November 01, 2009

Gold bullion market set to implode?

I don't normally follow the gold talk because on the one hand it is the goldbugs saying "gold is set to explode" and on the other is a bunch of bankers that insult the noble metal, while on the backside buying & selling it short, naked and happy as fast as they can. That is, the story never changes.

Which in some senses is good. There has always been an expectation that gold would survive. So far nothing has changed to keep that expectation solid, with gold at $1000 an ounce, up from around $250 8 or 9 years ago.

But there is another aspect beyond the price: the market itself. As it happens, this is founded on a thing called "good delivery" bars run by LBMA (London Bullion Market Association), London being the center of the physical gold trading world. This is a good efficient and simple system which works like this: once your gold is "in" the LBMA good delivery programme, you can reliably ship it to any one of the vaults that are in, and sell it within. Deliver it out of LBMA-territory, and your gold loses its status. To put it in, it has to be tested, at some cost.

So, most of the physical retail gold that is traded (in bars) is inside the LBMA system. It's just easier to buy and sell when someone guarantees it. Which brings me to the point: Obviously, the guarantee can be wrong.

About 10 years ago the debate of unreliable LBMA bars erupted in the digital gold community, and we discovered at that time that the gold is not routinely checked in any way once it is in the system (not this). At all! I predicted then that this would mean the gold would slowly lose its integrity, as insiders raided it sliver-by-sliver, over the many many decades of its operation. It looks like I was right, from this post that JPM sent:

C) In an Asian depository, they've found "Good Delivery" bricks that had been gutted and filled with tungsten.

And predictably, the writer goes on to report "B) A number of large interests have demanded audits of gold stored in London."

If you hold gold in the LBMA system, be worried. If you are an issuer of digital gold be very worried. Why? Because it looks like the gold markets are about to be tested. Not in price terms but in delivery terms. To summarise the long anti-markets rant by "marketskeptics" (a.k.a. Eric deCarbonnel):

If you hold gold in the LBMA system, be worried. If you are an issuer of digital gold be very worried. Why? Because it looks like the gold markets are about to be tested. Not in price terms but in delivery terms. To summarise the long anti-markets rant by "marketskeptics" (a.k.a. Eric deCarbonnel):

- Indians are shifting from buying gold jewellry to gold coins.

- China now actively promotes selling and holding of physical gold. That's the government, and every bank!

- Hong Kong and Dubai are pulling their physical gold out of London. German and Swiss investors and funds, likewise, and also demanding delivery out of the USA.

- There is now an overall trend to take physical delivery from metals facilities (vaults, exchanges, etc).

- Which has resulted in a rash of complaints ... which quickly become fingers pointed at possible collapse: delays, "complications", wrong bars, wrong weights, "restrictions", costs blossoming, etc.

- New York and Tokyo commodity exchanges are now permitting their gold futures contracts to be settled not in real metal but in shares of gold exchange-traded funds (ETFs)... NYSE-Liffe arbitrarily switched delivery of 1kg bars to ... notes on 1/3 interests in 100 ounce bars. If you can get three notes, you can take a 100 ounce!

- irregularities in bar amounts have surfaced at different places (e.g., Canadian Mint)

- Deutsche Bank may have recently closed out a gold shortage by buying it from the ECB and delivering it. Apparently, to the tune of 35.5 tons of gold, in one day! 12 days earlier someone shorted the same amount...

- gold banks (those big in the trade) are offering 25% over spot to settle in anything but physical gold.

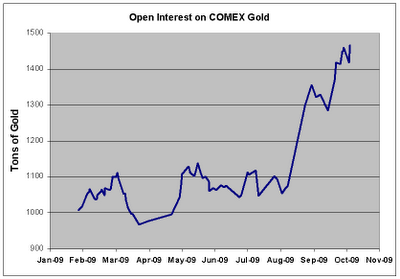

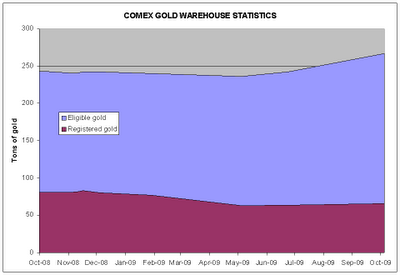

Have we got the message that physical gold now counts? If so, then one could wonder why open interest in gold trading on COMEX has since exploded? From August this year, it's jumped from a stable 1000-1100 tons band to around 1450. That's 40% up in a virtually traded commodity that is increasingly being demanded to convert to physical delivery! And, according to their reserves, it cannot be delivered: COMEX only holds 250t.

Have we got the message that physical gold now counts? If so, then one could wonder why open interest in gold trading on COMEX has since exploded? From August this year, it's jumped from a stable 1000-1100 tons band to around 1450. That's 40% up in a virtually traded commodity that is increasingly being demanded to convert to physical delivery! And, according to their reserves, it cannot be delivered: COMEX only holds 250t.

