October 13, 2009

Hard(er) data on the big shift for the dollar

Following last week's post on the "sneak attack on the dollar," here is some harder news from today's Lynn'o'gram. From Forbes:

Steven Englander, chief U.S. currency strategist at Barclays ( BCS - news - people ) Capital says it is the culmination of what currency traders have feared for some time now. In the second quarter central banks put just 37% of assets into dollars. Typically, banks invest 70% of their assets in the greenback."No one wants to be caught holding too many dollars," Englander said, "and this rising reluctance is increasing pressure on the U.S. dollar." Englander noted that the second quarter was the only time that central banks have accumulated more than $100 billion of reserves in the quarter, and the dollar's share of this accumulate has been less than 40%.

He also noted that this period was also the only time the euro has accounted for more than 50% of the accumulation when central banks, in aggregate, have accumulated more than $80 billion. Furthermore, the yen's share of the increase in reserves was 12%, by far the highest incremental share since 2005. "The drop in aggregate reserves in the fourth quarter of 2008 and the first quarter of 2009 was almost all U.S. dollar, but the recovery has been primarily in non-U.S. dollar reserves," Englander said.

From Bloomberg and the "picture is worth a 1000 words" school:

From Bloomberg and the "picture is worth a 1000 words" school:

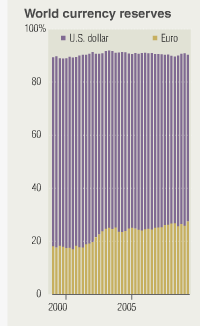

The CHART OF THE DAY shows the percentage of allocated world currency reserves in dollars has fallen as holdings in euros increased in the past decade, according to quarterly data compiled by the International Monetary Fund.

But you have to click and go there ... for the chart. It shows that euro reserve has risen from 18% to 29% over the last decade, meaning that dollar reserve has shrunk from 70% to 60%. Very approx, eyeball method. Elsewhere it says that chart covers 63% of the total reserves of central banks, as some reserves such as China's aren't reported.

In summary, it seems that most of the shift occurred around 2002 to 2003, but now there is a sudden leap in this last quarter.

“Global central banks are getting more serious about diversification, whereas in the past they used to just talk about it,” said Steven Englander,

Well, not quite all. The Europeans are still just talking:

The economies of both Japan and Europe depend on exports that get more expensive whenever the greenback slumps. European Central Bank President Jean-Claude Trichet said in Venice on Oct. 8 that U.S. policy makers’ preference for a strong dollar is “extremely important in the present circumstances.”

Here's an idea: why don't Japan and Europe trade with each other, and avoid the problem? Gosh.... Finally, to remind us that sentiment is an issue:

“People didn’t like the dollar in 1995,” said Taylor, whose firm has $9 billion under management. “That was very stupid and turned out to be wrong. Now, we are getting to the point that people’s attitude toward the dollar becomes ridiculously negative.”

To live contrarian, buy the dollar. Postscript from FC in 2006 for some old predictions of what this means:

Let's do the maths, so as to explain why this is significant. If we take the shift as from 60% to 50%, allowing euros to rise from 30% to 40%, then we see a relative shift in USD demand of say 20%. Call it over 2 years, and we can guess at a shift of 10% per year in the total international currency use of USD.If all countries are doing this - and there are good game theory, trade and geopolitical reasons to suspect this - then we see a massive washing around the world of some 10% of the USD during the space of a year. This will go on until we reach a new stability, a level which is anyone's guess at the moment

Just in case you're sacking your fundamentals analysts at the moment and need help...

Posted by iang at October 13, 2009 08:54 AM | TrackBack...or buy US companies that earn a majority of their revenue outside of the US. PG, Coca Cola, and 3M are examples of companies that earn the majority of their revenue in non-US currency.

Posted by: Gunnar at October 13, 2009 10:10 AM