January 29, 2019

How does the theory of terrorism stack up against AML? Badly - finally a case in Kenya: Dusit

Finally, an actual financial system & terrorism case lands before the courts, relating to the Dusit attack. Is this a world first? I don't know because this conjunction is so rare, nobody's tracking it.

The essential gripe is that since 9/11 the financial world decided to slap the terrorism label on their compliance process. Yet to no avail. Very few cases, so small that they fall between bayesian cracks. So misdirected because terrorists have options, and they can adjust their approach to slip under they radar. Backfiring because the terrorists are already outside norms and will do as much damage as needed, thus further harming the financial system.

And so hopeless because your true terrorist doesn't care about being caught afterwards - he's either dead or sacrificed.

Anyway, that's the theory - anti-terrorism applied to the financial system simply won't work. Let's see how the theory stacks against the evidence.

A suspect linked to the Dusit terror attack received Sh9 million from South Africa in three months and sent it to Somalia, the Anti-Terror Police Unit have said. Twenty one people, including a GSU officer, were killed in the January 15 attack. The cash was received through M-Pesa.

So far so good. We have about $90,000 (100 Kenya shillings is 1 USD) sent through M-Pesa, a mobile money system in Kenya, allegedly related to the Dusit attack.

Hassan Abdi Nur has 52 M-Pesa agent accounts. Fourty seven were registered between October and December last year, each with a SIM card. He used different IDs to register the SIM cards.

So (1), the theory of terrorism predicts that the money will be moved safely, whatever the cost. We have a match. In order to move the money, 52 accounts were opened, at the cost of different IDs.

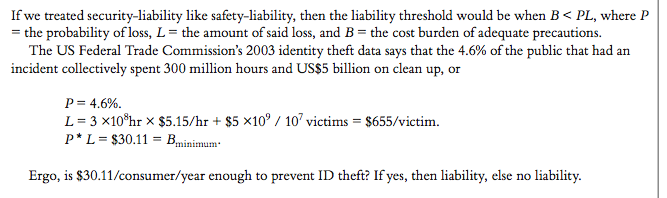

One curiosity here is the cost. In my long running series on the Cost of your Identity Theft we see (or I suggest) an average cost of an Identity set of around $1000. Which would amount to a cost of $52k for 50 odd sets. But this is high for a washed amount of $90k.

Either the terrorists don't care of the cost, or cost of dodgy ID is lower in Kenya, or the alleged middleman amortised the cost over other deals. Interesting for further investigation but not germane to this case.

Then (2), the theory of bayesian statistics and the "base rate fallacy" predict that no terrorists will ever be caught before the fact based on AML/KYC controls.

Clearly this is a match - the evidence is being compiled from after-the-fact forensics. Now, in this the Kenyan authorities are to be applauded for coming out and actually revealing what's going on. In the western world, there is too much of a tendency to hide behind "national secrets" and thus render outside scrutiny, the democratic imperative, an impossibility. One up for the Kenyans, let's keep this investigation transparent and before the courts.

Next (3). The theory predicts that follow the money is a useless tool.

Ambitham was in constant communication with slain lead attacker Ali Salim Gichunge, who died during the attack and his spouse Violent Kemunto Omwoyo.[Inspector] Githaiga yesterday said Ambitham’s phone led to his arrest on Tuesday after detectives established his communication with the Gichunges.

The police are following the social graph and arresting anyone involved. Having traced the phones, they then investigated the M-Pesa evidence, which provided many additional and interesting confirmatory facts.

Which is what they should do. But it was the contact information that cracked this case, not the financial flows. The contact information has always been available to them. And, where there is a credible case of terrorism as is in this case, the financial information has never been withheld. Again, the theory matches the evidence: follow the money is useless before the event, only confirmatory after the event.

Finally (4), the theory of unforeseen consequences says that the damage done by unintelligent responses will haunt the future of anti-terrorism efforts.

These are the agents that received the money, which was later withdrawn at the Diamond Trust Bank, Eastleigh branch, before it was wired to Somalia. ... The manager of the bank where Nur was withdrawing the money,, Sophia Mbogo, was arrested for failing to report Nur’s suspicious transactions. Nur is said to have made huge withdrawals in short intervals, which Mbogo ought to have reported to relevant authorities, but there is no indication she did so.

Without wishing to compromise the investigation - this looks inept. Eastleigh is the Somali district of Nairobi. It's a bustling centre of trade. In some respects the Somalis are better traders than the Kenyans, and a lot of trade is done. And a lot of that is in cash, because the Kenyan banking system is ... not responsive. Lots of legitimate cash would move in and out of that bank branch.

Given the alleged fact that the money man had 52 M-Pesa accounts, he was certainly aware enough to run under the radar of the branch. Thresholds and actions by banks are no secret, especially by those motivated by terrorism to conduct any crime to find out - bribery, extortion, kidnapping are options.

Maybe there is evidence that the branch or the manager is "in" on the deal. Or maybe there is not, and the Kenyan police have just confirmed the theory that FATF anti-terrorism will do more damage. They've sent a message to all branches to drown their customers in pointless compliance, and to not cooperate with the police.

The Kenyan police had better get a clear and undeniable conviction against the branch manager, or they are going to rue the day. The next terrorist attack will surely be harder.

October 21, 2018

ID Dox - now it's getting personal - Andreas spoofed

Writes Andreas Antonopolous, a noted Bitcoin commentator, that he has been impersonated with a mere scan!

Writes Andreas Antonopolous, a noted Bitcoin commentator, that he has been impersonated with a mere scan!

More than anything else this points at the fallacy of Identity Documents as the God of our Identity. AA may very well be a victim of our penultimate post on cheap-as-chips scans of your identity.

What's becoming clear is that identity is garnering more attention. Unwittingly, orgs and peoples who thought they had this under control are being dragged into the quagmire caused by firstly the Internet, then the upheavals caused by the great financial crisis and the drugs wars, and finally the devil of all devils, blockchain. Where will it end?

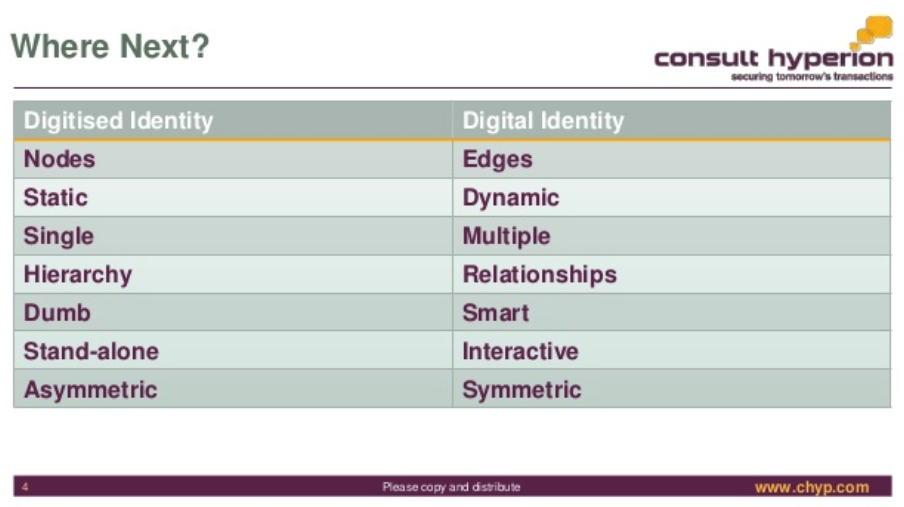

Meanwhile, here comes The Award-Winning David G.W. Birch @dgwbirch another understated twitter persona with slides and solutions for your identity:

The Award-Winning David G.W. Birch @dgwbirch A Short, Strategic Comment on Digital Identity by @chyppings #authentication #authorisation slideshare.net/15Mb/a-short-s… <- A short keynote for the Biometrics Congress in London. People liked it and asked for a copy so I've uploaded it to SlideShare.

I post this for debate not for endorsement ;-)

I'd also like to point out that it is unfortunate that <blockchain> is not a HTML entity, because that's what gets typed these days.

