July 30, 2013

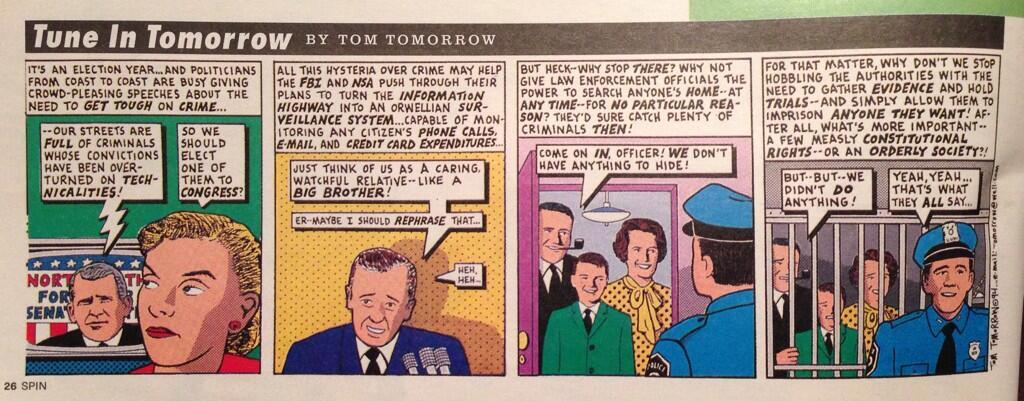

The NSA is lying again -- how STOOPID are we?

In the on-going tits-for-tat between the White House and the world (Western cyberwarriors versus Chinese cyberspies; Obama and will-he-won't he scramble his forces to intercept a 29 year old hacker who is-flying-isn't-flying; the ongoing search for the undeniable Iranian cassus belli, the secret cells in Apple and Google that are too secret to be found but no longer secret enough to be denied), and one does wonder...

Who can we believe on anything? Here's a data point. This must be the loudest YOU-ARE-STOOPID response I have ever seen from a government agency to its own populace:

The National Security Agency lacks the technology to conduct a keyword search of its employees’ emails, even as it collects data on every U.S. phone call and monitors online communications of suspected terrorists, according to NSA’s freedom of information officer.“There’s no central method to search an email at this time with the way our records are set up, unfortunately,” Cindy Blacker told a reporter at the nonprofit news website ProPublica.

Ms. Blacker said the agency’s email system is “a little antiquated and archaic,” the website reported Tuesday.

One word: counterintelligence. The NSA is a spy agency. It has a department that is mandated to look at all its people for deviation from the cause. I don't know what it's called, but more than likely there are actually several departments with this brief. And they can definately read your email. In bulk, in minutiae, and in ways we civilians can't even conceive.

It is standard practice at most large organizations — not to mention a standard feature of most commercially available email systems — to be able to do bulk searches of employees’ email as part of internal investigations, discovery in legal cases or compliance exercises.

The claim that the NSA cannot look at its own email system is either a) a declaration of materially aiding the enemy by not completing its necessary and understood role of counterintelligence (in which case it should be tried in a military court, being wartime, right?), or b) a downright lie to a stupid public.

I'm inclined to think it's the second (which leaves a fascinating panopoly of civilian charges). In which case, one wonders just how STOOPID the people governing the NSA are? Here's another data point:

The numbers tell the story — in votes and dollars. On Wednesday, the House voted 217 to 205 not to rein in the NSA’s phone-spying dragnet. It turns out that those 217 “no” voters received twice as much campaign financing from the defense and intelligence industry as the 205 “yes” voters..... House members who voted to continue the massive phone-call-metadata spy program, on average, raked in 122 percent more money from defense contractors than those who voted to dismantle it.

.... Lawmakers who voted to continue the NSA dragnet-surveillance program averaged $41,635 from the pot, whereas House members who voted to repeal authority averaged $18,765.

So one must revise ones opinion lightly in the face of overwhelming financial evidence: Members of Congress are financially savvy, anything but stupid.

Which makes the voting public...

July 28, 2013

I’m Still Waiting for My Phone to Become My Wallet

From the humour department, and for those of us who remember the hype of the 1990s over payments, this article from Jenna Wortham is hilarious:

From the humour department, and for those of us who remember the hype of the 1990s over payments, this article from Jenna Wortham is hilarious:

I’m Still Waiting for My Phone to Become My WalletDURING the sweltering heat wave earlier this month, it seemed too hot to wear much, carry much or do much of anything at all. Every time I left the house, I tried to figure out where to stuff my bulky wallet. I always had room for my iPhone, even if it meant carrying it in my hand. But the wallet was one thing too many.

