December 03, 2010

A small amount of Evidence. (In which, the end of banking and the rise of markets is suggested.)

In the last couple of weeks I posted a thesis on what caused the global financial crisis. In technical terms it is the invention and usage of securitization, a.k.a., the market for mortgage-backed securities. In economic and policy terms, it is the shift from banking to markets .

It sounds too simple to be true, but I'll stick to my guns. So, how to show this? Scientifically this is a difficult one to show. Instead, I'll just do this: make observations on big things happening, and interpret them from the theory.

Let's look at the EU who are currently dealing with Ireland. Here's the Economist summary:

The decision by finance ministers in the EURO ZONE to create a European Stabilisation Mechanism as a permanent system for resolving future sovereign-debt difficulties did little to soothe markets, at least at first. The mechanism distinguishes a "solvency" crisis from a "liquidity" one, with bondholders in insolvent countries expected to take the brunt of losses, but does not come into force until 2013. However, markets were encouraged by a hint of more immediate help from the European Central Bank. Jean-Claude Trichet, the ECB's president, advised that people were "tending to underestimate the determination" in Europe to solve the debt crisis. - See article

What does that tell us? Well, the EU went in with a big fat cheque book and acted as lender of last resort, one of the primary functions of central banks. They bailed out Ireland (the country, the banks, the economy, whichever). And the markets weren't impressed.

Europe's policymakers are crying foul. "The speculation on international financial markets can't be explained rationally at all," declared Wolfgang Schäuble, Germany's finance minister.

It's entirely rational: lender of last resort is appropriate to banking, but not appropriate to markets. The markets themselves have figured out the first part, the politicians, not.

(OK, so this skims past the second part, how to deal with markets, and all the pointed questions of what EU should do right now; and how to get themselves out of the mess -- see the article for more on that. I'm simply concentrating on the core, underlying, fundamental systemic cause of failure. Without understanding that, there is no foundation in discussing policy or rescue prescriptions.)

Let's now turn to the USA. There, the highly successful Federal Reserve has now revealed more details about how it managed the crisis:

The numbers are staggering, encompassing more than a dozen emergency programs set up starting in 2007 or 2008. In one program alone the Fed doled out nearly $9 trillion in funds to borrowers such as Morgan Stanley and Merrill Lynch, largely at interest rates below 1 percent. (This program involved overnight loans, so the amount of Fed credit outstanding at any single point in time was much smaller.)Other programs, with longer-term loans also measured in the trillions of dollars.

The Fed actions were just part of a larger array of government bailouts for the financial industry, which were deeply unpopular with most Americans. Rescue programs run outside the Fed included insurance-style backstops for bank debts and the investments from the Treasury's $700 billion TARP (Troubled Asset Relief Program).

In contrast to the EU, the Fed went to town, bought everything ... and is now able to sell it all back:

At the same time, it's possible that the release of details will end up largely vindicating the Fed for the massive financial support that it gave the economy at a time of severe stress. The emergency loans, in the view of many finance experts, helped to avert a much deeper economic slump. And those loans have now been largely paid back without losses to the central bank.

The Fed therefore scores top points as lender of last resort, and the obvious complaint is that the EU isn't spending enough. However, there is a rider or caveat on that:

"My view is that the Fed has done an excellent job since the crisis started, but they didn't do a very good job before the crisis started," says Pete Kyle, a finance expert at the University of Maryland. He says the central bank, as a key financial regulator, should have ensured that US banks had plenty of capital on hand to weather a storm.Some other economists echo that view, arguing that the Fed and other bank regulators should have done much more to safeguard against a surge in high-risk mortgage lending during the years leading up to the crisis, at a time when US home prices were soaring.

Once a crisis is under way, however, the standard view among economists is that a central bank should act as a "lender of last resort," providing credit as freely as possible to prevent widespread bank failures at a time when ordinary investors are in a panic.

When people resort to language like "the standard view" we know something's wrong. The economists are wobbling: they know the standard view, they see the lender of last resort is facing bankrupcy under its own rules, and they're feeling quite bad and conflicted about it.