October 10, 2018

Market for Scans

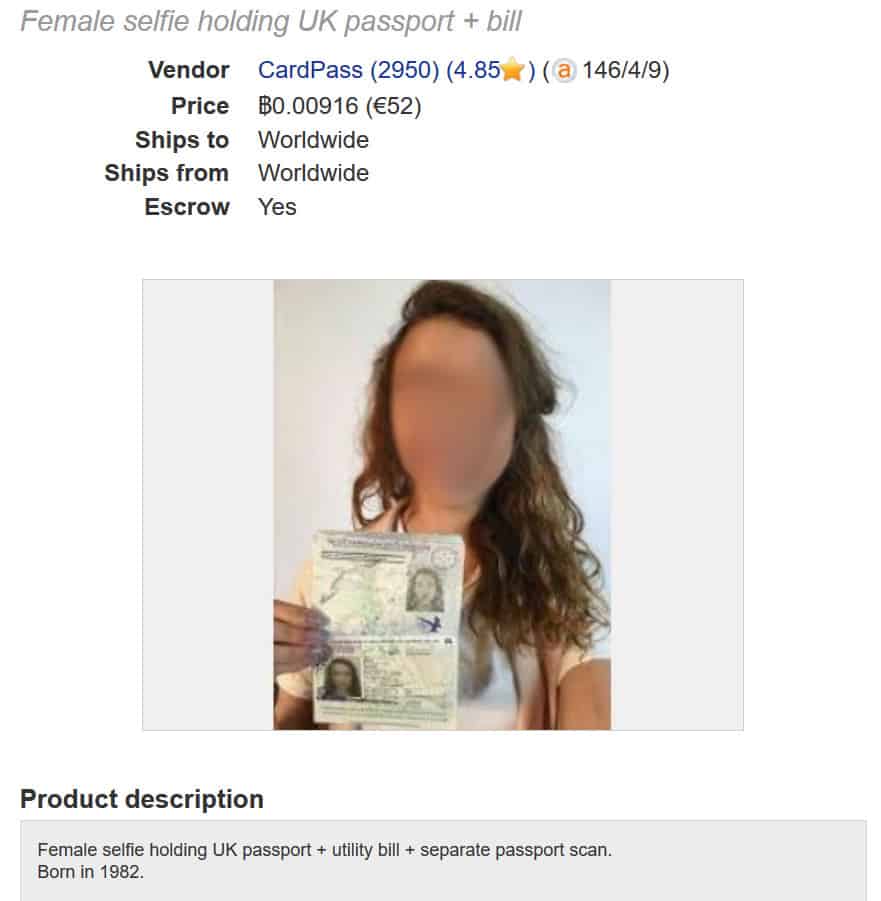

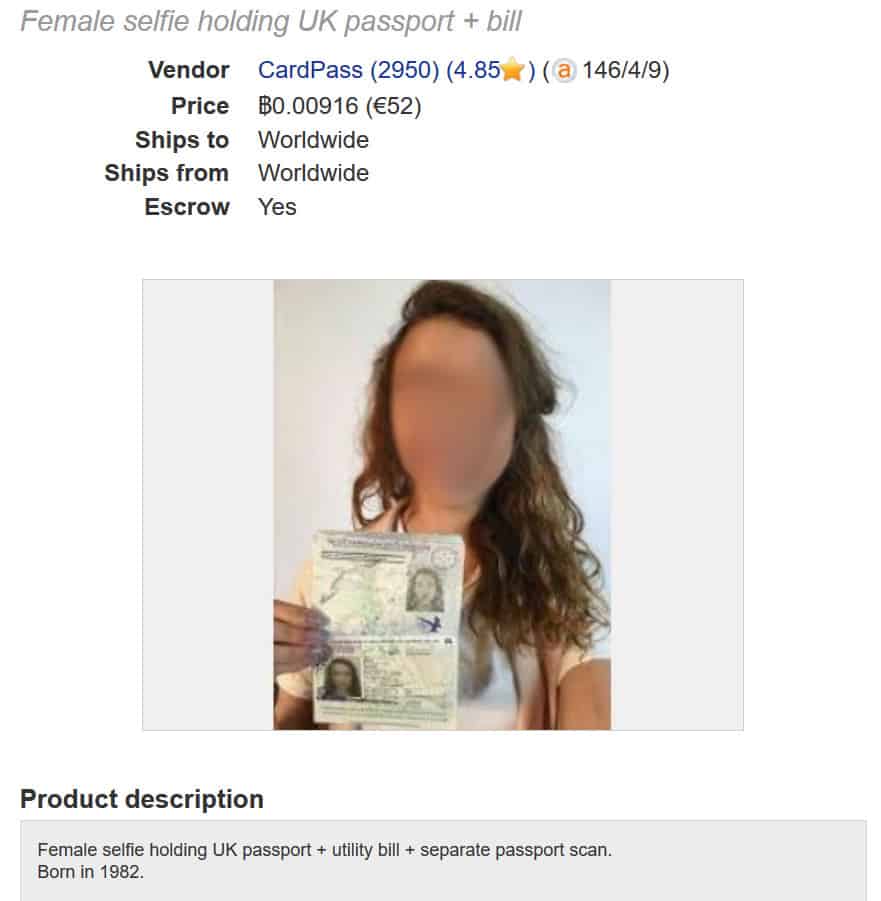

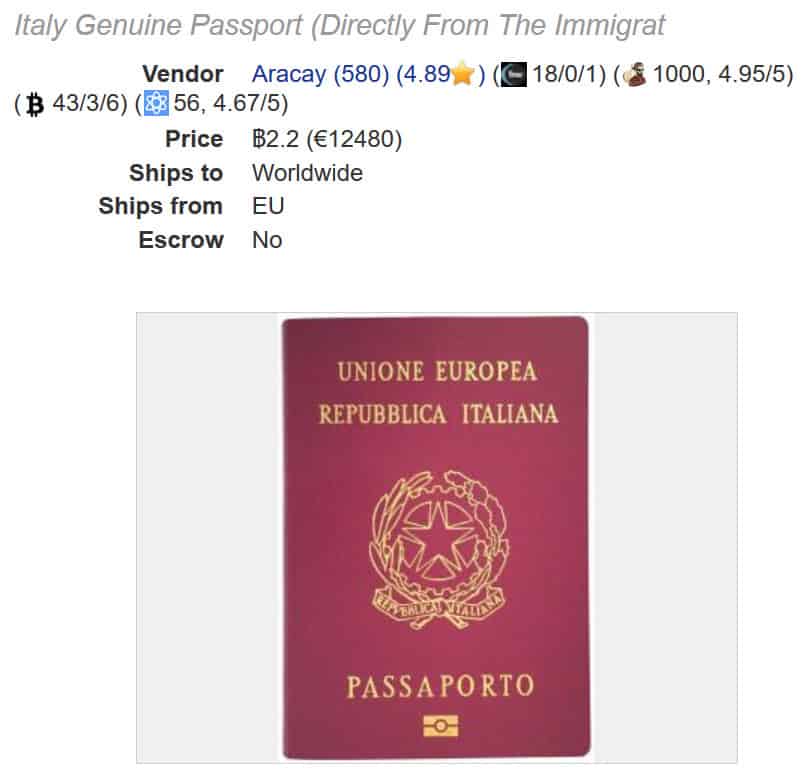

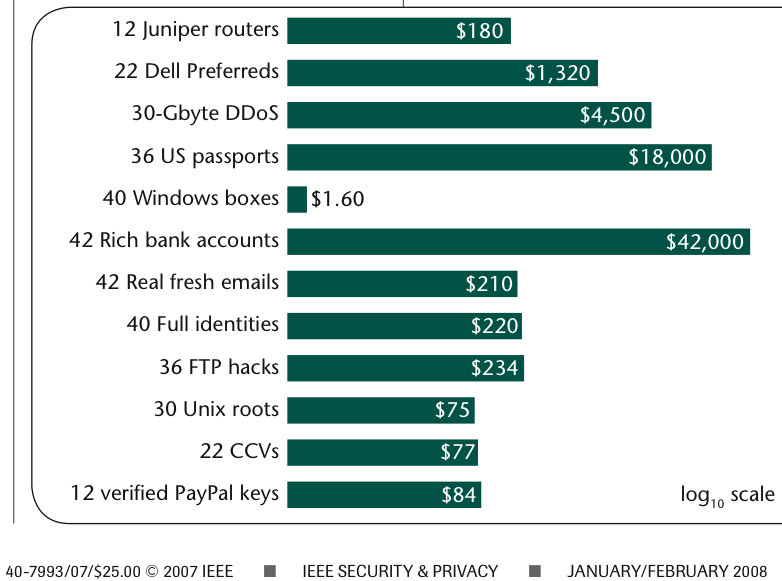

That's the market for scanned passports, not scammed passports, but hey!

From comparitech comes research on what it takes to get digital scans for opening KYC/AML procedures - presumably bank accounts.

Here are our key findings:

- The average price of a digital passport scan is $14.71.

- If proof of address or proof of identification -- a selfie, utility bill and/or driver’s

- license -- is added to a passport scan, the average price jumps to $61.27.

- Australian passport scans were the most common, and yet, the most expensive ($32).

- The average price of a real, physical passport is $13,567.

- The average price of a counterfeit, physical passport is $1,478.

Aside from a lot of interesting detail on scans and templates, here's the real deal:

Authentic, state-issued passports are hard to come by and cost a lot, ranging from $8,216 (Germany) to $17,116 (UK). The average price of the eight supposedly genuine passports was $13,567. At least one vendor claims these passports came from "our corrupt immigration police contacts," though we have no way of verifying this. In many cases buyers are given the option to specify what details are included in the passport, including stamps for specific countries.

This puts a little more colour on the rough benchmark of a thousand per set - this might predict that any passport in such a deal needs to be a forgery. Or, I suspect there may be several distinct marketplaces - this research by comparitech was over "dark web" online interfaces where you as purchaser exchange your money for the goods/docs online, primarily with Bitcoin. Other research has worked with migrant channels where hard-at-luck locals are giving up their physical documents and reporting them stolen/lost.

Commentary on this will have to wait for another day.

June 26, 2018

Shocking trade in stolen UK passports (really??)

Readers in UK obviously don't read the blog, because the Daily Mail has just published the headline of ignorance:

Shocking trade in stolen UK passports: How gangs sell them for £2,500 – so criminals and terrorists can sneak in to the country

By TOM KELLY INVESTIGATIONS EDITOR IN ISTANBUL FOR THE DAILY MAIL

PUBLISHED: 22:43 BST, 24 June 2018 | UPDATED: 07:34 BST, 25 June 2018

Shocking? This trade has been going on since forever, but because it is in the interests of practically everyone to believe that ID documents are perfect, it doesn't make it past the editor's desk. Check the Identity Cost tag.The only news is that the price might have risen - £2500 is a lot more than the £1000 we are used to.