A truly mobile wallet — one that would let you easily pay for restaurant meals, subway rides or beers at a bar with a quick wave of your cellphone — has long been described as imminent. But it remains elusive. Some innovations have begun to bridge the gap, but most have been a disappointment or have not yet worked well enough for mainstream adoption.

...

July 05, 2013

FC2014 in Barbados 3-7 March

Financial Cryptography and Data Security 2014

Eighteenth International Conference

March 3–7, 2014

Accra Beach Hotel & Spa

Barbados

Financial Cryptography and Data Security is a major international forum for research, advanced development, education, exploration, and debate regarding information assurance, with a specific focus on financial, economic and commercial transaction security. Original works focusing on securing commercial transactions and systems are solicited; fundamental as well as applied real-world deployments on all aspects surrounding commerce security are of interest. Submissions need not be exclusively concerned with cryptography. Systems security, economic or financial modeling, and, more generally, inter-disciplinary efforts are particularly encouraged.

Topics of interests include, but are not limited to:

Anonymity and Privacy

Applications of Game Theory to Security

Auctions and Audits

Authentication and Identification

Behavioral Aspects of Security and Privacy

Biometrics

Certification and Authorization

Cloud Computing Security

Commercial Cryptographic Applications

Contactless Payment and Ticketing Systems

Data Outsourcing Security

Digital Rights Management

Digital Cash and Payment Systems

Economics of Security and Privacy

Electronic Crime and Underground-Market Economics

Electronic Commerce Security

Fraud Detection

Identity Theft

Legal and Regulatory Issues

Microfinance and Micropayments

Mobile Devices and Applications Security and Privacy

Phishing and Social Engineering

Reputation Systems

Risk Assessment and Management

Secure Banking and Financial Web Services

Smartcards, Secure Tokens and Secure Hardware

Smart Grid Security and Privacy

Social Networks Security and Privacy

Trust Management

Usability and Security

Virtual Goods and Virtual Economies

Voting Systems

Web Security

Important Dates

Workshop Proposal Submission July 31, 2013

Workshop Proposal Notification August 20, 2013

Paper Submission October 25, 2013, 23:59 UTC

(19:59 EDT, 16:59 PDT) -- FIRM DEADLINE, NO EXTENSIONS WILL BE GRANTED

Paper Notification December 15, 2013

Final Papers January 31, 2014

Poster and Panel Submission January 8, 2014

Poster and Panel Notification January 15, 2014

Conference March 3-7, 2014

[ snip ... more at CFP ]

July 01, 2013

Why I am a fan of Alan Greenspan, still.

In comments to the last post, Glyph poses a hard question:

I'm curious: why, at this point, would you be a fan of Alan Greenspan?He's the epitome of everything that went wrong with our financial system: a demagogue who substituted ideology for critical thought. He spoke as if he were an entrepreneur who understood the creation of real wealth by use of the free market, but whose real power and influence came from being a bureaucrat with the keys to the largest fiat money machine in the history of mankind.

...

A simple answer is found in rephrasing the question -- what is the alternative?

Let me expand on that. I'm not a fan of Central Banking, as many readers will know from my frequent posts. I see Central Banking as inevitably enslaved to the banks, the regulated consumes the regulator (something known in economic literature as the Stigler Conjecture).

But the realpolitik of the 20th century was that Central Banking was the structure of finance. Granted, that we have a central bank, who then is best to lead it?

In the trade, knowledge of monetary policy would probably stand out as the first and highest metric. But, also known as important to Central Banking is the quality of "independence".

Alan Greenspan was a notorious goldbug who became a boutique investment banker. He retained his suspicion of all fiat currencies until the end, and it is this skepticism of Central Banking that established his credentials as an independent thinker. In my book, picking someone who was already suspicious of Central Banking was probably an inspired choice, and this is borne out by his incredibly long career.

If we look for example at Mark Carney, the current most-talked about Central Banker who last month took post at the Bank of England, we see something of the same flavour. He is suspicious of banks by nature, as well as having been a banker with Goldman-Sachs. As I hear it, his time in Canadian public service was marked by keeping the banks on a tight leash, while those south of the border ran roughshod.

To paraphrase the above, Mark Carney thus represents a least bad choice among many worse choices. Need we present examples of the worse choices?

The fundamental problem is still the failure of Central Banking, and its history of protecting the TBTFs and allowing them to bring the system down.

It would be far better if we as a society and economy could ease away from Central Banking, TBTF and all that, but that is likely to take decades. In the meantime, who better to lead Central Banks than people naturally suspicious of banks?