December 11, 2011

Why (my, all) financial systems fail -- information complexity

I spent over a decade building the snappiest financial system around. In that time I pursued one goal of efficiency: reduction of complexity. This wasn't only goodness in an angelic sense, it was a pragmatic goal to reduce my own costs in building systems.

The result was pretty spectacular: we were settling trades in seconds and doing so with every leg firmly fastened to the ground. That is, the whole thing was running with direct concrete ties to assets.

But, the big players weren't interested. Indeed they were more than uninterested, they were highly interested in making sure this would never ever happen. Time after time, the message was delivered: Never. Other companies received the same message, so after a few years, I started to take it seriously.

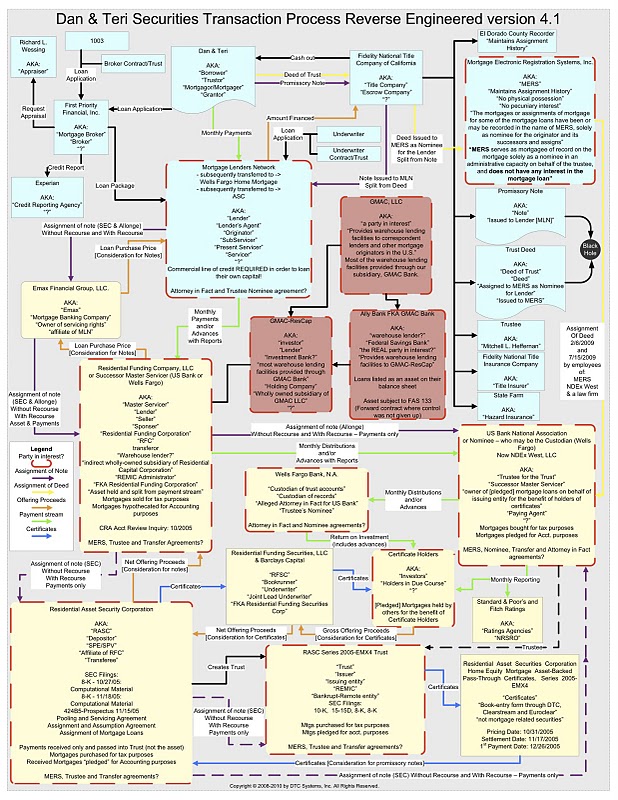

At the time I hypothesised that the reason for this was insider fraud, or at least profits capture. The complexities were endemic and there were very few people who could see the whole picture. So, I theorised that those who could understand the complexities were cashing in on their advantage; from the inside. And some very few who cashed in were also driving the information agenda, as their success made them both wealthy and influential:

more complexity!

Of course such a hypothesis is unlikely to find proof. By its very nature, how do you prove such a tendency towards chaos? Here comes an alternate perspective from ZeroHedge, citing two papers (1, 2):

And the punchline: "Liquidity requires symmetric information, which is easiest to achieve when everyone is ignorant. This determines the design of many securities, including the design of debt and securitization." Reread the last statement as it explains perhaps better than anything, the true functioning of modern capital markets and why they are terminally broken: in order to preserve the system, the banking cartel need to make everything of virtually infinite complexity so that no one has a clear understanding of what is going on!

Consider the perfect market hypothesis: the market already has all the information priced in, so you yourself cannot beat the market. Or, more politely, you get to earn the market rate of return, so you may as well invest in a unit fund that covers the entire market.

Although this hypothesis is proven, and proved time and time again (look at the averaged hedge fund returns against stock market returns over time), it is also clear that, at the limit, the hypothesis is impossible: if the market already knows, no new information will come to the market. In which case it gums up. (Leaving aside temporal arguments for now.)

So, the market also defends itself by creating reasons to bring in new information. ZeroHedge highlights Gorton & Metrick's punchline:

"Liquidity requires symmetric information, which is easiest to achieve when everyone is ignorant. This determines the design of many securities, including the design of debt and securitization."

The market promotes impenetrable securities, which promotes Ignorance, which generates symmetric information, and hence liquidity. QED.

Well, we're all on the same page. Banks support e.g., OTC or over-the-counter market, and will kill to preserve it, because it creates symmetric information. a.k.a ignorance, leading to profits. Meanwhile, I invented the Ricardian Contract which created an excessively visible and tangible chain of contract. These two concepts are at war, opposite poles of complexity versus transparency.

Which is where sites like Zero Hedge step in - to expose "shadowy" places where things are best left unseen.

Yeah. That's what I thought, too. As we watch the complexity-driven system implode it would be easy to assume that now is the time for transparency to rise from the ashes of Europe, thus to be renamed Phoenix.

But, such a thought would be facile and naive in the extreme. A forlorn hope. The implosion of the world financial system doesn't make people any wiser, just poorer. Since when has the world responded to a crisis by getting smart?