And in case anyone forgets, here's the rest of the Mail's shocking discovery of reality.

A disturbing trade in stolen British passports is exposed today by the Daily Mail.

Swiped by criminal gangs in Western Europe, they are flown to Istanbul or Athens for sale by people smugglers.

Security experts said owning a genuine British passport was like ‘winning the lottery’ for jihadis and criminals – allowing them to slip across borders undetected.

In response to the Mail’s findings, MPs called for action to address Britain’s ‘shocking vulnerability’ to potentially dangerous illegals.

Dozens of false documents seized by an organised crime unit in Greece, including hundreds of ID cards and scores of passports

Our investigation reveals that British citizens are selling their passports to be bought by migrants of similar appearance.

And fake EU identity cards that can be used to enter the UK are also being made to order within three days in the Balkans.

The Mail bought a UK passport for £2,500 from Abu Ahmad, a people-smuggling kingpin in Turkey. It had been stolen from a Milton Keynes man working in Brussels.

It was one of five passports that Ahmad, who is known as ‘The Doctor’, offered to the Mail.

The others included one stolen from an Oxford graduate visiting Paris and another taken from a 28-year-old Manchester woman who was on holiday in Spain.

Ahmad boasted that seven in ten of his clients succeed in duping immigration staff and making it to the UK.

He is on bail while he appeals against an eight-year sentence for spiriting thousands of migrants into Europe, including suspected jihadis. At its peak, his ‘business’ was bringing in £110,000 a month.

Europol, an EU police agency, warned yesterday that people smugglers operating in Turkey and Greece were ‘frequent’ offenders in the trade in black market documents, which is an ‘important enabler’ of organised crime.

Ahmad said all the passports he sold were genuine – otherwise they would be no use at border control.

They are either stolen or sold by their owners, who agree not to report them as missing for a few months, by which time they have been used by Ahmad’s customers.

He said: ‘Most British passports are stolen. Except if the passport was in the name of someone Arabic or Pakistani or something, that could have been sold.’

Ahmad said he had no qualms about profiting from stolen passports and, despite boasting he has smuggled thousands of people into Britain, insisted he was certain none of them were jihadis or criminals.

Abu Ahmad, who is known as ‘The Doctor’, helps smuggle people across the world by selling them stolen passports

But another Syrian immigrant in Turkey told the Mail at least two people Ahmad helped get into Europe were known Islamists operating in Damascus.

The German authorities were alerted about them after their arrival, he said.

Interpol, an international police agency, has a stolen and lost travel documents database, known as SLTD, which it says was searched more than 1.2billion times in the first nine months of 2016, providing 115,000 ‘hits’.

But on its website, it admits: ‘Interpol is not automatically notified of all passport thefts occurring worldwide, and the SLTD database is not connected to national lists of stolen or lost passports.

‘Despite the potential availability of the SLTD database, not all countries systematically search the database to determine whether an individual is using a fraudulent passport.’

For £7,000 Ahmad books his client a hotel room, gets them food and hands over a stolen passport. This is the full-service package, with the cheapest being just the passport for £2,500

In 2014, the head of the agency said just four in ten passports used for international flights were checked against the database.

Labour MP John Woodcock, a member of the Commons home affairs committee, said: ‘At a time when several hundred potentially highly dangerous jihadis have fled when Islamic State has been deposed it’s highly alarming to learn that this way of entering the UK illegally seems to be so readily available.’

Ed Davey, the Lib Dem home affairs spokesman, said: ‘Criminals who capitalise on the vulnerability of tourists and then profit off refugees and immigrants in desperate need of help must not be allowed to operate so freely.’

David Lowe, a former Special Branch counter-terrorism officer now based at Leeds Beckett University, said: ‘For terrorists and criminals getting a new passport is like winning the lottery.

‘It’s a significant concern with fighters coming from Islamic State or returning British fighters. Once you get in with somebody else’s passport you are very difficult to trace.’

One of the stolen passports used to help get people through passport control and across borders. The Daily Mail bought one from Ahmad in Istanbul for £2,500

Immigration minister Caroline Nokes said: ‘One hundred per cent of passports are inspected at the border.

‘Border Force officers are rigorously trained to prevent the holders of fraudulent documents from entering the country and between 2010 and March 2018, we denied entry to over 144,000 people.

‘Immigration Enforcement constantly monitors and identifies emerging threats in relation to the production and supply of false travel documents, including the use of the internet to facilitate the trade in passports and identity cards.

‘We have a range of interventions to target the criminals involved, including criminal prosecution of crime groups in the UK and overseas.’

April 19, 2018

How Refugees are reducing the cost of processing refugees - for around $2000

Der Spiegel online reports:

At some point Hassan Rahimi * wanted to go back, he tells it. Back to Syria , home, to his wife and two sons. They were starving in the devastated land. Rahimi saw himself as a refugee in Germany failed. The family he was not allowed to catch up, he did not get a job. The hopes that had led him to flee in early 2015 were dashed.And so the 35-year-old sat on a summer day 2017 in Berlin-Tegel in a plane to Thessaloniki, Greece. Once there, he entrusted himself to a smuggler. The man should take him to Turkey, the transit country - as if on the way there.

"Sell your papers!"

A refugee who has been recognized in Germany like Rahimi is not allowed to enter Turkey without further ado. And so the tug Rahimi even before the green border gave an advice: "Sell your papers!" The German documents, refugee card and refugee passport, the AOK card. To deny yourself if border guards suddenly turn up. And to make money.

Rahimi did as he was told. He sent the papers by post to his cousin, who lives in Leipzig. And he sold on to a stranger. For 1500 euros. Rahimi was later sent the sum. He was already back in Syria.

It's almost as if there is a law of identity documents - they work for the middle road of broad society but fail dismally at the edges. In this case, the desperate, but also the criminal, who are two separate classes merged into one in the fairyland fantasy of the bureaucratic mind.

The CDU interior politician Armin Schuster, chairman of the parliamentary control committee in the Bundestag, nevertheless calls sharp sanctions for fraudsters. "Every refugee who participates in a pass trade, has forfeited his right of residence," said Schuster the SPIEGEL. In this case, there must be "an accelerated form of deportation".

Yet - the broad swathe of comfortable society - they (we?) don't really need identity documents, because we already know each other and we already trade and we already have comfortable safe lives and we behave. Remember being taught not to steal as a child? You don't steal because of your identity documents, you behave because you're part of the community, and you want to remain part of the community.

Identity documents work for people who don't need them; they don't work for those that do. What is this product called in marketing or economic terms, the product that sells and works only for those who don't need it? A few terms come to mind: Vanity goods, marketing discrimination, security theatre, entrapment.

There are many discussions and conclusions we can draw from the story of refugees, but some are easy: the authorities will always say, our system is broken, bad people are doing bad things, we must try harder ! Bracelets, implants, biometrics, liveness detection, fingerprints, toeprints, roving police checks, cultural alignment testing! Meanwhile, only refugees will know that the recognition of status without humanity is no recognition. They will drift on in hope, as they are boxed into their new isolated, tolerated but despised class - like gypsies, never finding a real home, always despised.

Yet, perversely again, maybe in the breach we see the flaw:

The scam is therefore quite simple: Recognized in Germany refugees travel to Turkey. Somewhere along the way they sell their papers, apply for replacement at German consulates - if they want to return to their host country - or continue like Hassan Rahimi the journey to their homeland without documents.

Oh, the cunning devils at Der Spiegel - the real trade is different, and Rahimi's story is just to tug at the heart strings. Refugees are bringing back additional refugees!

Let's say the cost of formally processing a refugee through "the system" is X. And let's say the cost of informally running (a.k.a. smuggling) a new refugee through Greece is Y == €2000 = 3 flights + $1000 + the cost of replacement documents.

The cost of processing two refugees under this enhanced scheme is now to X + Y. The fact that refugees are doing this - bringing in new refugees and taking on the risk of right-wing outrage to boot is evidence that X is too high. This formula only works if X is very much greater than €2000.

To take a stab at that, I'll guess that the state's cost is around €100,000. To support that, if we go back to the start - the cost of Rahimi not finding a job is easily €20,000 or more. So, under these finger-in-the-air assumptions, the authorities have set the cost of processing a refugee too high, and therefore the system is breaking at the edges.

Assuming that Rahimi doesn't sell his papers to a terrorist (a vanishingly small probability) everyone wins under this scenario. The state saves $100,000 and the new refugee saves on a year of misery.

One may have moral views on the above - "it's just not right!!!" - but when the economy saves money, the economy follows the money. For more numbers and a slight segue:

Elsewhere, a potential salesman tells that he arrived in Turkey four days ago. "I have a residence permit for three years, with a passport and AOK card." If you are interested, the package of German papers for $ 1000 to have. It is crucial that the photo could be used on the documents. A buyer must look like him. Otherwise the danger would be too great to fly up with the papers..... There, people offered real passports from 500 euros, passes from 200 euros and driver's licenses from 150 euros.