Whatever is happening to the skepticism of the markets and the economists, this still doesn't tell the ordinary people what went wrong. We're so used to conflicting signals from economists and markets, we'll discount them all without a second thought.

Let's get a little bit more haptic. Let's reach in and touch the problem. Here it is:

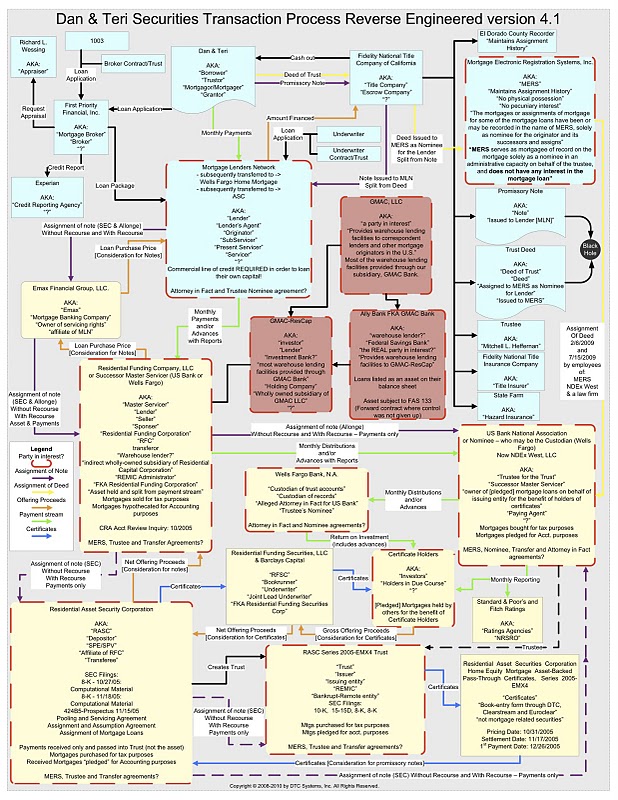

Dan Edstrom is a guy who is in the right place at the right time. His profession? He performs securitization audits (Reverse Engineering and Failure Analysis) for a company called DTC-Systems.The typical audit includes numerous [stuff, snipped]. The following flow chart reverse engineers the mortgage on the Ekstrom family residence. It took Dan over one year to take it this far and it clearly demonstrates what happens when there are too many lawyers being manufactured.

Dan went in and documented the mortgage on his house. Think of this as who owns Dan and Teri's house? or from an accountant's pov, who owns the cash flow?

Do you understand it? Of course not. Be not ashamed, the real point is, nobody else understands it either, and that includes the banks.

When the banks found themselves masters of the mortgage-backed securities market, they were holding onto a poisoned chalice. The value that was released in this method was immense: the entire risk premium of banking was delivered into their hands within days, but in exchange for selling off the banking risk, they took on a complexity risk as graphically suggested in that above diagram (or tabulated by ProPublica).

The first premium was large enough to overshadow the second negative premium; can you say appetite for risk? What inevitably occurred was a ponzi-like feeding frenzy on mortgage-backed securities, while complexity created a powder keg with a slow-burn fuse under the castle.

Quite how the spark gradually ate its way along the slow-burn fuse to the powder keg within is a fascinating subject, and one that many will discuss. Many causes and effects within. However, the key issue is this: switching from long term loans to the mortgage-backed securities market, a.k.a. securitization not loans, was the crux.

Now, if we see that, and we recognise there is no turning back, then the big question is, how are the central bankers going to deal with the shift from banking to markets ?

- What banking is. (Essential for predicting the end of finance as we know it.)

- What caused the financial crisis. (Laying bare the end of banking.)

- A small amount of Evidence. (In which, the end of banking and the rise of markets is suggested.)

- Mervyn King calls us to the Old Lady's deathbed?

