found to have been mis-sold. That’s a pretty damning indictment.

Even then the real issue, according to Jeremy [of Bully Banks], is that the banks are in charge of the process.

Not only is the fox in charge of the chickens, it's also paying off them off for their slaughter. Do we really need to say more? The regulators are in bed with the banks in trying to suppress this scandal.

Obviously, this cunning tactic will save poor banks money and embarrassment. But the emerging problem here is that, as suggested many times in this blog (e.g., 2, 3, 4, ...) and elsewhere, the public is now becoming increasingly convinced that banks are not healthy, honest members of society.

Which is fine, as long as nothing happens.

Which is fine, as long as nothing happens.

But I see an issue emerging in the next systemic shock to hit the financial world: if the public's patience is exhausted, as it appeared to be over Cyprus, then the next systemic shock is going to cause the collapse of some major banks. For right or wrong, the public is not going to accept any more talk of bailouts, taxpayer subsidies, etc etc.

The chickens are going to turn on the foxes, and they will not be satisfied with anything less than blood.

One hopes that the old Lady's bank tear-down team is boned up and ready to roll, because they'll be working hard soon.

December 16, 2012

Broadly Technical at Mobile Payments Startup (while musing on the impossibility of the reliable social network)

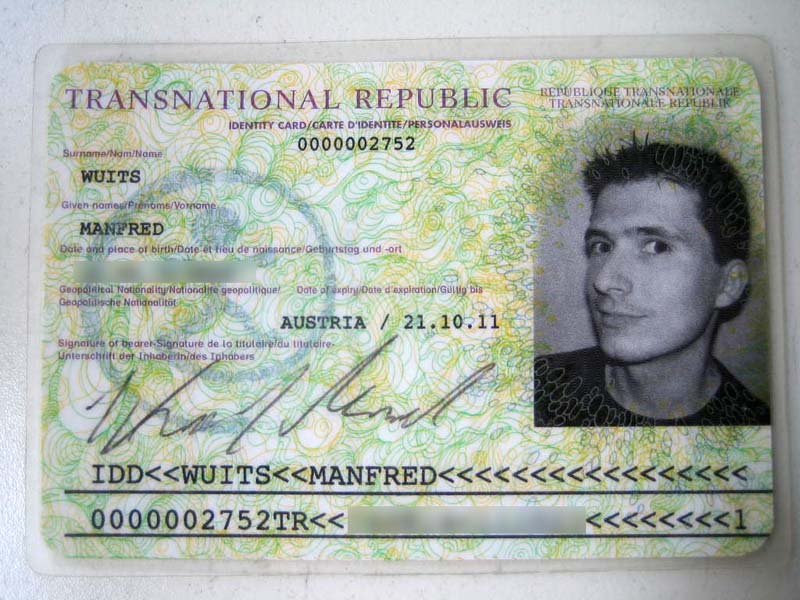

I'm now back in the payments space after a long hiatus. To draw a line from the past, I had a go at updating LinkedIn (yes, that business social network site that everyone complains about and everyone uses) to reflect that, and it just gave me the sense of how bad these systems really are. Minor point is that it insists on a job title - which means what? More oddly, the site led me into the endorsements section and the inevitable flood of claims over people I know.

The end result was? Noise. Looking at the results such as others endorsements over self, there is so much noise -- impossible claims, unlikely falsehoods and let's face it, lies -- in the system that the overall result is unreliable.

I mean that in a specific sense -- The system's only value is found when you are not relying on it. Therefore worthless, QED.

As my friend Ken has it, any claim is only worth the risk you take on it. Since social networking involves no risk, value is capped at somewhere between noise and zero.

But it doesn't have to be that way. In deep contrast, a claim made in CAcert's community of Assurers is worth something. The risk is that you can be arbitrated against for false claims, and people have been. That's a risk -- it might not be easy to put a number on that risk, but it is still a tangible, touchable and definable risk. It's painful when it happens, it's unforgettable.

Other systems and places in society have this worked out. For example, they make you sign statements on paper with words to effect "I make these statements as if in front of a judge and will be found guilty of perjury if I lie." So it is not as if the solutions aren't out there, and by some lights, what happened at CAcert was simply a copy of these other systems. To make light of the CAcert success - it is engineerable and it can be done.

We can imagine a reliable social network, but it seems an unlikely fit with the current vision.

Where existing social networks will fall down in my opinion is that they are too light-weight, almost risk-free. One cannot see the marketing-heavy approach working, one can only see the network collapsing as mouthpieces try and turn their customer base from a lightweight graph into a reliable society. Making someone reliable means turning thumbscrews on them, and every social network is based on exactly not doing that - they promise a pain-free environment, and beyond a certain measure of customer mass, this ensures a value-free environment.

And, counterintuitively, this is why I'm back in the payments space. It is my view that if you want to create a reliable community, you need to do it with thumbscrews. In this case, the payments world has the contractual thumbscrew known as the payment. If Alice pays Bob, they've both got skin in the game, as the North American expression has it. The payments world already gives us cryptographically basis for payments, and therefore for reliable claims.

I'm not talking here about Java crypto and secure receipts and invoicing messages and so forth - all the good old cryptoplumber magic in the last cycle. The really interesting question is the old FC7 thesis -- what are we going to do with it? I don't know the answer as yet but I do know what I'm thinking at a conceptual level: the reliable society.

December 14, 2011

the five parties model, and SPDR GLD invites users to play spot-your-gold-bar

Back in the old days, I invented the five parties model so as to protect static assets that had to be protected. I don't have a good URL for it, because to a large extent I was still in my pre-naivete phase, in which I thought this stuff is basic engineering, don't bother me with doco.

So in brief: A repository stores the metal, on behalf of the issuer of a financial instrument. A signatory, independently to the issuer signs incoming and outgoing metal, so as to stop the secret sales of metal. A Manager receives customer metal and disburses out of a kitty, and interacts via the signatory into the repository for large amounts. Finally, all of the preceeding 4 parties publish reports in real time to the fifth party, the public, who relies on the reports to guard against fudged account and re-use of assets, a.k.a. theft and fraud.