Higher up, €1500 and here, $1000. I guess I've been tracking the cost of stolen documentation for a decade now, and it quickly settled around 1000 ($ € £). In the Spiegel article, we see it hasn't changed in a decade, which I find surprising. It suggests that nothing that has happened over the last decade has changed anything, at least in the supply versus demand.

ps: better translations welcome.

January 04, 2018

Hackers selling access to Aadhar

TRIBUNE INVESTIGATION — SECURITY BREACH

Rs 500, 10 minutes, and you have access to billion Aadhaar details

Group tapping UIDAI data may have sold access to 1 lakh service providers

Rachna Khaira

Tribune News Service

Jalandhar, January 3

It was only last November that the UIDAI asserted that “Aadhaar data is fully safe and secure and there has been no data leak or breach at UIDAI.” Today, The Tribune “purchased” a service being offered by anonymous sellers over WhatsApp that provided unrestricted access to details for any of the more than 1 billion Aadhaar numbers created in India thus far.

It took just Rs 500, paid through Paytm, and 10 minutes in which an “agent” of the group running the racket created a “gateway” for this correspondent and gave a login ID and password. Lo and behold, you could enter any Aadhaar number in the portal, and instantly get all particulars that an individual may have submitted to the UIDAI (Unique Identification Authority of India), including name, address, postal code (PIN), photo, phone number and email.

What is more, The Tribune team paid another Rs 300, for which the agent provided “software” that could facilitate the printing of the Aadhaar card after entering the Aadhaar number of any individual.

When contacted, UIDAI officials in Chandigarh expressed shock over the full data being accessed, and admitted it seemed to be a major national security breach. They immediately took up the matter with the UIDAI technical consultants in Bangaluru.

Sanjay Jindal, Additional Director-General, UIDAI Regional Centre, Chandigarh, accepting that this was a lapse, told The Tribune: “Except the Director-General and I, no third person in Punjab should have a login access to our official portal. Anyone else having access is illegal, and is a major national security breach.”

...

read more.

September 10, 2017

Syrian Passports in hands of ISIS

In the long running thread about controversial identification documents, RT reports:

German authorities believe that Islamic State terrorists have stolen over 11,000 blank Syrian passports, confidential documents seen by the Bild am Sonntag newspaper reportedly reveal. German Investigators have made a list of the serial numbers of the blank passports, the newspaper reported, citing confidential documents of the German Federal Criminal Police Office (BKA), the interior ministry and the country's federal police (BPOL).“According to BKA information, there are 11,100 Syrian blank passports… in the hands of the IS [Islamic State, also known as ISIS/ISIL],” the documents from the interior ministry reportedly state. In total, 18,002 blank Syrian passports were stolen from the Syrian government, Bild am Sonntag reported.

Developments in connection with the refugee question have shown that terrorist organizations are using the opportunity to infiltrate potential IS attackers into Europe undetected, a BKA official told the paper.

Fake or altered passports are mostly used “for illegal entry without further motives like carrying out a terrorist attack,” the official added.

According to the documents seen by Bild, at least 8,625 passports checked by German migration authorities in 2016 turned out to be counterfeits.

No news of prices.

June 16, 2017

Identifying as an artist - using artistic tools to generate your photo for your ID

Copied without comment:

Artist says he used a computer-generated photo for his official ID card

A French artist says he fooled the government by using a computer-generated photo for his national ID card.

Raphael Fabre posted on his website and Facebook what he says are the results of his computer modeling skills on an official French national ID card that he applied for back in April.

| Le 7 avril 2017, j’ai fait une demande de carte d’identité à la mairie du 18e. Tous les papiers demandés pour la carte étaient légaux et authentiques, la demande a été acceptée et j’ai aujourd’hui ma nouvelle carte d’identité française.

La photo que j’ai soumise pour cette demande est un modèle 3D réalisé sur ordinateur, à l’aide de plusieurs logiciels différents et des techniques utilisées pour les effets spéciaux au cinéma et dans l’industrie du jeu vidéo. C’est une image numérique, où le corps est absent, le résultat de procédés artificiels. L’image correspond aux demandes officielles de la carte : elle est ressemblante, elle est récente, et répond à tous les critères de cadrage, lumière, fond et contrastes à observer. Le document validant mon identité le plus officiellement présente donc aujourd’hui une image de moi qui est pratiquement virtuelle, une version de jeu vidéo, de fiction. | On April 7, 2017, I made a request for identity card at the city hall of the 18th. All the papers requested for the card were legal and authentic, the request was accepted and I now have my new French Identity Card.

The Photo I submitted for this request is a 3 D model on computer, using several different software and techniques used for special effects in cinema and in the video game industry. This is a digital image, where the body is absent, the result of artificial processes. The image corresponds to the official requests of the card: it is similar, it is recent, and meets all the criteria for framing, light, background and contrast to be observed. The document validating my most official identity is now an image of me that is practically virtual, a video game version, fiction. The Portrait, the photo booth and the request receipt were shown at the r-2 Gallery for the Exposition Agora |

The image is 100 percent artificial, he says, made with special-effects software usually used for films and video games. Even the top of his body and clothes are computer-generated, he wrote (in French) on his website.

But it worked, he says. He followed guidelines for photos and made sure the framing, lighting, and size were up to government standards for an ID. And voila: He now has what he says is a real ID card with a CGI picture of himself.

"Absolutely everything is retouched, modified, and idealized"

He told Mashable France that the project was spurred by his interest in discerning what's artificial and real in the digital age. "What interests me is the relationship that one has to the body and the image ... absolutely everything is retouched, modified, and idealized. How do we see the body and identity today?" he said.

In an email, he said that the French government isn't aware yet of his project that just went up on Facebook earlier this week, but "it is bound to happen."

Before he received the ID, the CGI portrait and his application were on display at an Agora exhibit in Paris through the beginning of May.

Now, if the ID is real, it looks like his art was impressive enough to fool the French government.

December 04, 2016

Fake US embassy provides full service

It's been a while since I've posted on the cost of false documents, perhaps because I've fooled myself into belief that everyone's got the message: you can pick a full set for about $1000.

But this one is more adventurous:

In Accra, Ghana, there was a building that flew an American flag outside every Monday, Tuesday, and Friday, 7:30 a.m.-12:00 p.m. Inside hung a photo of President Barack Obama, and signs indicated that you were in the U.S. Embassy in Ghana. However, you were not. This embassy was a sham.It was not operated by the United States government, but by figures from both Ghanaian and Turkish organized crime rings and a Ghanaian attorney practicing immigration and criminal law. The "consular officers" were Turkish citizens who spoke English and Dutch. For about a decade it operated unhindered; the criminals running the operation were able to pay off corrupt officials to look the other way, as well as obtain legitimate blank documents to be doctored.

....

The sham embassy advertised their services through flyers and billboards to cultivate customers from Ghana, Cote d'Ivoire, and Togo. Some of the services the embassy provided for these customers included issuance of fraudulently obtained, legitimate U.S. visas, counterfeit visas, false identification documents (including bank records, education records, birth certificates, and others) for a cost of $6,000.

There's no indication as to why it took a decade to find, nor whether the documents were good enough to fool.

Nor is there any indication in the article as to what $6k buys you - and $6000 does seem to be an outlier.

Most of the prior information I have collected suggests $1000 gets you the set. It's important to know the number, roughly, because it sets the bar as to how much security we can expect from the identity documents provided by the state. Whether $1k or $6k is a low bar or a high bar depends, but what is the case is that there is a bar, above which we can expect criminals to leap for profit.

August 13, 2015

Fake Ids - comprehensive prices

When I was at CAcert, one of the risk analysis questions was how much it costs to provide a fake set of Identity documents. So I started collecting public references to that, and fairly quickly came up with a number -- 1000 as the cost for a good set.

When I was at CAcert, one of the risk analysis questions was how much it costs to provide a fake set of Identity documents. So I started collecting public references to that, and fairly quickly came up with a number -- 1000 as the cost for a good set.

That's a great number as a rule of thumb for risk analysis -- don't build a system that spends 10,000 to protect something that can be stolen for a tenth of that.

Now (via Zerohedge) someone else has picked up my slack and published a lot of info on this cost. Here comes Havocscope!

Prices of Stolen Passports and Fake IDs

Average Price of a Stolen Passport for Sale $3,500 Black Market Driver License – New Jersey $2,500 to $7,000 Black Market Passport – Nepal $6,961 Black Market Passport – Peru $1,750 Black Market Passport – Sweden $12,200 Black Market Passport and Visa – Australia $15,000 Blank Stolen Passport – UK $1,642 Fake Green Card $75 to $300 Fake Birth Certificate – Cuba $10,000 to $50,000 Fake Car License Plate in Cambodia $4.50 to $10 Fake Driver License – California $200 Fake Driver License – Confiscated in New York 1,450 in 2012 Fake ID Card – Malaysia $771 (includes smuggling) Fake ID Card – New York $160 in 90 min Fake ID Confiscated – Arizona 2,064 from students in 2010 Fake ID Confiscated from China 1,700 in 3 months at one airport Fake ID from China $300 for 1, $400 for 2 Fake ID Papers for Residency – USA $2,500 per set Fake IDs for Sale – United States $0.1 Billion ($100 Million) Fake Passport – Australia $806 Fake Passport – China $10,000 to $25,000 Fake Passport – China (Alter Photo) $3,500 to $5,000 Fake Passport – Egypt, Germany, Morocco $6,830 to Syrian Refugees Fake Passport in Thailand – Basic $245 in 2 hours Fake Passport in Thailand – Higher Quality $1,000 to $1,250 Fake Passports in India $294 Fake Social Security Card $75 to $300 Lost or Stolen Passport Reported 11 Million in 2010 Passport Selling – Thailand $200 Stolen ID to buy Health Insurance $1,250

At this stage I can hang up my hat - these guys are doing a better job. But before I retire, I might ask one question - what's up with Cuba? Why does a false birth certificate cost so much? And, they have the answer:

Price to Get a Fake Birth Certificate from CubaA man in the US State of Florida was selling counterfeit Cuban birth certificates to illegal immigrants in the United States. Due to US immigration policy, Cuban nationals are able to apply for a green card after one year of being in the country.