I wouldn't rule out a run on COMEX, and if so, it will likely collapse. That's because its reserves are a fraction of the open interest, so it looks highly vulnerable to being squeezed by the open traders (the "shorts") on one hand and the retail demands for physical delivery. Why won't the former deliver? Because for the most part they haven't got it; a short sale is generally a promise to acquire it when needed. In trading parlance, a lot more of the shorts are "naked shorts" which means they rely on a falling market (it's supposed to be illegal to be naked in a public trading, but a lot of markets look more like a nudist convention than a church meeting).

And we have a rising demand for physical, and a rising price in gold. So the squeeze happens this way: first the COMEX warehouse gets cleaned out. Then COMEX puts the squeeze on the short sellers to deliver their promise. Gold, physical, now. Which shorts then suddenly fold their cards, reveal their nakedness and declare mea culpa, I'm a nudist, so chase me. At some point, when enough of this goes on and is reported, the whole pyramid of cards collapses.

What's the likelihood of this happening? I feel it is being tested at the moment. It will probably take a rash of more bad financial news to make it happen, faster than we can react. E.g., a couple of months of CITs or European unemployment figures. But it is possible, because the gold markets have not been divorced from the decades of corruption that brought down the other markets. More likely we will see a gradual shift out of COMEX, out of London and across to other gold exchanges; preferably ones outside the western/toxic asset belt, and ones that can more easily prove their reserves. Meanwhile, those who hang on will lose value. Someone has to pay for the frauds of the past.

What's the likelihood of this happening? I feel it is being tested at the moment. It will probably take a rash of more bad financial news to make it happen, faster than we can react. E.g., a couple of months of CITs or European unemployment figures. But it is possible, because the gold markets have not been divorced from the decades of corruption that brought down the other markets. More likely we will see a gradual shift out of COMEX, out of London and across to other gold exchanges; preferably ones outside the western/toxic asset belt, and ones that can more easily prove their reserves. Meanwhile, those who hang on will lose value. Someone has to pay for the frauds of the past.

It's definitely not easy to predict when something will happen. But it is possible to point to fundamental and powerful contradictory forces. And that's the situation right now with the markets in gold, if that post is reliable (it might not be, it's from a goldbug, after all!). I would suggest that if people want to speculate in the gold of any form right now, hold physical only. The rest is ... too uncertain in value. That's beyond speculation, that's gambling, only do that if you really enjoy the thrill of losing bar-worths of value.

(Note: one thing I loosely follow is goldmoney's blogs and posts from founder James Turk. He's just announced that Turk's long-running newsletter is now migrated online only, and for free.)

Posted by iang at November 1, 2009 12:58 PM | TrackBack> > I don't normally follow the gold talk because on the one hand it is the

> > goldbugs saying "gold is set to explode" and on the other is a bunch of

> > bankers that insult the noble metal, while on the backside buying &

> > selling it short, naked and happy as fast as they can. That is, the

> > story never changes.

I'm always in the middle ground, that boring position which says that gold tends to maintain its purchasing power over the decades, centuries, and millenia. This is demonstrably true in spite of the "1980" canard which the gold-haters endlessly trot out, conveniently ignoring other years such as "1970" and "2000". And those who squawk "you can't eat gold" should promptly stuff their pie holes with $1 bills.

The USD, EUR, CHF, SEK, etc. are all figments of central bankers' imaginations, so I don't expect them to maintain real value very well over time. But they are highly convenient for everyday trade, so they have a special cherished place in my cash portfolio. Just not 100%.

> > But it is possible, because the

> > gold markets have not been divorced from the decades of corruption that

> > brought down the other markets.

Spot on, if you'll forgive the pun.

I shall heartily enjoy the forthcoming stories of asset owners calling the bluff on the lousy bums. A Krugerrand in hand is worth two in the bush.

Good to hear JPM is still kicking around.

Posted by: Regards, Patrick Chkoreff at November 3, 2009 12:06 PMHello (hat tip to Patrick who showed this to me)

My firm has dealt in LBMA Good Delivery Bars for over 17 years.

I have seen this before "In an Asian depository, they've found "Good Delivery" bricks that had been gutted and filled with tungsten."

What is unclear from anything I have been able to find anywhere, is which 'Good Delivery' system is being referred to here?

There are more than one. COMEX "Good Delivery" for example is settled in 100oz bars, while Dubai "Good Delivery" is settled in 1 kilo bars - LBMA bars are 400oz fine weight.

It is certainly possible that these were not 'LBMA Good Delivery bars' - I personally doubt the fiasco occurred with an LBMA security facility (solely my opinion)

Not to say I am defending all the member banks of the LBMA - but not all members of the LBMA are of the same ilk, and I should not say more on that.

Also "There is now an overall trend to take physical delivery from metals facilities (vaults, exchanges, etc)." - I would say this is more speculation than fact - while we may see some of this in the news I hardly think it amounts to an 'overall trend' - we are certainly not seeing it.