It's as easy as 1,2,3,4,5. Or so I thought:

...just ask Gerald Celente what happened to his so-called gold held at MF Global, or as it is better known now: "General Unsecured Claim", which may or may not receive a pennies on the dollar equitable treatment post liquidation. What, however, was less known is that physical gold in the hands of the very same insolvent financial syndicate of daisy-chained underfunded organizations, where the premature (or overdue) end of one now means the end of all, is also just as unsafe, if not more. Which is why we read with great distress a just broken story by Bloomberg according to which HSBC, that other great gold "depository" after JP Morgan (and the custodian of none other than GLD) is suing MG Global "to establish whether he or another person is the rightful owner of gold worth about $850,000 and silver bars underlying contracts between the brokerage and a client."

In short, the legal titleholder of the silver (MF Global) seems to have re-used the metal of customers, in a process known as hypothecation. Apparently legal, but definately dodgy. As, when MF Global went down due to increasing margin calls on dodgy financial calls, the creditors were left to sort out the opposing positions. Which causes a crisis in faith in the system itself:

Silver positions are being liquidated by COMEX traders after the MF Global fiasco uncovered the fragility of paper assets. ... The issue has been worsened as the CME Group has been unable to refund investor money even after a month after the MF Global filed for bankruptcy. Many traders have pulled out their money from the markets while many are advising others to close their paper trading accounts and instead focus on the physical metal itself.

Now, my view on this was clear: don't do that! The metal held on trust should have been simply held with one-to-one ties between the physics and the paper. Although it is common practice with other assets to loan out customer assets ( http://www.zerohedge.com/news/shadow-rehypothecation-infinte-leverage-and-why-breaking-tyrrany-ignorance-only-solution ) that shouldn't be done with gold or arguably with silver. Precious metal's special feature is its vote against the financial system, which it only preserves when done simply. Not in complexity.

Another point of favourite polemic from those days was whether the gold was ever really there in the first place. Many observers didn't really trust the repositories, a point which was underscored when LBMA announced a few years back that for the first time in around a century, it would start assaying bars at random. How do we know the bars that have been in there for decades are really bars at all?

Auditing technique such as point-in-time spot checks are good ones for flushing out long-lived frauds: tell me right now, on the spot, which is my gold! And then I'll count it. Maybe assay it too.

My idea here in the sense of open governance was to have well known representatives of the body public come in and also audit the stuff. Unlike auditors who were hopelessly conflicted, the five parties thesis said that users could be responsible for auditing the system, *iff* they were given the tools. Then, I too would be delighted that this idea has come of age:

... we were delighted to see that after years of ridicule and provocations, the SPDR GLD ETF finally cracked and decided to do a wholesale PR campaign to comfort the investing public it actually does own its gold, by inviting none other than Bob Pisani in its secret warehouse which allegedly contains 40 million ounces of gold,

When an unbiased user goes in there and touches the gold, she has no particular incentive to do anything than report what is seen. All parties are incentivised to make it real. Or so we thought:

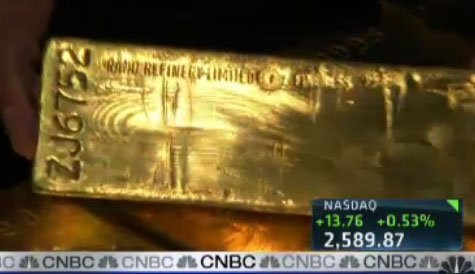

While the 4 minute PR campaign is enjoyable and we invite readers to watch it, what is amusing is that it is sure to set off another set of conspiracy theories. Here's the reason: amusingly the very gold bar that Pisani demonstrates so eagerly for the camera, Rand Refineries ZJ6752, is somehow, at last check, missing from the full barlist as posted daily by the GLD. Whose is it? Where did it go? When was this clip shot? Inquiring minds want to know...

Oops! Not their bar... At the direct level, the visit by none-other-than Bob Pisani proved *NOTHING* about the reserves of gold. It did show that the issuer SPDR GLD ETF felt that it could do a pretty marketing presentation, and that would substitute for real governance.

It did however prove everything about the five parties model and the wider question of open governance: The User closes the circle, if the circle exists and can be closed. Read the above post for the conspiracy theories and supporting analysis that the bar so displayed was not "in the vault" at all. I'll just leave you with this insight into open governance:

Our advice: please tell your client HSBC to open up its vault to general observation and assay: at that point, we are confident all conspiracies will end. Until then, be prepared to be retained by HSBC on a frequent basis as more and more ask themselves: what is really in that vault?

The users have called SPDR GLD ETF's bluff. Is there gold in the vaults? To me, this stinks, and raises a sell question over SPDR GLD. Just as you insist on real gold in your real issuance of Internet gold, don't go short on the governance. Insist on full open governance with five parties in control. Demand those reports, insist on independent visits.

Now, more than ever. Chances are good that everyone will see their governance model tested within the next 12 months.

August 07, 2011

Regulating the future financial system - the double-entry headache needs a triple-entry aspirin

How to cope with a financial system that looks like it's about to collapse every time bad news turns up? This is an issue that is causing a few headaches amongst the regulators. Here's some musings from Chris Skinner over a paper from the Financial Stability gurus at the Bank of England:

Third, the paper argues for policies that create much greater transparency in the system.This means that the committees worldwide will begin “collecting systematically much greater amounts of data on evolving financial network structure, potentially in close to real time. For example, the introduction of the Office of Financial Research (OFR) under the Dodd-Frank Act will nudge the United States in this direction.

“This data revolution potentially brings at least two benefits.

“First, it ought to provide the authorities with data to calibrate and parameterise the sort of network framework developed here. An empirical mapping of the true network structure should allow for better identification of potential financial tipping points and cliff edges across the financial system. It could thus provide a sounder, quantitative basis for judging remedial policy actions to avoid these cliff edges.

“Second, more publicly available data on network structures may affect the behaviour of financial institutions in the network. Armed with greater information on counterparty risk, banks may feel less need to hoard liquidity following a disturbance.”

Yup. Real time data collection will be there in the foundation of future finance.

But have a care: you can't use the systems you have now. That's because if you layer regulation over policy over predictions over datamining over banking over securitization over transaction systems … all layered over clunky old 14th century double entry … the whole system will come crashing down like the WTC when someone flies a big can of gas into it.

The reason? Double entry is a fine tool at the intra-corporate level. Indeed, it was material in the rise of the modern corporation form, in the fine tradition of the Italian city states, longitudinal contractual obligations and open employment. But, double entry isn't designed to cope with the transactional load of of inter-company globalised finance. Once we go outside the corporation, the inverted pyramid gets too big, too heavy, and the forces crush down on the apex.