The man was selling fake Cuban birth certificates to migrants from Argentina, Colombia, Costa Rica, El Salvador, Mexico, Peru and Venezuela. Each migrant was already in the United States illegally, and paid between $10,000 to $50,000 for the fake documents. By possessing the fake Cuban birth certificates, the migrants attempted to pass off as Cuban nationals to US immigration officials.

According to court documents, the man sold around 50 fake birth certificates and made over $500,000.

Answered! Looks like I'm out of a job! Maybe I should take up forging Cuban birth certificates... Or, go chase these guys who organised a hit in Bahrain using false ID:

The price of a hit is also tracked by Havocscope, but now we're getting off track.

March 16, 2013

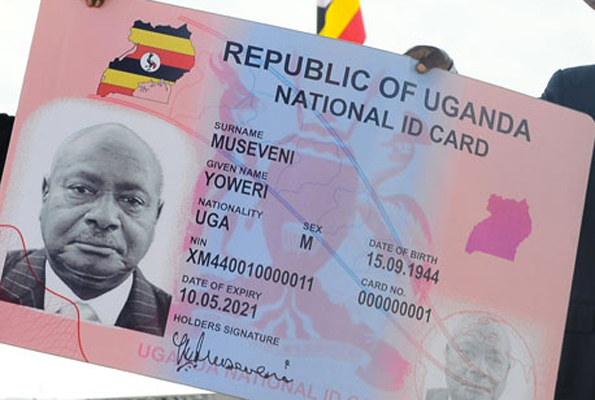

It all started as a noble idea - Identity Cards in Uganda

Another in an occasional series addressing the cost of identity. It turns out that Uganda has so far spent a whopping 600 million shillings per identity card, as reported by Nicholas Kalungi:

Another in an occasional series addressing the cost of identity. It turns out that Uganda has so far spent a whopping 600 million shillings per identity card, as reported by Nicholas Kalungi:

It all started as a noble idea. Every Ugandan holding a National Identity Card (NIC) that would be acceptable for elections, to financial institutions, travel within East Africa and more. A decade down the road, with about Shs240 billion spent, only 401 identity cards have been issued. Uganda is a country of about 33 million people.

Even converted to USD, that turns out to be $226,642 per card. Oh, and:

Also of concern is the fact that the ID cards yet to be issued is will use barcode technology instead of the smartcard technology that uses a chip.A chip can accommodate a lot more information, such as medical records, criminal records, educational data, driving permits and social security data. It can also authenticate fingerprints and photographs, which are additional safeguards against forgery. Blank ID cards using the barcode technology will cost the government 22.5 million euros (Shs63 billion) for 15 million cards, amounting to $2 per card.

This sounds like one of those frequent cases of inept importing of western notions -- bad enough in their own territory, where the sole justification turns out to be "we can afford it" -- into places where it enters the realm of fantasy.

In somewhat proof of this, the market has responded:

Thousands of Ugandans have resorted to using local council (LC) stamped identification cards (IDs) as national IDs.This comes at the back of the government’s failure to implement the national ID project that would enable citizens have a uniform identification document. For a decade now, the national ID project has been mired in corruption allegations and internal fights over who should be in charge of the multi-billion shilling project.

The multiple delays in the national ID project have left people with no alternatives save for exploiting alternatives and creating their own IDs-labeling them as “Citizens” identifications. One of the booming businesses on the streets of Kampala, taxi parks and at local council offices across the country is making, selling and issuing IDs.

A week-long investigation around Kampala showed that these IDs are of two types. One type bears the word ‘Resident’ on the cover while another brand bears the word ‘Citizen’ on the cover. They are mainly made at Nasser and Nkrumah roads in Kampala.

Several centres along these Streets are famous for originating all sorts of fake documents that include, among others, academic certificates ranging from bachelor’s degrees, diplomas and of recent PhDs. The wholesale price range for ‘’Citizen” and “Resident” IDs are between Shs300 and Shs1, 000.

After buying the card from Nasser Road or any other outlet, you get a passport photo and take it to a local council official who at between Shs3,000 and Shs20,000 approves and stamps it to confirm that you are a citizen of Uganda or a resident of a given area.One John Muyomba, a resident of Kasubi, tells this newspaper that he acquired a citizens ID from his local chairman a year ago and it has been doing wonders for him following the expiry of his university ID. “I paid Shs5,000 and took two passport size photos. I presented a friend at the LC office as a referee and got the ID. ...

At around 2600 shillings to the USD, we are looking at from $1 to $4 for the card, and $12 to $80 or so for the certification. Now divide those numbers by the average daily wage -- about $1 -- to get a view as to their purchasing-power-parity cost.

Prone to abuse

For one to get this acquired ID stamp, all they need is a person to recommend them to an LC leader that he/she is a resident of an area. “We always ask the person seeking our approval to come with a resident of the area to prove that they are Ugandans or resident of that area,” says Bright Kashaka, an LC chairperson in Kisenyi, a Kampala suburb.When this reporter visited a local council office in an area he neither works from nor resides, he was told by the people he found at the office to pay Shs10, 000 and present a passport photo after which he would have one ID issued. From this discovery, it became clear that you only need to have money and passport size photos to a citizen or resident ID.

What's going on here is that the market for documents has stepped in to provide the physical carrier, and the market for local councils has stepped forth to provide the certification. This seems like an efficient solution, especially when we factor in the experience of government-led production experiments.

Curiously, it also makes the case that an ID of any form is a good thing, as shown by the thriving market, evidencing demand from somewhere.

"...It is this ID that I used to register my Sim card and to get an account at one of the banks,” says Muyomba. While, these IDs seem to be serving different purposes, for example, local identification and Sim card registration, among others, the ease at which they are acquired, stamped and issued is worrying.

Worrying? For those who suffer angst from any free-market solution, the trick is to see free-market identity cards as an intermediate between nothing and some hypothetical perfect identity proof. Of course, all forms of identity documents are just that, an intermediate between nothing and perfection, so the argument turns on whether the market can do a better or worse job, for more or less money, than say a given government endeavour.

In Uganda, the answer is strongly in favour of the market.

However, if you are good with numbers, one observation must strike out and slap at the face: why is the cost of the Local Council certification so high? At from 3000 to 20000 shillings, that translates to from one to eight day's worth of average earnings.

The answer is almost certainly corruption. The fact that there are variable prices is a bit tip-off, and the indication of a special price for a newcomer is a dead giveaway. There may, or may not be a local government listed price for the certification, as that is not evidenced in these articles, but any variation of that base price is likely going straight into the pockets of the corrupt local government officials.

If we take the 3000 as a base price, this indicates that corruption is many times more than the honest LC cost-based price alone.

And it is this factor that slows these countries down. Corruption, created almost universally by government mandate. (Effects of corruption in Ghana.) In this case the local council monopoly on certifications, makes the cost of business far higher than it is in western countries, when converted to PPP numbers. And now we find the incestuous circle of government intervention leading to this corruption:

Lately, telecommunications companies and Uganda Communications Commission (UCC) have been blaming the absence of national IDs as the main challenge affecting the on-going Sim card registration process. Even though the process has been extended untill August, millions are still unregistered and the main reason cited is absence of recognised identification mainly in rural areas that are mandatory before anyone registers a Sim card. The effort to procure national IDs has been on for since 2001.

The requirement for LC-stamped Ids is driven by ... government rules for SIM registration. In what is a widely acknowledged economic miracle -- the rollout of unidentified cell phones across Africa -- someone, somewhere has decided we need identity for each user of a cell phone. Thus putting the brakes on the one thing that Africa got right.

The requirement for LC-stamped Ids is driven by ... government rules for SIM registration. In what is a widely acknowledged economic miracle -- the rollout of unidentified cell phones across Africa -- someone, somewhere has decided we need identity for each user of a cell phone. Thus putting the brakes on the one thing that Africa got right.

What's the benefit to slowing down Africa's economic miracle? Why do we want to slow down the ability of locals to afford necessities like mosquito nets? If we dig a little deeper, it will almost certainly evidence itself once again: inept importation of bad Western notions into a place where they simply make no sense. Which will continue until the locals get a clue:

Until the production and selling of fake IDs is made illegal however, the different between a non-citizen, foreign and criminal holding the fake IDs is only a stamp hit.

These western notions are so easy to believe, and so very wrong.

October 26, 2011

Phishing doesn't really happen? It's too small to measure?