- (Introducing the death of the partner and the central bank as turbocharger as 2 new causes)

I had gone back yesterday and was reading "Two Trillion Dollar Meltdown"

http://www.amazon.com/Two-Trillion-Dollar-Meltdown-Rollers/dp/B002CMLQVQ/ref=sr_1_1?ie=UTF8&qid=1291471717&sr=8-1

from early '2009 ... Kindle edition is only $2.88 ....

and theme is quite complimentary (with quite a bit more detail) to above (even tho it didn't have details of how much money FED has been pumping in).

Posted by: Lynn Wheeler at December 4, 2010 09:14 AMsome other detail ...

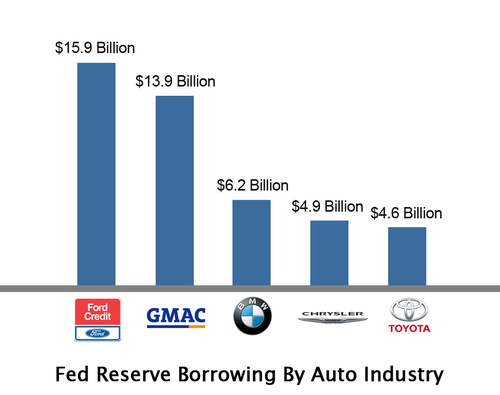

Ford, BMW, Toyota Took Secret Government Money

http://jalopnik.com/5704575/

The designed use of securitization was for the effective transfer of cashflows from loans to investors. This design was breached in that the bonus paid to the originator of the loan and the securitization package became so great and bifurcated within the institutions that they purchased their own packages to float their bonuses along with fluffy the mark to market pricing of those securities. There was a considerable amount of effort in getting the first lost traunche holder i.e. the equity traunche so that these deals could be be floated in many cases the equity traunche holders where offer rates of return close to 30% per year with the expectation of taking a loss within 5 years due to the short fall in the securitization packages collection on the debts. If one had the representations offered to the equity traunche then one would known the lack of quality in the loans used to securitize. These offerings where private and the resulting securitizations where both public and private without the buyers of the other traunches having knowledge of the equity traunche insider risk assessments.

Posted by: Jim Nesfield at December 5, 2010 11:07 AMtwo trillion meltdown book went into lots of the slight of hand that was rampant contributing to the whole mess ... from fudging the numbers that complex calculations were done on (i.e. past references to the inputs were fiddled until the business people got the outputs they wanted) to fake trades between institutions to maintain the mark-to-market valuations. it also went thru how some of the leveraging was actually around to 100:1 ... when slight of hand being represented as 10 or 20 to one.

other tidbits ... was toxic CDOs that were going for 22cents on the dollar ... the FED started buying at 98cents on the dollar; 20% of loans had been unregulated ... but had grown to 80% by 2006.

book sort of ended with recommendation to create barrier around regulated depository institutions (at least glass-steagall) ... and let all the rest live or die.

trivia ... car companies in order to write loans had to have chartered bank ... either a national charter that comes under FDIC or 50 state charters, with a different one for every state. there was a loop-hole with ILCs, mostly from Utah ... that were allowed to operate ... BMW is in the follow list:

http://en.wikipedia.org/wiki/Industrial_loan_company

....

But there is also a big negative. The banks' margins were driven down in the 1990s and early 2000s by competition from new lenders, who derived much of their funding from securitisation: selling bundles of our mortgages to investors, and reinvesting the proceeds in new loans.

The global financial crisis began when this market was poisoned by American banks filling their securitised bundles with bad mortgages. As they went bad, the market for securitisation collapsed - even for Australian lenders, whose bundles remain good. And as it collapsed, so did the new lenders.

The big banks swooped, bought up their weakened rivals, and regained their lost market power. The four big banks now hold 80 per cent of all loans. The other banks have 17 per cent, and all credit unions and building societies, just 3 per cent. They're to be our fifth pillar? This will be a long wait.

We got here partly because the GFC wiped out securitisation and the new lenders, but also because in good times and bad, governments and competition regulators have allowed the big banks to gobble up their rivals.

Posted by: TheAge on the Aussie experience... at December 14, 2010 06:12 AM