It can't do it. Triple entry can. That's because it is cryptographically solid, so it can survive the rigours of those concentrated forces at the inverted apex. That doesn't solve the nightmare scenarios like securitization spaghetti loans, but it does mean that when they ultimately unravel and collapse, we can track and allocate them.

Message to the regulators: if you want your pyramid to last, start with triple entry.

PS: did the paper really say "More taxes and levies on banks to ensure that the system can survive future shocks;" … seriously? Do people really believe that Tobin tax nonsense?

January 31, 2011

Zuckerberg urged to go social... by hacking the lending space?

There's something poignant about this:

A bug allowed an unidentified person to post a message on Facebook chief executive Mark Zuckerberg's fan page on Tuesday.The odd message garnered more than 1,800 'likes' and around 400 comments before it was taken down. The message read:

"Let the hacking begin: If facebook needs money, instead of going to the banks, why doesn't Facebook let its users invest in Facebook in a social way? Why not transform Facebook into a 'social business' the way Nobel Price [sic] winner Muhammad Yunus described it?"

The social network meets social lending. In some sort of whiteboarding sense, this could be done. If Facebook had good payments tech, a good marketplace, and a good offering, then something like a social-net investment could emerge within. Many plausible alternatives exist such as Spring Street or Zopa, and all of them are fun to talk about.

But realities interfere somewhat to make this a workable idea. Facebook exists in an environment that would mitigate against Facebook itself getting involved; the regulatory and media attention to its business is rather different to that of Bangladesh 30 years ago. Also, the challenge for Facebook is not to tap the social network to solve a problem for its people, but to monetarise its network in time for IPO. Grameen's concept is too small-scale to effect that need much, and Spring Street was demonstrably at the opposite end of a very long scale.

October 16, 2010

Skype -- the mobile leader?!

Finanser posted this great picture from Sameer Zafar on mobile payment systems:

in commenting on some talks from Safar and Dave Birch. Well, you probably had to be there, but the picture is quite a compelling one, if you're interested in Skype, VoIP and the mobile market. For reading, these are probably more useful:

Dave [Birch] developed on his themes, and presented one slide that was incredibly insightful statistically speaking. There are:

- 5 billion active mobile phone subscribers out there

- 4.1 billion actively used mobile telephones

- 4 billion text message users, increasing at 19% per annum

- 2.2 billion bank accounts in use

- 1.6 billion television sets

- 1.4 billion email users, increasing at 7% per annum

- 1.25 landlines at its peak, as there are now 1.15 billion and falling

- 1.2 PCs of any kind

According to Dave's research, half of all phones In the developing world are 3G and a third are smartphones whilst, in the emerging world, only 4% of all phones are 3G and 8% are smart. Meanwhile, 1 in 10 phones are never used for voice calls, and data now represents a quarter of all mobile revenues.

Which leads into an old theme here at FC: what's with Skype and payments?

September 04, 2010

UN convention on Electronic Transactions: knowns and unknowns

Someone at the UN has a clue about financial transactions [1]. In the UNCITRAL's Convention on Electronic Transactions, there is this (pp2):

Article 2. Exclusions2.1. This Convention does not apply to electronic communications relating to any of the following:

(a) contracts concluded for personal, family or household purposes;

(b) (i) transactions on a regulated exchange; (ii) foreign exchange transactions;

(iii) inter-bank ... systems... ; (iv) the transfer of security rights....

2.2. This Convention does not apply to bills of exchange [snip, similar] ... or any transferable document or instrument that entitles the bearer or beneficiary to claim the delivery of goods or the payment of a sum of money.

The first lot (a) are approximately consumer contracts, which ordinarily attract specific consumer contract protection.

The second group (b) and 2.2 are financial transactions that will resonate with all financial cryptographers. Here's what the document observed in the Explanatory note (pp14):

7. ... These transactions have been excluded because the financial service sector is already subject to well-defined regulatory controls and industry standards that address issues relating to electronic commerce in an effective way for the worldwide functioning of that sector.

And (pp34):

78. The transactions in paragraph 1(b) relate essentially to certain financial service markets governed by well-defined regulatory and contractual rules that already address issues relating to electronic commerce in a manner that allows for their effective worldwide functioning. Given the inherently cross-border nature of those markets, UNCITRAL considered that this exclusion should not be left for country-based declarations under article 19.

So, because these transactions are sufficiently well designed and resolved in the first place, no need for the UNCITRAL to stick its oar in. Another way of putting it is that anyone engaged in those headline activities is big enough and ugly enough to look after themselves.

However, UNCITRAL went on to lay out a more rigourous rationale for their exclusion. Firstly (in my order), they observe:

... the Convention does not apply to negotiable instruments or documents of title, in view of the particular difficulty of creating an electronic equivalent of paper-based negotiability, a goal for which special rules would need to be devised.

In other words, the UNCITRAL people had not seen how to do this, and they knew it was a hard problem. Proving the asset in qualitative form, as a document in paper or electronic form, was the role of the Ricardian Contract. Its rather odd digitally-signed form was directed at proving equivalence with paper form, something we called the rule of one contract or more shortly, prove the electronic form to the judge!

Yes, it's a hard problem. Empirically, only a few times has the Ricardian Contract been copied as a way to cut the gordian knot of digital description of contracts. The problem is as much conceptual as anything, as those expert in technology typically start from an assumption of a database, which unfortunately clashes with the legal foundation of contracts. This fruitless chase down a blind alley is something that neither the lawyers nor the technologists really appreciate until they've spent all their investment.

Moreover (pp35):

80. Paragraph 2 of article 2 excludes negotiable instruments and similar documents because the potential consequences of unauthorized duplication of documents of title and negotiable instruments—and generally any transferable instrument that entitles the bearer or beneficiary to claim the delivery of goods or the payment of a sum of money—make it necessary to develop mechanisms to ensure the singularity of those instruments.81. The issues raised by negotiable instruments and similar documents, in particular the need for ensuring their uniqueness, go beyond simply ensuring the equivalence between paper and electronic forms, which is the main aim of the Electronic Communications Convention and justifies the exclusion provided in paragraph 2 of the article. ...

My emphasis. What UNCITRAL refers to as the need to ensure uniqueness and singularity is the quantitative challenge of the payment system, aspects that can be seen in SOX, and also DigiCash's design to do rollovers of blinded coins.