Two Microsoft researchers have published a paper pouring scorn on claims cyber crime causes massive losses in America. They say it’s just too rare for anyone to be able to calculate such a figure.Dinei Florencio and Cormac Herley argue that samples used in the alarming research we get to hear about tend to contain a few victims who say they lost a lot of money. The researchers then extrapolate that to the rest of the population, which gives a big total loss estimate – in one case of a trillion dollars per year.

But if these victims are unrepresentative of the population, or exaggerate their losses, they can really skew the results. Florencio and Herley point out that one person or company claiming a $50,000 loss in a sample of 1,000 would, when extrapolated, produce a $10 billion loss for America as a whole. So if that loss is not representative of the pattern across the whole country, your total could be $10 billion too high.

Having read the paper, the above is about right. And sufficient description, as the paper goes on for pages and pages making the same point.

Now, I've also been skeptical of the phishing surveys. So, for a long time, I've just stuck to the number of "about a billion a year." And waited for someone to challenge me on it :) Most of the surveys seemed to head in that direction, and what we would hope for would be more useful numbers.

So far, Florencio and Herley aren't providing those numbers. The closest I've seen is the FBI-sponsored report that derives from reported fraud rather than surveys. Which seems to plumb in the direction of 10 billion a year for all identity-related consumer frauds, and a sort handwavy claim that there is a ration of 10:1 between all fraud and Internet related fraud.

I wouldn't be surprised if the number was really 100 million. But that's still a big number. It's still bigger than income of Mozilla, which is the 2nd browser by numbers. It's still bigger than the budget of the Anti-phishing Working Group, an industry-sponsored private thinktank. And CABForum, another industry-only group.

So who benefits from inflated figures? The media, because of the scare stories, and the public and private security organisations and businesses who provide cyber security. The above parliamentary report indicated that in 2009 Australian businesses spent between $1.37 and $1.95 billion in computer security measures. So on the report’s figures, cyber crime produces far more income for those fighting it than those committing it.

Good question from the SMH. The answer is that it isn't in any player's interest to provide better figures. If so (and we can see support from the Silver Bullets structure) what is Florencio and Herley's intent in popping the balloon? They may be academically correct in trying to deflate the security market's obsession with measurable numbers, but without some harder numbers of their own, one wonders what's the point?

What is the real number? Florencio and Herley leave us dangling at that point. Are they are setting up to provide those figures one day? Without that forthcoming, I fear the paper is destined to be just more media fodder as shown in its salacious title. Iow, pointless.

Hopefully numbers are coming. In an industry steeped in Numerology and Silver Bullets, facts and hard numbers are important. Until then, your rough number is as good as mine -- a billion.

November 15, 2010

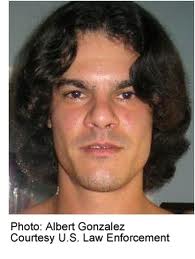

The Great Cyberheist

The biggest this and the bestest that is mostly a waste of time, but once a year it is good to see just how big some of the numbers are. Jim sent in this NY Times article by James Verini, just to show that breaches cost serious money:

The biggest this and the bestest that is mostly a waste of time, but once a year it is good to see just how big some of the numbers are. Jim sent in this NY Times article by James Verini, just to show that breaches cost serious money:

According to Attorney General Eric Holder, who last month presented an award to Peretti and the prosecutors and Secret Service agents who brought Gonzalez down, Gonzalez cost TJX, Heartland and the other victimized companies more than $400 million in reimbursements and forensic and legal fees. At last count, at least 500 banks were affected by the Heartland breach.

$400 million costs caused by one small group, or one attacker, and those costs aren't complete or known as yet.

But the extent of the damage is unknown. “The majority of the stuff I hacked was never brought into public light,” Toey told me. One of the imprisoned hackers told me there “were major chains and big hacks that would dwarf TJX. I’m just waiting for them to indict us for the rest of them.” Online fraud is still rampant in the United States, but statistics show a major drop in 2009 from previous years, when Gonzalez was active.

What to make of this? It may well be that one single guy / group caused the lion's share of the breach fraud we saw in the wake of SB1386. Do we breathe a sigh of relief that he's gone for good (20 years?) ... or do we wonder at the basic nature of the attacks used to get in?

What to make of this? It may well be that one single guy / group caused the lion's share of the breach fraud we saw in the wake of SB1386. Do we breathe a sigh of relief that he's gone for good (20 years?) ... or do we wonder at the basic nature of the attacks used to get in?

The attacks were fairly well described in the article. They were all through apparently PCE compliance-complete institutions. Lots of them. They start from the ho-hum of breaching the secured perimeter through WiFi, right up to the slightly yawnsome SQL injection.

Here's my bet: the ease of this overall approach and the lack of real good security alternatives (firewalls & SSL, anyone?) means there will be a pause, and then the professionals will move in. And they won't be caught, because they'll move faster than the Feds. Gonzalez was a static target, he wasn't leaving the country. The new professionals will know their OODA.

Read the entire article, and make your own bet :)

November 06, 2010

I am Spartacus! and other dramatic "Identity" scripts

Name collisions are such fun! The apocryphal story of the Spartacus, the slave-turned-revolutionary, has him being saved by all his slave-warriors standing up saying, "I am Spartacus!" The poor Roman Leaders had little grip on the situation, as they couldn't recall any biometrics for the guy.

A short time ago, I wondered into an office to get some service, and a nice lady grabbed me at the door, entered my name in and eventually queued me to a service desk. The poor woman at the computer couldn't work it out though, as having entered my first name into the computer, all the details were wrong. It was finally resolved when an attendant 2 desks away asked why she'd opened up his client's file ... who had the same first name. Apparently, my name is subject to TLCs, three-letter-collisions...

Luckily, that was easy to solve. My 4-letter name reduces to around 2 people in our field. Hopefully, this is all resolved in a seminal paper on the subject:

Global Names Considered Harmful by Mark Miller, Mark Miller, and Mark Miller

As reported by Bill Frantz, that's the paper.

Meanwhile, if you want to purchase one of these fabulous global names, some prices spotted a while back: As reported by Dave Birch somewhere, and I only copied this one line (before the link went south):

Authorities said Lominy charged $1,600 to $2,000 for a state driver's license...

And (this time with the link still working):

The gangs are setting up fake-ID factories using printers bought at high street shops. The Met has shut at least 20 “factories” in the last 18 months and believes more than 30,000 fake identities are in circulation.Police examined 12,000 of them and established they were behind a racket worth £14 million. One £750 printer was withdrawn from sale at PC World after detectives revealed it could produce replicas of the proposed new ID card and EU driving licences.

...

Mr Mawer added: “There are people with dual identities, one real and one for committing crime.” He revealed that specialist printers capable of making convincing ID documents such as EU driving licences could be bought for £750, though others cost £5,000.

I'm currently trying to get my drivers licence back, and so far it has cost $465, with more costs to come. At some point, the above deal looks good, and they throw in a free printer! A steal :)

Speaking of "Identity" I also watched a British drama of that name tonight. In true form, it's "gritty police drama," which is to say, a copy of a dozen other shows which make a habit of implausible scripts woven around too many cross-overs.

September 01, 2010

profound misunderstandability in your employee's psyche

Speaking of profound misunderstandings, this:

BitDefender created a "test profile" of a nonexistent, 21-year-old woman described as a "fair-haired" and "very, very naïve interlocutor" -- basically a hot rube who was just trying to "figure out how this whole social networking thing worked" by asking a bunch of seemingly innocent, fact-finding questions.With the avatar created, the fictitious person then sent out 2,000 "friendship requests," relying on the bogus description and made-up interests as the presumptive lure. Of the 2,000 social networks pinged with a "friendship" request, a stunning 1,872 accepted the invitation. And the vast majority (81 percent) of them did it without asking any questions at all. Others asked a question or two, presumably like, "Who are you?" or "How do I know you?" before eventually adding this new "friend."

...

But it gets worse. An astonishing 86 percent of those who accepted the bogus profile's "friendship" request identified themselves as working in the IT industry. Even worse, 31 percent said they worked in some capacity in IT security.

May 18, 2010

advertising fake passports and other puzzles?

Well.... as frequent readers know, I collect data on how much it costs to purchase a set of Identity documents. I do this so that we know what the rough barrier to totally breaching the so-called "Identity Requirement" costs. So that we can feed that number into our construction of security models, and not get caught out.

In short, my research suggests strongly that the cost is about a thousand, in any of the major currencies.

Some reader in that business has just fed a comment into a post, advertising exactly that. My first thought was to remove it, as I don't like spam and adverts on the site ... but it is precisely on topic! In the spirit of research and data collection, I went to the site (which is at fake passports dot eu) and it has these prices, in Euros:

Australia 800 Austria 900 Belgium 800 Canada 900 Finland 900 France 900 Germany 1000 Israel 700 Malaysia 700 Netherlands 800 New Zealand 800 South Africa 700 Switzerland 1200 UK 1000 USA 1100

I'm guessing that site will be complained about soon enough, and they'll lose their domain, so I've collected the prices quickly.

Which, ruminating over ones morning coffee, as one does, does rather lead to some dilemmas, rather! Is advertising such fake goods against some law, somewhere? Possibly, but advertising is more a problem of pressure than law, as generally, making and selling fake goods is a fraud against the owner of the real ones. The problem with accepting the anti-advertising argument is that it then allows the owners of the real goods to perpetuate a type of deception on the buyers: that the goods are unfakeable, which becomes a serious deception on those who are reliant on the goods.

