September 18, 2009

Where does the accounting profession want to go, today?

So, if they are not doing audits and accounting, where does the accounting profession want to go? Perhaps unwittingly, TOdd provided the answer with that reference to the book Accounting Education: Charting the Course through a Perilous Future by W. Steve Albrecht and Robert J. Sack.

So, if they are not doing audits and accounting, where does the accounting profession want to go? Perhaps unwittingly, TOdd provided the answer with that reference to the book Accounting Education: Charting the Course through a Perilous Future by W. Steve Albrecht and Robert J. Sack.

It seems that Messrs Albrecht and Sack, the authors of that book, took the question of the future of Accounting seriously:

Sales experts long ago concluded that "word of mouth" and "personal testimonials" are the best types of advertising. The Taylor Group1 found this to be true when they asked high school and college students what they intended to study in college. Their study found that students were more likely to major in accounting if they knew someone, such as a friend or relative, who was an accountant.

So they tested it by asking a slightly more revealing question of the accounting professionals:

When asked "If you could prepare for your professional career by starting college over again today, which of the following would you be most likely to do?" the responses were as follows:

Type of Degree % of Educators Who Would % of Practitioners Who Would Who Would Earn a bachelor's degree in something other than accounting and then stop 0.0 7.8 Earn a bachelor's degree in accounting, then stop 4.3 6.4 Earn a Master's of Business Administration (M.B.A.) degree 37.7 36.4 Earn a Master's of Accountancy degree 31.5 5.9 Earn a Master's of Information Systems degree 17.9 21.3 Earn a master's degree in something else 5.4 6.4 Earn a Ph.D. 1.6 4.4 Earn a J.D. (law degree) 1.6 11.4 These results are frightening,...

Well indeed! As they say:

It is telling that six times as many practicing accountants would get an M.B.A. as would an M.Acc., over three times as many practitioners would get a Master's of Information Systems degree as would get an M.Acc., and nearly twice as many practitioners would get a law degree instead of an M.Acc. Together, only 12.3 percent (6.4% + 5.9%) of practitioners would get either an undergraduate or graduate degree in accounting.2 This decrease in the perceived value of accounting degrees by practitioners is captured in the following quotes:We asked a financial executive what advice he would give to a student who wanted to emulate his career. We asked him if he would recommend a M.Acc. degree. He said, "No, I think it had better be broad. Students should be studying other courses and not just taking as many accounting courses as possible. ...My job right now is no longer putting numbers together. I do more analysis. My finance skills and my M.B.A. come into play a lot more than my CPA skills.

.... we are creating a new course of study that will combine accounting and

information technology into one unique major.......I want to learn about information systems.

(Of course I'm snipping out the relevant parts for speed, you should read the whole lot.) Now, we could of course be skeptical because we know computing is the big thing, it's the first addition to the old list of Reading, Arithmetic and Writing since the dark ages. Saying that Computing is core is cliche these days. But the above message goes further, it's almost saying that Accountants are better off not doing accounting!

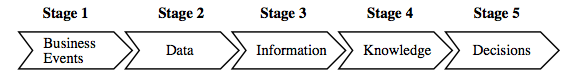

The Accounting profession of course can be relied upon to market their profession. Or can they? Todd was on point when he mentioned the value chain, the image in yesterday's post. Let's look at the wider context of the pretty picture:

Robert Elliott, KPMG partner and current chairman of the AICPA, speaks often about the value that accountants can and should provide. He identifies five stages of the "value chain" of information. The first stage is recording business events. The second stage is summarizing recorded events into usable data. The third stage is manipulating the data to provide useful information. The fourth stage is converting the information to knowledge that is helpful to decision makers. The fifth and final stage is using the knowledge to make value-added decisions. He uses the following diagram to illustrate this value chain:This five-stage breakdown is a helpful analysis of the information process. However, the frightening part of Mr. Elliott's analysis is his judgment as to what the segments of the value chain are worth in today's world. Because of the impact of technology, he believes that:

- Stage 1 activity is now worth no more than $10 per hour

- Stage 2 activity is now worth no more than $30 per hour

- Stage 3 activity is now worth $100 per hour

- Stage 4 activity is now worth $300 per hour

- Stage 5 activity is now worth $1,000 per hour

In discussing this value chain, Mr. Elliott urges the practice community to focus on upper-end services, and he urges us to prepare our students so they aim toward that goal as well. Historically, accounting education has prepared students to perform stage 1- and stage 2-type work.

Boom! This is compelling evidence. It might not mean that the profession has abandoned accounting completely. But it does mean that whatever they do, they simply don't care about it. Accounting, and its cousin Audits are loss-leaders for the other stuff, and eyes are firmly fixed on other, higher things. We might call the other stuff Consulting, and we might wonder at the correlation: consulting activities have consumed the major audit firms. There are no major audit firms any more, there are major consulting firms, some of which seem to sport a vestigial audit capability.

Robert Elliot's message is, more or less, that the audit's fundamental purpose in life is to urge accountancy firms into higher stages. It therefore matters not what the quality (high?) is, nor what the original purpose is (delivering a report for reliance by the external stakeholder?). We might argue for example whether audit is Stage 2 or Stage 3. But we know that the auditor doesn't express his opinion to the company, directly, and knowledge is the essence of the value chain. By the rules, he maintains independence, his opinion is reserved for outsiders. So audit is limited to Stages 3 and below, by its definition.