Finally, there is this seemingly accidental flash of wisdom:

79. It should be noted that this provision does not contemplate a broad exclusion of financial services per se, but rather specific transactions such as payment systems, negotiable instruments, derivatives, swaps, repurchase agreements, foreign exchange and bond markets. The criterion for the exclusion in paragraph 1(b) is not the type of the asset being traded but the method of settlement used ...

Which, indeed gets right to the heart of of the ultimate test. Once we have cracked the equivalence issue, and qualitatively locked down the value in a payment system, what remains is to settle trades. Trading is easy, settlement is hard. With that one simple test, we can identify whether the entire architecture is solid, which for UNCITRAL's purposes, means whether the overall system meets their exclusion.

Kudos to the UNCITRAL team for having enough understanding of the financial minefield to know what they were up against, and stepping aside carefully. As they summarise, which I interpret for all three of the key design challenges raised:

81 ... UNCITRAL was of the view that finding a solution for this problem required a combination of legal, technological and business solutions, which had not yet been fully developed and tested.

What they see as a known unknown, is also an unknown known :) But it is fair to say that the deployment of financial cryptography that solves the issues they identify is not as widespread as we had hoped. The solutions are known, it will just take a lot longer for them to percolate.

[1] I found the information used in this post in the Standing Committee of Australian Attorneys-General' review on the Convention (look for consultation paper, November 2008).

September 18, 2009

Where does the accounting profession want to go, today?

So, if they are not doing audits and accounting, where does the accounting profession want to go? Perhaps unwittingly, TOdd provided the answer with that reference to the book Accounting Education: Charting the Course through a Perilous Future by W. Steve Albrecht and Robert J. Sack.

So, if they are not doing audits and accounting, where does the accounting profession want to go? Perhaps unwittingly, TOdd provided the answer with that reference to the book Accounting Education: Charting the Course through a Perilous Future by W. Steve Albrecht and Robert J. Sack.

It seems that Messrs Albrecht and Sack, the authors of that book, took the question of the future of Accounting seriously:

Sales experts long ago concluded that "word of mouth" and "personal testimonials" are the best types of advertising. The Taylor Group1 found this to be true when they asked high school and college students what they intended to study in college. Their study found that students were more likely to major in accounting if they knew someone, such as a friend or relative, who was an accountant.

So they tested it by asking a slightly more revealing question of the accounting professionals:

When asked "If you could prepare for your professional career by starting college over again today, which of the following would you be most likely to do?" the responses were as follows:

Type of Degree % of Educators Who Would % of Practitioners Who Would Who Would Earn a bachelor's degree in something other than accounting and then stop 0.0 7.8 Earn a bachelor's degree in accounting, then stop 4.3 6.4 Earn a Master's of Business Administration (M.B.A.) degree 37.7 36.4 Earn a Master's of Accountancy degree 31.5 5.9 Earn a Master's of Information Systems degree 17.9 21.3 Earn a master's degree in something else 5.4 6.4 Earn a Ph.D. 1.6 4.4 Earn a J.D. (law degree) 1.6 11.4 These results are frightening,...

Well indeed! As they say:

It is telling that six times as many practicing accountants would get an M.B.A. as would an M.Acc., over three times as many practitioners would get a Master's of Information Systems degree as would get an M.Acc., and nearly twice as many practitioners would get a law degree instead of an M.Acc. Together, only 12.3 percent (6.4% + 5.9%) of practitioners would get either an undergraduate or graduate degree in accounting.2 This decrease in the perceived value of accounting degrees by practitioners is captured in the following quotes:We asked a financial executive what advice he would give to a student who wanted to emulate his career. We asked him if he would recommend a M.Acc. degree. He said, "No, I think it had better be broad. Students should be studying other courses and not just taking as many accounting courses as possible. ...My job right now is no longer putting numbers together. I do more analysis. My finance skills and my M.B.A. come into play a lot more than my CPA skills.

.... we are creating a new course of study that will combine accounting and

information technology into one unique major.......I want to learn about information systems.

(Of course I'm snipping out the relevant parts for speed, you should read the whole lot.) Now, we could of course be skeptical because we know computing is the big thing, it's the first addition to the old list of Reading, Arithmetic and Writing since the dark ages. Saying that Computing is core is cliche these days. But the above message goes further, it's almost saying that Accountants are better off not doing accounting!

The Accounting profession of course can be relied upon to market their profession. Or can they? Todd was on point when he mentioned the value chain, the image in yesterday's post. Let's look at the wider context of the pretty picture:

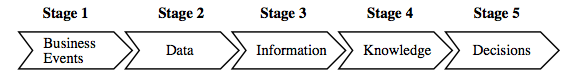

Robert Elliott, KPMG partner and current chairman of the AICPA, speaks often about the value that accountants can and should provide. He identifies five stages of the "value chain" of information. The first stage is recording business events. The second stage is summarizing recorded events into usable data. The third stage is manipulating the data to provide useful information. The fourth stage is converting the information to knowledge that is helpful to decision makers. The fifth and final stage is using the knowledge to make value-added decisions. He uses the following diagram to illustrate this value chain:This five-stage breakdown is a helpful analysis of the information process. However, the frightening part of Mr. Elliott's analysis is his judgment as to what the segments of the value chain are worth in today's world. Because of the impact of technology, he believes that:

- Stage 1 activity is now worth no more than $10 per hour

- Stage 2 activity is now worth no more than $30 per hour

- Stage 3 activity is now worth $100 per hour

- Stage 4 activity is now worth $300 per hour

- Stage 5 activity is now worth $1,000 per hour

In discussing this value chain, Mr. Elliott urges the practice community to focus on upper-end services, and he urges us to prepare our students so they aim toward that goal as well. Historically, accounting education has prepared students to perform stage 1- and stage 2-type work.

Boom! This is compelling evidence. It might not mean that the profession has abandoned accounting completely. But it does mean that whatever they do, they simply don't care about it. Accounting, and its cousin Audits are loss-leaders for the other stuff, and eyes are firmly fixed on other, higher things. We might call the other stuff Consulting, and we might wonder at the correlation: consulting activities have consumed the major audit firms. There are no major audit firms any more, there are major consulting firms, some of which seem to sport a vestigial audit capability.