Alternatively, who does one complain to? One cannot complain to ones local bobby, because he wouldn't know what to do or who to talk to. He's probably unaware of why such a thing is useful, having likely not gone further than Costa del Sol, with his s/o. No such luck at the Federal level, either, because almost certainly they have no jurisdiction, the shop being in some other country. A bit of a central flaw in the whole passport concept, really.

There isn't a sort of global passport policeman, because this is one of those odd areas where each country maintains its own sovereignty, with ferocity, not withstanding their lack of sovereignty in any place the passport is likely to be used.

However, it has been pointed out in the past that people who don't like these fake passports, among other troubling truths found on this site, are watching this site! Aha! Problem solved, so this is perhaps the fastest way to report to all.

Another problem. We don't know if the goods are real, or a setup to shake out lightweight players. Given that in some countries, the practice of entrapment is considered legal, and evidence derived from entrapment might be entertainable in court, it's not clear how the hapless customer would prove the quality of the wares, before purchasing. At least, none of my readers will take that risk, and especially considering the path beaten by Shahida for Panorama. Good work, that!

Another problem. We don't know if the goods are real, or a setup to shake out lightweight players. Given that in some countries, the practice of entrapment is considered legal, and evidence derived from entrapment might be entertainable in court, it's not clear how the hapless customer would prove the quality of the wares, before purchasing. At least, none of my readers will take that risk, and especially considering the path beaten by Shahida for Panorama. Good work, that!

Finally, for those who've read this far and are looking for the really interesting question, it is this: is the variation of prices seen above a result of supply factors or demand factors?

Now back to your normal channel...

February 15, 2010

The cost of playing red-footed football for European top-league clubs

An article in the Dutch paper NRC Handelsblad reveals that

An article in the Dutch paper NRC Handelsblad reveals that

A classified Dutch government report has revealed that criminals stole 341,956 passports, identity cards, visa stickers and drivers' licences from European government facilities since 2000.

OK! That would be 34k per year across Europe. It states that purchasers

are willing to pay increasingly high prices for travel documents and passports," the report states. Depending on the country and the type of document sought, prices are said to vary from 500 to 11,000 euros .

That's for documents based on stolen-as-blank European documents (which supports our rule of thumb: 1,000 euros for a good set). Later on the article gives one estimate of costs (to us) or profits (to crooks):

"The damages incurred can amount to at least a hundred times the prices paid for these documents." A couple of years ago, Dutch customs officials estimated that in the Netherlands alone, fraud committed using forged proof of identity cost three billion euros annually.

If one guesses say a tenth of the numbers for Netherlands alone (finger in air, divide European numbers above by 11), then each year, 3000 good identity documents are selling into the Netherlands and chasing 3 billion euros of fraud. That's 3 million bux per identity sale .

That's serious money. This is for the real item, and only the printing would give them away on inspection, which makes those numbers useful. Here's more information.

To combat the abuse of stolen documents, customs offices protecting the Schengen area's outer borders have the so called Schengen Information System (SIS) at their disposal. The SIS lists not only all persons and vehicles wanted by law enforcement in countries party to the Schengen treaty, but also contains data on all blank travel documents that were stolen or went missing from government facilities there. According to the Dutch police, the database contains 341,956 documents in all. However the SIS is not consulted with every entry into the EU.

So the headline 3.4m over Europe, the 2000s decade, would be a floor rather than ceiling. Another remarkable pointer in the article:

The report, entitled Report on Security norms for Diplomatic Posts, lists numerous European embassies and consulates that were robbed around the turn of the century by Eastern and Central European "crime syndicates", bagging large numbers of passports and visa stickers in the process.The gangs "occasionally used extreme violence" to gain access to the "poorly secured" diplomatic posts, the report states. The gangster were privy to "know-how and techniques used by former intelligence agencies". Netherlands, Spain, Austria and Portugal ... Vienna, Geneva, Lausanne, Brussels and other locations. The crime spree was kept under wraps at the time, but the thefts were recently confirmed by the foreign ministry at NRC Handelsblad's request.

Which would point the finger at organised crime. Which means it is serious, it is working, it is making money, and it isn't going away. Add to that observation the above 3 million profit number, and now we something serious: That's a trend we can rely upon .

Who are likely customers? The report lists the usual grab-bag of scumbags & losers such as "criminals, human traffickers and illegal asylum seekers," terrorist(s):

Stolen Belgian passports were used by Abdessatar Dahmane and an accomplice in September 2001 to pose as journalists and gain access to Ahmed Shah Massoud, the leader of Afghanistan's Northern Alliance, and kill him in a suicide bombing.

And this odd one:

Brazilian football star Leonardo Santiago was caught red-handed in 2000 when his Portuguese passport proved to be a fake. The 17-year-old darling of Rotterdam's Feyenoord team had thus been able to circumvent the strict regulations that apply to all non EU-citizens playing for European football clubs.The story is by no means unique in European football. In recent years, law enforcement officials in France, Italy and Spain have caught dozens of 'Leonardos', playing for clubs like Inter Milan, Lazio Roma, AS Monaco and Saint-Etienne.

Shouldn't that be "caught red-footed" ? Joking aside, what exactly is the harm here?

Teams and players alike benefited from the fraudulent documents. In France and Italy, regulations only allow clubs to field a limited number of non-EU players. In the Netherlands, the same foreign nationals can only be signed if they are paid at least 503,000 euros annually.

Exactly. One presumes there is no serious cost to society to fielding a footballer of the wrong colour in a game. Lumping mass entertainment in with serious crime is a misuse of police resources, and we'd rather they be chasing those real criminals mentioned earlier, and now here:

|

| Police in Dubai have issued arrest warrants for 11 suspects they want to question about the killing of a senior Hamas official in Dubai. The suspects include six men travelling on false British passports. |

|

October 16, 2009

Chip & pin fallacies

We often print numbers reported in the press and other places, because sometimes these are useful for dealing with the fantasies and fallacies common in this world. I wish they were more used! Stephen Mason and Roger Porkess have just published an article full of such numbers on British chip&pin, and done in a fairly scientific survey fashion:

The findingsForty-six respondents had been contacted by their banks, many of them several times. Most of the transactions had in fact been authorised, but 11 of the 46 people had been contacted about unauthorised transactions. Of the 11 with unauthorised transactions, three could explain them as security lapses (typically losing the card) but nine could not (one person was in both categories).

The survey then went on to ask about unauthorised withdrawals; these cases had not been detected by the banks' detection software. Twenty-one people had had unauthorised withdrawals. Of these nine people could explain them as security lapses and 13 could not (again one person was in both categories).

What this article lays to rest is whether there is any possibility of fraud and breach of the security in the Chip & pin system. Clearly yes: depending on how you view the numbers, the possibility of a person experiencing an "unexplainable" breach is between a lower bound of 6% and an upper bound of 20%.

The total of 29 unexplained attacks were reported by 16 individuals from the 80 respondents. This would suggest a probability of one in five, that a randomly selected individual has experienced an attack.There are two problems with this estimate. If all those who did not return the questionnaire had nothing to report, the probability would reduce to about one in 16. More importantly, the claimant is not a randomly selected individual but one of a very small group of people involved in such cases. However, the importance of this probability is not its actual value, but that it is not zero. Such attacks can happen, and so it is entirely possible that the claimant is telling the truth.

That is a stunning amount of fraud. Another observation made by the article is how efficacious are the bank's systems. Working backwards from the respondents' numbers, it is suggested that:

These figures show that the banks take measures to detect unauthorised transactions, but that their processes are still not very effective. They suggest that only about half of unauthorised transactions are detected in advance; however, to achieve even that level of success, a large number of transactions are investigated, about 90% of which are authorised.That the banks are prepared to bear the considerable costs that are involved in the process of carrying out checks in this manner could be taken as an indication that they recognise that a security problem exists.

What is the point of all this? It is because of a rather stunning observation made in a court in a recent case:

In his judgment, Judge Inglis stated, at [20]: "...that the absence of a history of successful fraudulent attacks on online chip and PIN transactions, and the absence of any evidence of systems failure, as showing that these were transactions that can be taken at face value...are important pieces of evidence from which it is open to the court to draw the inference that these were transactions that took place using Mr Job's card and his PIN."

The authors suggest this as a case of the Prosecutor's fallacy: whether the event happened or not is the same question as whether the person holding the card is innocent or not. I'm not sure I quite follow what this means, but it seems to mean that there is a presumption being made that if the event happened, the cardholder was responsible. But, there are other possibilities:

A thief has stolen the money from the bank following a breach of the card's security.A thief has stolen the money without a breach of the card's security.

The claimant is making a dishonest claim.

The bank has made an error.

And this is what the survey attempts to predict. So the bank in question, Halifax, successfully made the case that there was nothing in wrong with the security of their systems. If there was a fraud, it was caused by the cardholder, in some way or other.

I've worked in this field for a bank, doing smart card work, and I can offer the following observation. During my time there, a stunning piece of open academic work swept through the crypto world and destroyed the "perfect security" belief in the bank's systems. Yet, the bank did not respond, at all. I investigated this, and discovered that there were in fact two beliefs. The bank on the whole believed there was perfect security, but the core security team knew it was not true (and indeed knew about the research for some 5-10 years).