Can you see a "stage 4,5 sales opportunity" here?

Or perhaps more on point, can you avoid it?

It is now very clear where the auditors are. They're not "on audit" but somewhere higher. Consulting. MBA territory. Stage 5, please! The question is not where the accounting profession wants to go today, because they already got there, yesterday. The financial crisis thesis is confirmed. Audits are very much part of our problem, even if they are the accounting profession's solution.

What is less clear is where are we, the business world? The clients, the users, the reliers of audit product? And perhaps the question for us really is, what are we going to do about it?

Posted by iang at September 18, 2009 09:13 AM | TrackBackIan,

As an engineer who's father was an accountant I will give you three guesses as to what he told me not to do when I grew up...

Oddly it is the same for engineers, we tend to tell our children to do other things.

As I've said before if you want to get on in life you should learn to speak the language that the man who cuts your cheque at the end of the month does, or more correctly his boss ;)

So even if you are just a humble team leader get yourself three courses,

1, MBA,

2, Vocal training

3, Psychology or Method acting.

And no I'm not joking about 3.

If you have the time to watch and learn you will discover that most large businesses are not actually run by those at the top...

They hire consultants to tell them what to do...

And I have seen more sound companies get into trouble for buying into the latest "methodology" pedaled by the "business consultant" ilk than I have through any other form of mismanagement...

After all step sideways and ask yourself a question what does a business do?

In most cases it has a "value added" section that actual brings in the income from customers, every other part of the company is an outgoing.

These other parts have where ever possible followed the "Marketing lead" that is make a claim that they are "essential to the business process".

Well actually in most cases there is absolutely not a shred of testable evidence that their claims are remotely true...

The only purpose an accountant is actually qualified for is stages 1 and 2, the rest is all unsupported "opinion" or fluff.

As has been seen by the banking crisis there is absolutely no diversity in large business. Traders all took the same risks to get the same reward, it was not in their interest to do anything else.

Likewise large business executives do what other large business executives do. Just look at the US motor car industry "SUV's all round" and no customers for "gas guzzlers".

Essentially what large business execs who want to survive do is most definitely not take any risk their co-execs have not bought into, that's for the "chancers/wannabees".

And the safest option of all is to say XYZ (your leading competitor in your market place) has consulted Mega-firm A/CG.

The game for aspiring business professionals these days is "billable hours" for "death by overhead" presentation to big business execs...

As Maggie Thatcher once noted the real money is in the service industry.

But... that is a problem what is money?

Let's be honest here it is really an abstraction of energy over time, onto which we stick a moving target number. The trick is to use your money quicker faster and better than anybody else.

The downside is of course that although real value only increases by increasing an items utility (manufacturing etc). Monetary value increases by the speed it moves it does not increase utility in the slightest.

If you look at the "Accounting / Banking / Consulting" sector it's value added is not in increasing utility but in getting more "financial value" AKA Inflation...

Posted by: Clive Robinson at September 18, 2009 06:14 PMThe business culture of the US is one that only tolerates a single leader within any organization, and the driving need for analysis rather than a deeper understanding of the data, i.e. understanding how they got there, is what is lacking. I'm sure that if the MBA were truly titled, it would be a degree that permits a higher level of entry into a corporate structure based on those granting access having similar degrees. Accountants are seen as a working class profession, thinly veiled in titled firms that pretend to be law firms, as is the case in the big six accounting firms along with their vulture cousins, the IT consulting crowd.

In essence those with degrees in areas that grant them permission to comment on corporate matters have a bad case of myopia and lack a real understanding of the events that drive a profit. This ignorance is reinforced by a single theory: pay less, charge more and replicate the success of competitors.

As result of this plantation methodology all businesses are reduced to commodity events whereby the market share, its capture and maintenance are the only goal. These structures only need one boss "Mister Type A" and accountants that do not support the cult are not welcomed. In addition the Type A cults require an over reaching centralized government to manipulate the monetary incentives changing the rules on an arbitrary basis to meet their needs, and in this environment accountants are of no need.

The next level above the MBA will be the designer of Public Relations campaigns, that sell on a mass scale the next notional construct that meets the need of the static elite. In fact we have them but they are smarter than this writer in that they know they only have to sell their snake oil to the elite. How much is sold and who gets to buy are a contrived event in modern capitalism.

Examine Walmart, a company that grew based on its logistical effort in moving products to locations that people where buying. Walmart's utilization of discrete sales information was in part done by accountants, but the rewards where only afforded to one family. The availability of the information to the management was made possible by the IT staff, but it was one man that determined to use this information not a committee. All entities and affiliations that do not worship at the Type A church are not welcomed and subjugation of the individual is the only goal proffered by the society that lived by this credo regardless of their professions to the contrary. It is the real world, the defacto sense of dissatisfaction that lurks in the recommendations of older accountants to potentially younger ones, when in essence the only fact that can be gleaned is that subjugation is not pleasant but inevitable. We are the Borg, resistance is useless, join the hive.

Posted by: jimmy at September 19, 2009 11:31 AMWell the other future for accountants is to collate the Stage 2/ 3 output and use that for making Stage 5 (trading/ investment) decisions outside the firm's walls..

But that, children, is called insider-trading and is frowned upon...

Posted by: AC2 at September 22, 2009 01:29 AM