Robert Elliot's message is, more or less, that the audit's fundamental purpose in life is to urge accountancy firms into higher stages. It therefore matters not what the quality (high?) is, nor what the original purpose is (delivering a report for reliance by the external stakeholder?). We might argue for example whether audit is Stage 2 or Stage 3. But we know that the auditor doesn't express his opinion to the company, directly, and knowledge is the essence of the value chain. By the rules, he maintains independence, his opinion is reserved for outsiders. So audit is limited to Stages 3 and below, by its definition.

Can you see a "stage 4,5 sales opportunity" here?

Or perhaps more on point, can you avoid it?

It is now very clear where the auditors are. They're not "on audit" but somewhere higher. Consulting. MBA territory. Stage 5, please! The question is not where the accounting profession wants to go today, because they already got there, yesterday. The financial crisis thesis is confirmed. Audits are very much part of our problem, even if they are the accounting profession's solution.

What is less clear is where are we, the business world? The clients, the users, the reliers of audit product? And perhaps the question for us really is, what are we going to do about it?

September 02, 2009

Robert Garigue and Charlemagne as a model of infosec

Gunnar reports that someone called Robert Garigue died last month. This person I knew not, but his model resonates. Sound bites only from Gunnar's post:

"It's the End of the CISO As We Know It (And I Feel Fine)"......First, they miss the opportunity to look at security as a business enabler. Dr. Garigue pointed out that because cars have brakes, we can drive faster. Security as a business enabler should absolutely be the starting point for enterprise information security programs.

...Secondly, if your security model reflects some CYA abstraction of reality instead of reality itself your security model is flawed. I explored this endemic myopia...

This rhymes with: "what's your business model?" The bit lacking from most orientations is the enabler, why are we here in the first place? It's not to show the most elegant protocol for achieving C-I-A (confidentiality, integrity, authenticity), but to promote the business.

How do we do that? Well, most technologists don't understand the business, let alone can speak the language. And, the business folks can't speak the techno-crypto blah blah either, so the blame is fairly shared. Dr. Garigue points us to Charlemagne as a better model:

King of the Franks and Holy Roman Emperor; conqueror of the Lombards and Saxons (742-814) - reunited much of Europe after the Dark Ages.He set up other schools, opening them to peasant boys as well as nobles. Charlemagne never stopped studying. He brought an English monk, Alcuin, and other scholars to his court - encouraging the development of a standard script.

He set up money standards to encourage commerce, tried to build a Rhine-Danube canal, and urged better farming methods. He especially worked to spread education and Christianity in every class of people.

He relied on Counts, Margraves and Missi Domini to help him.

Margraves - Guard the frontier districts of the empire. Margraves retained, within their own jurisdictions, the authority of dukes in the feudal arm of the empire.

Missi Domini - Messengers of the King.

In other words, the role of the security person is to enable others to learn, not to do, nor to critique, nor to design. In more specific terms, the goal is to bring the team to a better standard, and a better mix of security and business. Garigue's mandate for IT security?

Knowledge of risky things is of strategic valueHow to know today tomorrow’s unknown ?

How to structure information security processes in an organization so as to identify and address the NEXT categories of risks ?

Curious, isn't it! But if we think about how reactive most security thinking is these days, one has to wonder where we would ever get the chance to fight tomorrow's war, today?

July 13, 2009

Goldman Sachs caught with their pants down?

In the world of trading there is a scandal erupting. At first blanche, it was just another insider job. JPMay points to "Goldman: Pwned?". Snippets to get the general thrust. Firstly, GS drops off the trading reports:

This week's NYSE Program Trading report was very odd: not only because program trading hit 48.6% of all NYSE trading, a record high ... but what was shocking was the disappearance of the #1 mainstay of complete trading domination (i.e., Goldman Sachs) from not just the aforementioned #1 spot, but the entire complete list. In other words: Goldman went from 1st to N/A in one week.

Matt Goldstein apparently led the story, reporting that they were inside-hacked, asking "Did someone try to steal Goldman Sachs' secret sauce?"

... a Russian immigrant living in New Jersey was being held on federal charges of stealing secret computer trading codes from [Goldman Sachs].

So, the press made a lot about how this, but it is old news. For the techies reading today, here is how they said they 'got their man':

...the affidavit that Zerohedge has makes clear what they claim they've got this guy cold on - the "bash history" file they're referring to is a Unix system log that the "shell", or command interpreter, automatically keeps. Said alleged offender apparently was aware of this file and tried to erase it after doing his deed, but was unaware that the system he was working on had auditing enabled (oops.)

"Industrial espionage is nothing new of course." Nor is logging the activities of insiders :) This is a standard requirement imposed by audits, whether you like it or not, whether you can do it or not. However, the story grows bigger. This open comment lays it out:

...GS, through access to the system as a result of their special gov't perks, was/is able to read the data on trades before it's committed, and place their own buys or sells accordingly in that brief moment, thus allowing them to essentially steal buttloads of money every day from the rest of the punters world.

The unbacked, unevidenced allegation in the popular blogs is this: the code that was stolen might be been the code that drove a system that "saw" others' trades before they could be executed. More technically, it is claimed:

The big ticket, the magic wand for a rogue quant shop is technology to grab off FIX PROTOCOL, OCX, or SWIFT messages that precede every transaction_commit at the Exchanges.

If true in fact, this is almost guaranteed to lead to front-running. That is, if Goldman Sachs has any such magic wand, they would need to be bona fide arch-angels to avoid the temptation to read the trades coming, and beat them into the market. We're not talking millions here, but billions, or as that blog claimed "The profitability of this split-second information advantage would have been and could have been extraordinary. Observed yielding profits at $100,000,000 a day."

The structural details match: they are given special access for various reasons, and they are on the relevant security committees. Which is perversely backed by the actual claims of the bank:

Assistant U.S. Attorney Joseph Facciponti told a federal magistrate judge at his July 4 bail hearing in New York. The 34-year-old prosecutor also dropped this bombshell: “The bank has raised the possibility that there is a danger that somebody who knew how to use this program could use it to manipulate markets in unfair ways.”

Unlike most other claims written here, this has some degree of reliance. If the prosecutor said it, then, more or less, Goldman Sachs said it. And, the guy from Bloomberg asked the right question:

How could somebody do this? The precise answer isn’t obvious -- we’re talking about a black-box trading system here. And Facciponti didn’t elaborate. You don’t need a Goldman Sachs doomsday machine to manipulate markets, of course. A false rumor expertly planted using an ordinary telephone often will do just fine.