There was cognitive dissonance between a small core group of experts, and the wider bank. Every conversation between the two groups was characterised by careful choice of wordings to allow the beliefs to co-exist in harmony. So consequently, although the academic work was on the face of it highly threatening, it achieved nothing. The two beliefs separated briefly in the face of this evidence, then bypassed it, one each side, and rejoined on the other side. Harmony was restored.

So I would say that the Halifax believes its systems secure, and was able to present enough evidence or absence of evidence to sway the court. However the trick of asking the right person in the Halifax was probably not tried (and of course this is quite problematic, because you need to know who it is, and how to get them to open up, *and* get them to court). We in the security field know that there is a lot of fraud there in chip & pin, but it is only with serious evidence at hand -- this survey for example -- that we can start to attack the castle of convenient beliefs.

Another curious thought of mine: Chip&pin is more risky than cash! In fact, I'm trying to think when was the last time I heard of someone being robbed of cash. I don't mean the Swedish helicopter heist of September, I mean pick-pockets, muggings, etc. So far, I'm thinking zero risk, but maybe that's just cognitive dissonance?

October 01, 2009

Man-in-the-Browser goes to court

Stephen Mason reports that MITB is in court:

A gang of internet fraudsters used a sophisticated virus to con members of the public into parting with their banking details and stealing £600,000, a court heard today.Once the 'malicious software' had infected their computers, it waited until users logged on to their accounts, checked there was enough money in them and then insinuated itself into cash transfer procedures.

(also on El Reg.) This breaches the 2-factor authentication system commonly in use because it (a) controls the user's PC, and (b) the authentication scheme that was commonly pushed out over the last decade or so only authenticates the user, not the transaction. So as the trojan now controls the PC, it is the user. And the real user happily authenticates itself, and the trojan, and the trojan's transactions, and even lies about it!

Numbers, more than ordinarily reliable because they have been heard in court:

'In fact as a result of this Trojan virus fraud very many people - 138 customers - were affected in this way with some £600,000 being fraudulently transferred.'Some of that money, £140,000, was recouped by NatWest after they became aware of this scam.'

This is called Man-in-the-browser, which is a subtle reference to the SSL's vaunted protection against Man-in-the-middle. Unfortunately several things went wrong in this area of security: Adi's 3rd law of security says the attacker always bypasses; one of my unnumbered aphorisms has it that the node is always the threat, never the wire, and finally, the extraordinary success of SSL in the mindspace war blocked any attempts to fix the essential problems. SSL is so secure that nobody dare challenge browser security.

The MITB was first reported in March 2006 and sent a wave of fear through the leading European banks. If customers lost trust in the online banking, this would turn their support / branch employment numbers on their heads. So they rapidly (for banks) developed a counter-attack by moving their confirmation process over to the SMS channel of users' phones. The Man-in-the-browser cannot leap across that air-gap, and the MITB is more or less defeated.

European banks tend to be proactive when it comes to security, and hence their losses are miniscule. Reported recently was something like €400k for a smaller country (7 million?) for an entire year for all banks. This one case in the UK is double that, reflecting that British banks and USA banks are reactive to security. Although they knew about it, they ignored it.

This could be called the "prove-it" school of security, and it has merit. As we saw with SSL, there never really was much of a threat on the wire; and when it came to the node, we were pretty much defenceless (although a lot of that comes down to one factor: Microsoft Windows). So when faced with FUD from the crypto / security industry, it is very very hard to separate real dangers from made up ones. I felt it was serious; others thought I was spreading FUD! Hence Philipp Güring's paper Concepts against Man-in-the-Browser Attacks, and the episode formed fascinating evidence for the market for silver bullets. The concept is now proven right in practice, but it didn't turn out how we predicted.

What is also interesting is that we now have a good cycle timeline: March 2006 is when the threat first crossed our radars. September 2009 it is in the British courts.

Postscript. More numbers from today's MITB:

A next-generation Trojan recently discovered pilfering online bank accounts around the world kicks it up a notch by avoiding any behavior that would trigger a fraud alert and forging the victim's bank statement to cover its tracks.The so-called URLZone Trojan doesn't just dupe users into giving up their online banking credentials like most banking Trojans do: Instead, it calls back to its command and control server for specific instructions on exactly how much to steal from the victim's bank account without raising any suspicion, and to which money mule account to send it the money. Then it forges the victim's on-screen bank statements so the person and bank don't see the unauthorized transaction.

Researchers from Finjan found the sophisticated attack, in which the cybercriminals stole around 200,000 euro per day during a period of 22 days in August from several online European bank customers, many of whom were based in Germany....

"The Trojan was smart enough to be able to look at the [victim's] bank balance," says Yuval Ben-Itzhak, CTO of Finjan... Finjan found the attackers had lured about 90,000 potential victims to their sites, and successfully infected about 6,400 of them. ...URLZone ensures the transactions are subtle: "The balance must be positive, and they set a minimum and maximum amount" based on the victim's balance, Ben-Itzhak says. That ensures the bank's anti-fraud system doesn't trigger an alert, he says.

And the malware is making the decisions -- and alterations to the bank statement -- in real time, he says. In one case, the attackers stole 8,576 euro, but the Trojan forged a screen that showed the transferred amount as 53.94 euro. The only way the victim would discover the discrepancy is if he logged into his account from an uninfected machine.

September 04, 2009

Numbers: CAPTCHAs and Suicide Bombers

Two hard numbers effecting the attack model. The cost of attacking a CAPTCHA system with people in developing regions, from the Economist's report on the state of the CAPTCHA nation:

Two hard numbers effecting the attack model. The cost of attacking a CAPTCHA system with people in developing regions, from the Economist's report on the state of the CAPTCHA nation:

The biggest flaw with all CAPTCHA systems is that they are, by definition, susceptible to attack by humans who are paid to solve them. Teams of people based in developing countries can be hired online for $3 per 1,000 CAPTCHAs solved. Several forums exist both to offer such services and parcel out jobs. But not all attackers are willing to pay even this small sum; whether it is worth doing so depends on how much revenue their activities bring in. “If the benefit a spammer is getting from obtaining an e-mail account is less than $3 per 1,000, then CAPTCHA is doing a perfect job,” says Dr von Ahn.

And here, outside our normal programme, is news from RAH that people pay for the privilege of being a suicide bomber:

A second analysis with Palantir uncovered more details of the Syrian networks, including profiles of their top coordinators, which led analysts to conclude there wasn't one Syrian network, but many. Analysts identified key facilitators, how much they charged people who wanted to become suicide bombers, and where many of the fighters came from. Fighters from Saudi Arabia, for example, paid the most -- $1,088 -- for the opportunity to become suicide bombers.

It's important to examine security models remote to our own, because it it gives us neutral lessons on how the economics effects the result. An odd comparison there, that number $1088 is about the value required to acquire a good-but-false set of identity documents.

June 21, 2009

Cost of your PC

Some prices on how much it costs to rent your PC, if infected:

Prices vary greatly. Finjan said in Australia 1,000 infections have been sold for $100, while the same number can be picked up for as little as $5 in other countries, but mainly in the Far East.

Although it doesn't say it, your PC is for rent in batches only if it is a Windows machine. Apples Macs are a bit tougher, although their market share must one day get to the point where they justify more attention:

As TrendLabs' technical communications specialist Det Caraig points out in his research note on the attacks, Apple users are still far less likely to have their endpoints owned than their Microsoft Windows using peers. However, as proven over the last year in particular, Apple's growing PC market share has driven a subsequent upswell in the numbers of threats being created to target its OS.

That day may be here soon. Note that the (2) threats mentioned above are based on the user downloading and installing dodgy software. That's generally considered not to be something that Apple Macs or Microsoft can protect a user against. A market-share comment only, not a security-share comment.

Fans for either camp will twist the words whichever way. For my money, the #1 security tip -- buy a Mac -- is still intact.

February 04, 2009

The un-internalised cost of your data breach

Adam points to a report by Ponemon Institute and old friends PGP Inc on data breaches.

Adam points to a report by Ponemon Institute and old friends PGP Inc on data breaches.

data breach incidents cost U.S. companies $202 per compromised customer record in 2008, compared to $197 in 2007. Within that number, the largest cost increase in 2008 concerns lost business created by abnormal churn, meaning turnover of customers. Since the study’s inception in 2005, this cost component has grown by more than $64 on a per victim basis, nearly a 40% increase.

Frequent readers of this blog will recall that I often post numbers of the average end-user cost of events like phishing. The number is about $1000.

Ignoring the obviously simplistic scientific process here, or better yet, leaving it to someone more scientific ... there is a huge difference between $200 and $1000.

We can take several views on this:

- a "caveat emptor view" has the user taking all the costs, because in libertarian economies, the user takes the responsibility for their choices. The responsible libertarian purchases PGP, of course.

- a "switching view" would have it that the only kick-back to the company is when a smaller proportion of the users switch to other providers, thus causing lessons of pain. This "churn view" is where the Ponemon report suggests the market is.

- the "risk sharing view" would have it that the user pays a smaller but still painful part. Call it 20%, or the opposite of what we see above. This should put the user firmly in the security protocol, and address any risks that the user is lax, but puts the onus on the business to provide the right tools.

- the "insurance view" is that the user pays the first $50 such as happens in credit card purchases. This more or less fixes the user's part in the protocol to little things like "don't lose the card" and passes the rest across to the company.