I do not discount the idea we could see defaults on major exchanges or with individual banks.

Best,

Alex

In an effort to diversify its foreign reserves, India bought 200 tonnes of GOLD from the IMF during October, which will nudge the country into the top ten gold-holders worldwide. The news sent the price of gold to another high, approaching $1,100 a troy ounce.

http://news.economist.com/cgi-bin1/DM/y/eB24U0Vsyj0Mo0GCSm0EU

India is eager for the IMF’s bullion

IF YOU count bangles, necklaces, anklets and other pieces of jewellery, India is the largest repository of gold in the world, according to the World Gold Council. Many Indians see gold as an investment as well as an adornment. India’s post office sells 24-carat gold coins, as small as 0.5 grams, to savers wary of fiat currencies or mutual funds. The latest big investor in the metal is the Reserve Bank of India (RBI). On November 3rd the central bank said it had bought 200 tonnes of gold from the IMF, a purchase that would have cost about $6.7 billion. The news pushed the price past $1,090 an ounce for the first time.

The IMF’s gold holdings are less decorative than India’s, but also impressive: the third-biggest official stash in the world. Its sale to the RBI is part of a plan to offload 403.3 tonnes, or an eighth of its total. The proceeds will create an endowment to cover the fund’s operating expenses and help expand its lending. It is doing its best not to rock the market by selling first to central banks, in keeping with their agreement in August to sell no more than 2,000 tonnes over five years. But the gold market is now interested in how much central banks might buy, not how much they might sell.

The central banks of China, Mexico, the Philippines and Russia have all added to their gold reserves in the past year. The RBI is merely catching up. Its stockpile fell to just 3.5% of its total foreign-exchange reserves (of $281 billion) in September. This purchase will restore it to almost 6%. Every central bank with a large holding of American debt is worried about capital losses if the dollar continues to weaken. Gold offers reassurance. Anyone who wants to try “quantitative easing” in the gold market has to dig a mine.

Posted by: The Economist... at November 5, 2009 01:33 PMThe story of phony gold and naked trading reminds me of the old "race horse" scam.

What the scamers used to do was sell shares in the horse to people however they would sell 20 or 30 10% shares.

They would then bill each share holder 10% of the running costs.

However the trick was to make sure the horse nearly always nearly won to keep the shareholders in the scam. But in reality the horse next to never won any significant money.

Because if the horse ever made significant winnings then the shareholders would expect dividends or put their shares up on the open market.

So who want's to buy a 10% share of a horse called "gold brick"?

Posted by: Clive Robinson at November 6, 2009 08:29 AMThe amount of “salted tungsten” gold bars in question was allegedly between 5,600 and 5,700 – 400 oz – good delivery bars [roughly 60 metric tonnes]. This was apparently all highly orchestrated by an extremely well financed criminal operation.

Within mere hours of this scam being identified – Chinese officials had many of the perpetrators in custody. And here’s what the Chinese allegedly uncovered:

Roughly 15 years ago – during the Clinton Administration [think Robert Rubin, Sir Alan Greenspan and Lawrence Summers] – between 1.3 and 1.5 million 400 oz tungsten blanks were allegedly manufactured by a very high-end, sophisticated refiner in the USA [more than 16 Thousand metric tonnes]. Subsequently, 640,000 of these tungsten blanks received their gold plating and WERE shipped to Ft. Knox and remain there to this day. I know folks who have copies of the original shipping docs with dates and exact weights of “tungsten” bars shipped to Ft. Knox.

Posted by: “salted tungsten” gold bars at November 15, 2009 07:54 AMRefuting the current tungsten rumor:

http://www.rapidtrends.com/2009/11/14/why-gold-bugs-are-considered-nuts/

Do not mistake this for me saying we may not see scandals in the future involving banks, gold, who says they have it but really dont etc

What I am posting is that I dont think the current story holds water - and the reasons why

Posted by: Alex S at November 15, 2009 02:35 PMAlex: I don't disagree, and would expect many of the claims of that community to not hold water. You'll note that I don't often post on the gold market, partly for that reason. :-)

However there is a case to be made that there might be trouble ahead. Humans are sadly human, and we are in the presence of material evidence that the banking system as a whole has been fiddled with in quite large doses. By humans.

Also, above, you say "and I should not say more on that." Well, precisely: this means that the good evidence we need for both bad and good events is simply not available. So even as the goldbugs' stories are often laced with wild speculation propped up on thin facts, so goes also the credibility of the more formal press. When a gold bank puts out news that gold is going up another $50, does that mean that this is serious financial reporting, or are they trying to front-run their customers?

Given that practically all of the real information as to gold reserves and positions is locked up somehow, we'd be a bit naive not to assume the financial crisis rot is in there somewhere. It may not be likely we can figure out where, though, before it happens.

Posted by: Iang at November 15, 2009 08:06 PM