If it is an honest trading system, it can't manipulate the market. Except by volume and sneaky trades and false rumours and so forth, but that is the market. As long as everyone is under the same rules, they are in the market. Goldman Sachs can only manipulate the market if it is in possession of information that others do not have.

The final word seems to go to thefinanser in the UK, which deliciously juxtaposed Goldman's responses to salacious gossip in a popular mag:

The story actually goes back to when Goldmans announced last week that they were fed up with rock mag, Rolling Stone, over a piece claiming that the bank had “engineered every major market manipulation since the Great Depression — and they’re about to do it again.”Goldmans responded that it was “hysterical in both senses of the word” and that the magazine had “cobbled together every conspiracy theory ever written about us and injected some hyperbole and lots of bad language and called it a story.”

back to back with the prosecutor's filed statements before court:

The problem is that in their case against this guy, Sergey Aleynikov (a Russian immigrant no less, how James Bond is this getting?), the bank's lawyer made the statement that this “raised the possibility that there is a danger that somebody who knew how to use this program could use it to manipulate markets in unfair ways.”So, the program can be used to manipulate markets, can it?

Goldmans has virtually admitted as much, and no-one is going to let them off the hook.

In fact, GATA (the Gold Anti-Trust Committee) has already raised questions with “the U.S. Securities and Exchange Commission and the U.S. Commodity Futures Trading Commission to investigate the Goldman Sachs Group Inc. computer trading program that, according to a federal prosecutor, the bank acknowledges can be used to manipulate markets.”

What is perhaps worth underlining is that this last post is a credible bunch of insiders, not the rebels-with-a-blog. If the Financial Services Club are calling BS to GS, likely other insiders are too.

And well they should, if Goldman Sachs had an insider track on all the trades into NYSE. If this proves true, we're looking at an event that will make Arthur Andersen look like a Kindergarten squabble.

February 13, 2009

Rumour: NSA offering 'billions' for Skype eavesdrop solution

A printable-quality rumour straight from El Reg:

News of a possible viable business model for P2P VoIP network Skype emerged today, at the Counter Terror Expo in London. An industry source disclosed that America's supersecret National Security Agency (NSA) is offering "billions" to any firm which can offer reliable eavesdropping on Skype IM and voice traffic.The spybiz exec, who preferred to remain anonymous, confirmed that Skype continues to be a major problem for government listening agencies, spooks and police. This was already thought to be the case, following requests from German authorities for special intercept/bugging powers to help them deal with Skype-loving malefactors. Britain's GCHQ has also stated that it has severe problems intercepting VoIP and internet communication in general.

Skype in particular is a serious problem for spooks and cops. Being P2P, the network can't be accessed by the company providing it and the authorities can't gain access by that route. The company won't disclose details of its encryption, either, and isn't required to as it is Europe based. This lack of openness prompts many security pros to rubbish Skype on "security through obscurity" grounds: but nonetheless it remains a popular choice with those who think they might find themselves under surveillance. Rumour suggests that America's NSA may be able to break Skype encryption - assuming they have access to a given call or message - but nobody else.The NSA may be able to do that: but it seems that if so, this uses up too much of the agency's resources at present.

"They are saying to the industry, you get us into Skype and we will make you a very rich company," said the industry source, adding that the obscure encryption used by the P2Pware is believed to change frequently as part of software updates.

The spyware kingpin suggested that Skype is deliberately seeking to frustrate national listening agencies, which seems an odd thing to do - Skype has difficulties enough getting revenues out of its vast user base at any time, and a paid secure-voice system for subversives doesn't seem like a money-spinner

But corporate parent eBay, having had to write down $1.4bn already following its $2.6bn purchase of Skype back in the bubble-2.0 days of 2005, might see an opportunity here. A billion or two from the NSA for a backdoor into Skype might make the acquisition seem like a sensible idea.

Maybe it was just bad timing ... or maybe eBay hasn't got the smarts. I would dearly love to monetise that asset, and that's no secret (it will be on this blog somewhere). Either way, if eBay failed to integrate Skype, it's a solid sell signal on eBay. They are now just another cash cow. Milk on!

December 13, 2008

Ecuador's default: how to tame the angry Rafael Correa

(This article was co-written with Chris Cook; although the final presentation was done by me, so I have mangled his ideas somewhat!)

The basic story: Ecuador's government is pissed & angry with the debt issuances of previous governments: accusations of bribes, misconduct, EHMs, etc. And, they are broke, or broke enough to suggest default. And it was an election promise!

So why not default? Let's run the thought experiment.

Argentina did it, and survived, or at least that theory is popular in some circles. If this were to happen, what do future partners do, like Venezuala, or the emerging Banco del Sur? Kick the Ecuadorean's sorry tail all the way to Galapogas islands, join them in default, or think about how to adopt?

It needn't be that way. The fundamental problem is that the debt has migrated from an honest contract to a dishonest circle of mutually supporting pieces. This structure no longer helps any of the participants. So here's a plan to help any bankrupt country to move to the future:

- Default on the lot?

- adopt a Peer to Peer system of issuance and trading, as found in this recent FT award, and as epitomised by zopa.com,

- move the banking sector across to a service provision model, based on p2p credit

- structure issuances as debt/equity sharing (consider LLPs). This means that bond holders are no longer simply holders of debt, they are partners and investors,

- back the instruments with guarantees provided by mutual societies; being a member automatically gives you not only the guarantee but the incentive to look after the downstream risks,

- then, in the bankrupcy of all the debt, replace all the old broken instruments with new equity/debt sharing instruments.

OK, so maybe we skip point 1 because we want to retain some friends. There are some pretty bad punishments that the financial world can levy you with. But think of the rest.

This is a good future model for banks. p2p investment has higher margins, and the banks do not have to risk their own capital to play. Indeed that's where they want to be, c.f., securitization, and we could argue they are already there.

But, where they are now, the risks are not properly spread to those who care for the instruments, so, say hello to financial crisis.

We just have to go the next step by engaging the players end-to-end. The real essence is to move the financial issuance of debt across to a flexible creation of debt/equity balanced contracts between issuers and investors. The details are for later.

(It goes without stressing, in this new financial structure, we would need the ability for smaller issuers to create flexible contracts together.)

November 25, 2008

Who would judge a contest for voting machines?

In a previous entry I suggested creating an AES-style competition for automated voting systems. The idea is to throw the design open to the world's expertise on complex systems, including universities, foundations and corporates, and manage the process in an open fashion to bring out the best result.