What Zero Hedge is really discovering is that rewards are there if you participate in being aware of the complexity. It is a proof of the hypothesis: wisdom emerges in understanding where the masses, the herd, have it wrong. It is not in itself an absolute, nor a way to save them. For anything good to arise, something else is needed.

Posted by iang at December 11, 2011 04:33 AM | TrackBackThat's a helluva thesis ya got there. Enclosing their gardens with walls of complexity. Which is great, until those walls collapse on you.

Posted by: Patrick at December 11, 2011 08:28 AMComplexity is also frequently taken as a snakeoil in security (complexity as form of obfuscation as to what is really going on) ... along with exploits tending to being proportional to complexity (would contend that the snakeoil analogy isn't just limited to security business).

In the US there has long been periodic rant about military-industrial-complex ... recent item was that Eisenhower originally was going to say military-industrial-congresional-complex (MICC), but shortened it at the last minute. There has been frequent items that DOD has been leqally required for decades to pass financial audit ... but has yet to have one (claims that it amounts to unaccounted trillion during the last decade)

I've used an analogy for FRCC ... or financial-regulatory-congressional-complex.

I remember original draft of Basel-2 having both additional quantitative measures as well as a new qualitative section ... which basically required top executives and board being able to demonstrate end-to-end understanding of the business processes ... sort of combination of ISO9000 and Sarbanes-Oxley ... but the new section effectively disappears during the review process.

Posted by: Lynn Wheeler at December 11, 2011 10:22 AMoh and finishing up reading: Confidence Men: Wall Street, Washington, and the Education of a President.

http://www.amazon.com/Confidence-Men-Washington-Education-ebook/dp/B004OVEZ8O

One of the items is new governor of the New York Fed comes in the early part of the century and at one of the first NY FED advisory board meetings, Shiller explains how the real estate market is in big inflation "bubble" and will be do for burst. The new New York Fed governor replaces Shiller on the advisory board (part of allowing the bubble to reach truly epic proportions).

Don't hold your breath, but don't despair either http://www.newscientist.com/article/mg21228421.300-bank-says-no-ditch-the-bank--borrow-from-the-crowd.html

A Merry Christmas!

Iang,

Thank you for this.

This is probably the best thing you have committed to paper. You should be ashamed for disclosing such insight.

Posted by: KatzGlobal at December 13, 2011 04:56 AMI came here from google (searching for the Gorton quote), at first I thought the title of your whole blog referred to this obscuring of financial data that is described here :)

Posted by: Zbigniew Lukasiak at December 19, 2011 10:45 AManalogy for the current financial infrastructure that it is heavily populated with vampires sucking the blood out of the world and would be destroyed by sunlight (transparency and visibility) ...

http://curiouscapitalist.blogs.time.com/2010/04/16/sec-goldman-is-actually-a-vampire-squid/ ...

http://www.phibetaiota.net/2010/11/review-griftopia-bubble-machines-vampire-squids-and-the-long-con-that-is-breaking-america/ "confidence men" makes the case that open exchanges would also help eliminate vampire (lots of the illegal and quasi-legal) activity ... also "No One Is Above The Law" http://baselinescenario.com/2011/12/22/no-one-is-above-the-law/

recent posts mentioning need for transparency and visibility to correct much of the finanical infrastructure:

http://www.garlic.com/~lynn/2011p.html#70 ..

http://www.garlic.com/~lynn/2011p.html#87 ..

http://www.garlic.com/~lynn/2011p.html#92 ..

SEC: Goldman Is Actually a Vampire Squid | The Curious Capitalist | TIME.com

A few weeks ago, I did a blog post questioning whether the mega-profitable, much-hated investment bank Goldman Sachs really methodically set about putting together mortgage-backed securities that woul...

latest on the lack of transparency and visibility

https://plus.google.com/u/0/102794881687002297268/posts/N8BTQJjVK8j

The lack of transparency means we don't really know what the exposures of major U.S. financial institutions are, and we very much have to be concerned about the possible negative repercussions.

http://www.bloomberg.com/news/2011-12-22/bankers-complaint-of-uncertainty-obscures-reluctant-disclosure.html

So much for triple-entry bookkeeping. Washington Mutual Bank failed because five-entry bookkeeping with five certified and notarized physical copies of each entry, carried under armed guard to separate locations, kept under lock and key, and continuously monitored by 24/7 tamperproof video surveillance, with multiple redundant access logs, was not even close to adequate for guaranteeing the integrity of financial transactions.

Posted by: Justin N. Lindberg at January 28, 2012 12:58 AMJustin,

If someone is going to steal, triple entry will reveal how they did it. Double entry can do that too, but it is not concrete like triple entry, it's possible to futz behind the scenes if you have access to the computers.

Posted by: Iang at January 28, 2012 01:20 AM