October 31, 2011

_Currency Wars_

If you want some view on the future, James Turk reviews a new book: Currency Wars, by Jim Rickards:

If you want some view on the future, James Turk reviews a new book: Currency Wars, by Jim Rickards:

.... the first part being almost surreal because it reads more like a novel than non-fiction. It details Rickards’ participation in an exercise at the Warfare Analysis Laboratory near Washington D.C. This group is one of the Defense Department’s leading venues for war games and strategic planning, but in a first-ever event, the game in which Rickards joined was not a war-fighting simulation. Rather, several dozen people from the military, academic and intelligence communities fought a global financial war using currencies and capital markets to support national interests. Rickards and two colleagues were invited to give the simulation some real-world, Wall Street expertise about markets, which they certainly did.I guarantee that when you start reading this part, you won’t put the book down until you learn the outcome of the war. It reads better than a suspense novel, even though the ending is somewhat anti-climactic and predictable. While I won’t spoil it for you by divulging the ending, I will note that gold has a big role to play. In fact, gold reappears throughout the whole book.

In the second section, Rickards analyzes the first two currency wars (CWI and CWII). ...

From the "you read it here first" department:

The final section of the book explains why the world is now fighting Currency War III, which Rickards believes began in 2010. He speculates that there are three possible outcomes from CWIII – paper, gold or chaos. Each of these alternatives is analyzed in detail, providing readers with much food for thought.

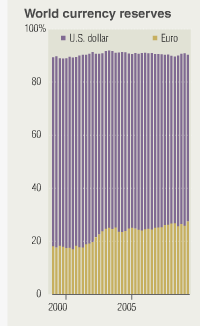

Actually, the scenes of this war go back to the issuance of the Euro as a credible alternative, and play their part in the great Financial Crisis of the 21st century. For confirmation of the thesis, Goldmoney's blog also pointed at The Real Contagion Risk which makes the same point: watch for the Central Banks to shift out of US Treasuries:

Step 1: As the global growth story frays, global trade decelerates, and the sovereign and total debt burdens of various countries drag at economic growth, fewer and fewer dollars will be accumulated and stored by various foreign central banks. The typical way dollars are stored is in the form of Treasury holdings. Because of this, several years of record-breaking Treasury accumulation by these foreign banks will grind to a halt and foreign Treasury holdings will begin to decline.

So what's our prediction? Well, it'll be a long slow decline from the dollar as reserve currency. The Euro looked good for a decade, but that's off it's shine now. Expect Central Banks to get back into the currency trading game -- and keep reserves of their bigger partners. And, the next shot in the war will be related to energy -- which is typically priced in dollars.

Gold? Well, everyone expects that to come up. James Turk says:

The harmful effects from abandoning gold still impair economic activity today because the necessary discipline has been removed from the monetary system, creating the global imbalances, debt loads, insolvent banks, risky derivatives and other problems that plague our world. So as economic activity sinks ever deeper into an abyss, think about the cause.

Yeah, and we used to say that governments should go back to the gold standard because we don't trust them with their own units.

Very proven true, no doubt, these days, but there has been a bit of a shift in thinking of late. For me, it was signalled by Alan Greenspan as far back as 1995 (?) when he said "nobody's listening any more." (In response to being asked why he didn't talk about gold anymore.) Fact is, governments will issue their own currencies, whether we trust them or not:

Namely, governments have created this mess, so we cannot rationally expect governments to get us out of it, which is something I have intuitively understood for some time but was also the main conclusion I reached from Rickards’ book.

And, the clanger is this: We don't trust governments, period. We don't trust them to issue their own inflation-protected currency, and we don't trust them to issue a gold-based unit either.

So, gold goes free. Economists are no longer advising governments to base off gold, because we know it won't work. Gold therefore will remain the independent watchdog it has since the closing of the gold window by Nixon; a three-way tussle between central bankers, gold banks and the buying public.

So, gold goes free. Economists are no longer advising governments to base off gold, because we know it won't work. Gold therefore will remain the independent watchdog it has since the closing of the gold window by Nixon; a three-way tussle between central bankers, gold banks and the buying public.