Several people said "Who would judge a contest for voting machines?" I thought at first blush that this wasn't an issue, but others do. Why is that? I wonder if the AES experience surfaced more good stuff than superficially apparent?

If you look at the AES competition, NIST/NSA decided who would be the winner. James points out in comments that the NSA is indeed competent to do this, but we also know that they are biased by their mission. So why did we trust them to judge honestly?

In this case, what happened is that NIST decided to start off with an open round which attracted around 30 contributions, and then whittled that down to 5 in a second round. Those 5 then went forward and battled it out under increased scrutiny. Then, on the basis of the open scrutiny, and some other not-so-open scrutiny, the NSA chose Rijndael to be the future AES standard.

Let's hypothesize that the NSA team had a solid incentive to choose the worst algorithm, and were minded to do that. What stopped them doing it?

Several things. Firstly, there were two rounds, and all the weaker algorithms were cleaned out in the first round. All of the five algorithms in the second round were more or less "good enough," so the NSA didn't have any easy material to work with. Secondly, they were up against the open scrutiny of the community. So any tricky choice was likely to cause muttering, which could spread mistrust in the future, and standards are susceptible to mistrust. Thirdly, by running a first round, and fairly whittling the algorithms done on quality, and then leading into the second round, NIST created an expectation. Positively, this encouraged everyone to get involved, including those who would normally dismiss the experiment as just another government fraud, waiting to reveal itself. At a more aggressive extreme, it created a precedent, and this exposed the competition to legal attack later on.

These mechanisms worked hand in hand. Probably, either alone was not sufficient to push the NSA into our camp, but together they locked down the choices. Once that was done, the NSA saw its natural incentives to cheat neutered by future costs and open scrutiny. As it no longer could justify the risk of cheating, its best strategy was to do the best job, in return for reputation.

The mechanism design of the competition created the incentives for the judge to vote how we wanted -- for the best algorithm -- even if he didn't want to.

So, we can turn the original question around. Instead of asking who would judge such a competition, design a mechanism such that we don't care who would judge it. Make it like the AES competition, where even if they had wanted to, the NSA's best strategy was to choose the best. Set yourself a challenge: we get the right result even when it is our worst enemy.

November 14, 2008

A voting design competition?

I'm at LISA and just listened to this one:

The State of Electronic Voting, 2008

David Wagner, University of California, BerkeleyAs electronic voting has seen a surge in growth in the U.S. in recent years, controversy has swirled. Are these systems trustworthy? Can we rely upon them to count our votes? In this talk, I will discuss what is known and what isn't. I will survey some of the most important developments and analyses of voting systems, including the groundbreaking top-to-bottom review commissioned by California Secretary of State Debra Bowen last year. I will take stock of where we stand today, the outlook for the future, and the role that technologists can play in improving elections.

The one-line summary seems to be that voting machines are in a mess, and while there are brave efforts (California's review cited), there are no easy answers. It's a mess. This accords with my own prejudices: it looks like it should be a mess, by architectural requirements. My advice is to keep away, but today I didn't follow that advice, and have a suggestion!

One thing that is frequently suggested is that if the Internet community can build an Internet, surely we should be able to build a secure voting system. We can do big secure systems on the net, right? The counter example for this is IPSec or DNSSec or S/MIME: surely we should have been able to get a secure system into widespread use, but we seem to have failed at every turn here.

One reason why these things didn't work out is that the IETF committees who put them together got bogged down in details, as different stakeholders fought over different areas. The result is that familiar camel known as a secure but unusable architecture. Committees are at their best when they are retro-standardising an already successful design, such as SSL, because then they cannot dive into their own areas. They are forced to focus on the existing successful design.

Another suggestion is to use NIST or the NSA (same thing in this context) to design the system for us. But, this only works when we don't really care so much about the results. With encryption algorithms, for example, we the public get very suspicious about funny S-Boxes and the like, and skepticism dogged the famous DES algorithm as well as Skipjack and the cryptophones. For Hash designs, we are less fussed, because in application space much less much can go wrong if there is a secret way of futzing the hash.

Now, in the late 1990s, NIST took these issues seriously and took a novel path. They created a design competition to create a new encryption algorithm, asking anyone and everyone to propose. Any team around the world could submit an algorithm, and the final winner came from Belgium. As well, all the teams were encouraged to review the others' designs, and knock themselves out with criticisms. (By way of disclosure, Raif in my old Cryptix group created the Java framework for the AES proposals. It was that open that they took in help from crazy net hackers like ourselves.)

This worked! People mutter about AES as being a bit odd, but everyone admires the open design process, the use of the free and open scrutiny, and the way that the worldwide cryptography community rose to the challenge.

Why can't we do that with voting machines? All the elements seem to rhyme: stakeholders who will bog it down, conspiracy theories in abundance, desperate need of the people to see a secure outcome, and lots and lots of students and academics who love a big design challenge. NIST seems to be the ring-in to manage the process, and the result could be a standard design, which avoids the tricky issue of "mandating use".

Just a thought! I don't know whether this will work or not, but I can't see why not?

July 20, 2008

SEC bans illegal activity then permits it...

Whoops:

SEC Spares Market Makers From `Naked-Short' Sales BanJuly 18 (Bloomberg) -- The U.S. Securities and Exchange Commission exempted market makers in stocks from the emergency rule aimed at preventing manipulation in shares of Fannie Mae, Freddie Mac and 17 Wall Street firms.

The SEC granted relief for equity and option traders responsible for pairing off orders from a rule that seeks to bar the use of abusive tactics when betting on a drop in share prices. Exchange officials said limits on ``naked-short'' sales would inhibit the flow of transactions and raise costs for investors.

``The purpose of this accommodation is to permit market makers to facilitate customer orders in a fast-moving market,'' the SEC said in the amendment.

A reader writes: "that lasted what, 12 hours ?" I don't know, but it certainly clashes with the dramatic news of earlier in the week from the SEC, as the Economist reports:

Desperate to prevent more collapses, the main stockmarket regulator has slapped a ban for up to one month on “naked shorting” of the shares of 17 investment banks, and of Fannie Mae and Freddie Mac, the two mortgage giants. Some argue that such trades, in which investors sell shares they do not yet possess, make it easier to manipulate prices. The SEC has also reportedly issued over 50 subpoenas to banks and hedge funds as part of its investigation into possibly abusive trading of shares of Bear Stearns and Lehman Brothers.