The future is a world of competitive currencies, USD, Euros, Yen, the Chinese unit ... and gold. With a very slow long decline of the power of the USD.

Disclosure: Author is long gold, and short fingernails.

Posted by iang at October 31, 2011 10:34 AM | TrackBackYou'll enjoy Jim Grant's Warm Thoughts on a Cold Metal, he calls gold the Wiki Central bank

http://www.grantspub.com/UserFiles/File/G28_WINTER(1).pdf

"We say we are bullish, but we have no idea where the price is going. And neither do you, whoever you are. The gold price, it has sometimes seemed to us, is the reciprocal of the world’s faith in the judgment of Ben S. Bernanke. The greater the trust, the lower the price, and vice versa. You would sup- pose, after all the blood, sweat and tears of the past three years, that the market would not trust the chairman of the Federal Open Market Committee fur- ther than it could throw him. "

Posted by: gunnar at October 31, 2011 02:35 PM> We don't trust them to issue their own inflation-protected currency,

> and we don't trust them to issue a gold-based unit either.

Classic.

> So, gold goes free. Economists are no longer advising governments

> to base off gold, because we know it won't work. Gold therefore

> will remain the independent watchdog it has since the closing of the

> gold window by Nixon; a three-way tussle between central bankers,

> gold banks and the buying public.

Probably just as well. Let private currencies take up the slack. The

best the government can do is stay out of the way (which is often asking

a lot).

> The future is a world of competitive currencies, USD, Euros, Yen,

> the Chinese unit ... and gold. With a very slow long decline of the

> power of the USD.

I know of at least one hedge fund manager who wants reports denominated

in gold. More importantly, the investors want it, because they view

gold as the best measure of real purchasing power. They don't care so

much about performance relative to the S&P, but relative to gold, yes.

@ Iang,

As you are aware I hold "energy" to be the base currency, as gold is by and large a usless rare commodity with limited intrinsic worth.

Further you are also aware from past conversations that I consider the "Financial Industry" (which includes the currency printers) to be one who's actual product is inflation. And because of this I distinguish between "financial wealth" of non finite currency and "real wealth" of the utility of finite tangable resources and goods.

However what I'm also aware of and tend not to talk about is "intangable wealth" of services, and IP where a manufactured item can be infinitly reproducable and "non-utility wealth" of the likes of gold and other scarce resources which can (and often are) black tulips.

However underlying them all is "work" to both accrue the wealth and to utilise it to transform raw materials or ideas into marketable goods or services. As such "work" is just an abstraction of energy.

Thus I would keep my eye on the essential resources of non finite energy and finite raw resources, and their efficient utilisation, which is the real measure of mankinds growth not the faux notion of an "economy" based on the growth of financial wealth at the expense of either non renewable or dificult to renew resources, expressed through a percieved value of a black tulip.

History tells us about what to expect with shortages of esential resources with the "water wars". This appears to be something that is lost on the short term minded Governments and investors of the majority of Western / First world countries but not to the longer term minded of China and some third world countries.

Which brings me around to the issue of future "resource wars" based around the control of energy and scarce resources. We can see that China is already putting significant limits on the use of rare earth metals. But what appears to have gone by most people is the "foreign aid" China has given to countries with exploitable raw resources that there is a reasonable chance for China to obtain significant control.

China's technique is nolonger the old "imperialist invade and conquer with force" of empire building, nor the short term "bribe an official" favoured by Western organisations. But a variation of "hearts and minds" with a hidden leash. China has supplied technology and manpower to build infrastructure, but it's all dual purpose. The hidden leash is that the Chinese manpower control the actual technology and effectivly become citizens with voting rights, but the technology it's self can only be controled by the Chinese because the spare parts and required knowledge only come from China. China gets the benifit of land for it's people who then over a couple of generations become the "elite classes" of proffessionals, within the nation that exist on the land, and dependance of the nation on China for energy and certain scarce manufactured items. China thus gets the raw resources for it's continued development, it also gets food etc for it's home population and at the same time effectivly locks out the Western Nations. China thus corrects what it sees as the "20th Century Aberrance" that saw it not being the worlds most powerfull nation.

As has been noted "The West's short term view, is sleep walking it, into a future conflict it cannot win and thus decline to insignificance of vasal status".

Oh and China is not the only nation playing this game keep an eye on what Russia is upto they are past masters of "war by proxie" and what we call "APT".

But ultimatly the power struggle will be about control of energy and the scarce resources behind it's generation. And the intermediate step on this is currently the ability to have independant nuclear generation capability (not weapons) to ensure energy independance. But China is a step ahead on controling the raw resources behind it...

By all means "go short on the fingernails" but I'd thing about going very long on something other than black tulips.

Posted by: Clive Robinson at November 2, 2011 08:28 AM@Clive - like the energy currency idea

Two quotes from Seth Klarman come to mind both from his book Margin of Safety (which you can buy on eBay for ~$2,000 or rent for about a $100 for a week)

1. "Trading Sardines and Eating Sardines: The Essence of Speculation

There is the old story about the market craze in sardine trading when the sardines disappeared from their traditional waters in Monterey, California. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines”."

2. “…value investing can work very well in an inflationary environment. If for fifty cents you buy a dollar of value in the form of an asset, such as natural resource properties or real estate, which increases in value with inflation, a fifty-cent investment today can result in the realization of value appreciably greater than one dollar.”

Goldmoney Research: Would it be possible and desirable for a country to transition to a free market in money – that is, one without government legal tender laws?

Nathan: Most countries have something like this already, at least informally. You can go to Honduras or Vietnam today and spend your US dollars at any shop or restaurant. Europe has had “eurodollars” for decades. It would be better if this was formally recognised, with no legal tender laws, fees or taxes on using whatever currency you like.

This is actually an important idea today, because we have to find some sort of way to transition from the dollar-centric world monetary system to whatever comes next – ideally a gold-based system. Unless the dollar itself gets a gold link, then there will have to be some sort of transition period from one to the other. During this transition period, I think it would be good to have the option to do business in whatever currency you like. Each person will be able to decide for themselves the timing of when they use one currency or another.

......

Posted by: Countries on multiple currencies.... (Goldmoney Research Interview) at November 5, 2011 04:11 AMIang,

With regards Seth Klarman and his book Margin of Safety, I did not realise people were paying those sort of "status symbol" prices for a book that sold for around 20GBP many years ago...

At that price I'm assuming people would be selling PDF's of it for a few bucks (then again as Seth is a "tangable asset" not "intangable asset" guy...).

However one thing I do know about Mr Klarman's organisations is they held (hold?) around a quater of a billion dollars worth of News Corp A & B shares. I wonder what the closure of the News of the World and the recent lamentable performance of James Murdoch in front of the House of Commons has done for his thinking on this holding. Especialy if as some pundits keep predicting some of the US Gov Three Letter Agencies start nosing around with intent to collect scalpes...

Oh by the way it's not just "energy as a currancy" it's the "efficiency of energy utilisation" as well as a measure of economic success.

But further to that the "efficiency of energy utilisation" is backed by real raw resources the control of which give them inordinately large real value.

Take for instance rare earth metals, their use can add more than a couple of percent to the efficiency figures on energy conversion systems, and are almost invaluable when it comes to some "green energy" solutions.

Many of these metals are rarer than hen's teeth and the Chinese currently have pretty much a monopoly on their production. Then look at the strings China is placing on access to these metals, I would say they are getting inordinate good value out of them, even before you start looking at the stratigic advantage of stealing away the manufacturing base and supposed Intelectual Property from US and other Western Markets...

Oh and the flip side the same rare earth metals are also essential to the production of high tech "smart weapons" and their delivery systems, so control on them limits the ability of dependent nations to wage conventional war...

The late Issac Asimov wrote a series of books known as the "Foundation Series" whilst being a good SiFi read it also had a few jems hidden away in their about value and markets.

I will have a hunt around and see if I can get a read of Seth Klarman's book, I know a couple of people who might just have a copy they might let me borrow as they have borrowed some of my rarer books.

Posted by: Clive Robinson at November 13, 2011 01:34 PMBloomberg interview with Rickards and Jim Grant

http://www.bloomberg.com/video/79944740/

Talks about the book and the financial wargame that Rickards did which is in the book

Posted by: Gunnar at November 14, 2011 10:42 PM