Naked selling is technically illegal but unenforceable. The fact that it is illegal is a natural extension of contract laws: you can't sell something you haven't got; the reason it is technically easy is that the markets work on delayed settlement. That is, all orders to sell are technically short sales, as all sales are agreed before you turn up with the shares,. Hence, all orders are based on trust, and if your broker trusts you then you can do it, and do it for as long as your broker trusts you.

"Short selling" as manipulation, as opposed to all selling, works like this: imagine I'm a trusted big player. I get together with a bunch of mates, and agree, next Wednesday, we'll drive the market in Microsoft down. We conspire to each put in a random order for selling large lumps of shares in the morning, followed by lots of buy orders in the afternoon. As long as we buy in the afternoon what we sold in the morning, we're fine.

On the morning of the nefarious deed, buyers at the top price are absorbed, then the next lower price, then the next ... and so the price trickles lower. Because we are big, our combined sell orders send signals through the market to say "sell, sell, sell" and others follow suit. Then, at the pre-arranged time, we start buying. By now however the price has moved down. So we sold at a high price and bought back at a lower price. We buy until we've collected the same number we sold in the morning, and hence our end-of-day settlement is zero. Profit is ours, crack open the gin!

This trick works because (a) we are big enough to buy/sell large lumps of shares, and (b) settlement is delayed as long as we can convince the brokers, so (c) we don't actually need the shares, just the broker's trust. Generally on a good day, no more than 1% of a company's shares move, so we need something of that size. I'd need to be very big to do that with the biggest fish, but obviously there are some sharks around:

The S&P500 companies with the biggest rises in short positions relative to their free floats in recent weeks include Sears, a retailer, and General Motors, a carmaker.

Those driven by morality and striven with angst will be quick to spot that (a) this is only available to *some* customers, (b) is therefore discriminatory, (c) that it is pure and simple manipulation, and (d) something must be done!

Noting that service of short-selling only works when the insiders let outsiders play that game, the simple-minded will propose that banning the insiders from letting it happen will do the trick nicely. But, this is easier said than done: selling without shares is how the system works, at its core, so letting the insiders do it is essential. From there, it is no distance at all to see that insiders providing short sales as a service to clients is ... not controllable, because fundamentally all activities are provided to a client some time, some way. Any rule will be bypassed *and* it will be bypassed for those clients who can pay more. In the end, any rule probably makes the situation worse than better, because it embeds the discrimination in favour of the big sharks, in contrast to ones regulatory aim of slapping them down.

Rules making things worse could well be the stable situation in the USA, and possibly other countries. The root of the problem with the USA is historical: Congress makes the laws, and made most of the foundational laws for stock trading in the aftermath of the crash of 1929. Then, during the Great Depression, Congress didn't have much of a clue as to why the panic happened, and indeed nobody else knew much of what was going on either, but they thought that the SEC should be created to make sure it didn't happen again.

Later on, many economists established their fame in studying the Great Depression (for example, Keynes and Friedman). However, whether any parliament in the world can absorb that wisdom remains questionable: Why should they? Lawmakers are generally lawyers,and are neither traders nor economists, so they rely on expert testimony. And, there is no shortage of experts to tell the select committees how to preserve the benefits of the markets for their people.

Which puts the lie to a claim I made repeatedly over the last week: haven't we figured out how to do safe and secure financial markets by now? Some of us have, but the problem with making laws relying on that wisdom is that the lawmakers have to sort out those who profit by it from those who know how to make it safe. That's practically impossible when the self-interested trader can outspend the economist or the financial cryptographer 1000 to 1.

And, exactly the same logic leads to the wide-spread observation that the regulators are eventually subverted to act on behalf of the largest and richest players:

The SEC’s moves deserve scrutiny. Investment banks must have a dizzying influence over the regulator to win special protection from short-selling, particularly as they act as prime brokers for almost all short-sellers...The SEC’s initiatives are asymmetric. It has not investigated whether bullish investors and executives talked bank share prices up in the good times. Application is also inconsistent. ... Like the Treasury and the Federal Reserve, the SEC is improvising in order to try to protect banks. But when the dust settles, the incoherence of taking a wild swing may become clear for all to see.

When the sheepdog is owned by the wolves, the shepherd will soon be out of business. Unlike the market for sheep, the shareholder cannot pick up his trusty rifle to equalise the odds. Instead, he is offered a bewildering array of new sheepdogs, each of which appear to surprise the wolves for a day or so with new fashionable colours, sizes and gaits. As long as the shareholder does not seek a seat at the table, does not assert primacy over the canines, and does not defend property rights over the rustlers from the next valley, he is no more than tomorrow's mutton, reared today.

June 06, 2008

BarCampBankLondon: alternative finance workshop

Thomas Barker sends this press release:

Innovators Gather in the City to Set Shape for Future of Finance

Contact: Thomas Barker

Email: tbarker(at)barcampbank[..]org

LONDON, UK, Monday June 2nd, 2008 - On Saturday July 5th, 2008, one of the most unusual conferences in the financial services industry, BarCampBankLondon (BCBL), will get underway at 9:30 AM near the heart of the City. BCB London follows the success of previous BarCampBanks in Paris, Seattle, San Francisco, New Hampshire and New York City. Ranging from interested students, to banking executives, to VCs, startup founders and internet technologists. BCBL is a forum where participants from diverse backgrounds can get together to discuss topics impacting the industry. It will attract thought leaders and innovators from as far away as America for an intense day of discussions on the future of financial services.

Event co-founder, Frederic Baud said "We wanted to get away from the typical event where a group of senior executives listen to PowerPoint slides and exchange business cards. This is really about getting together people who share a genuine interest in building the future." The event has no set speakers, agenda or sales pitches and getting in the door will only set you back £10. To ensure that the event is relevant to all those attending, the agenda will be discussed online (http://barcamp.org/BarCampBankLondon), then set by the participants on the morning of the event.

It might seem strange that an event like this has taken so long to reach London, a city often considered to be the global financial hub. Another organizer, Thomas Barker said "People might not immediately think of London as a tech cluster. But walking around the City, you can see hundred of software firms nestled in among the banks and lawyers. There's a lot happening here". So far, BCBL intends to discuss the topics of P2P lending, startup financing, mobile banking, personal finance management and micro-finance amongst others.

To attend BCBL, register online at http://bcblondon.eventbrite.com/ .