March 25, 2013

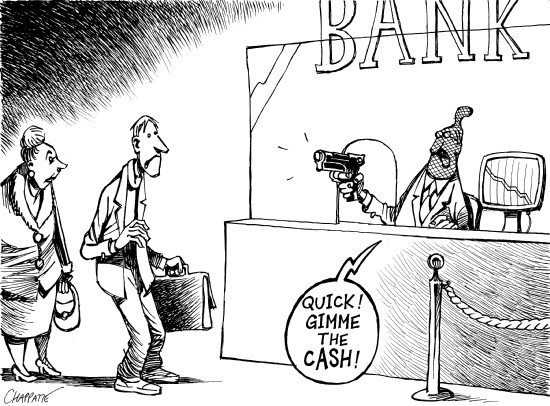

After a decade of bad banking, finally some Good News: Cyprus forced to shut down a bad bank!

From the ghoulish department of "good news unless you're affected" comes the story that the Cyprus government has agreed to the terms of the Troika:

From the ghoulish department of "good news unless you're affected" comes the story that the Cyprus government has agreed to the terms of the Troika:

Cypriot President Nicos Anastasiades agreed to shut the country’s second-largest bank under pressure from a German-led bloc in a night-time negotiating melodrama that threatened to rekindle the debt crisis and rattle markets....

The revised accord spares bank accounts below the insured limit of 100,000 euros. It imposes losses that two EU officials said would be no more than 40 percent on uninsured depositors at Bank of Cyprus Plc, the largest bank, which will take over the viable assets of Cyprus Popular Bank Pcl (CPB), the second biggest.

Cyprus Popular Bank, 84 percent owned by the government, will be wound down. Those who will be largely wiped out include uninsured depositors and bondholders, including senior creditors. Senior bondholders will also contribute to the recapitalization of Bank of Cyprus.

This is how it should be. In order to avoid moral hazard - the laziness from complete insurance - the people responsible must suffer the consequences of their judgement. The bond holders must be left short. The creditors -- uninsured depositors [0] -- must lose. The shareholders must be wiped out. The employees must be sacked, and officers in positions of material decision making must be pursued.

Only when that message gets out across Europe, and the world, will the people who choose to do business with their bank begin to regulate their bank.

Or withdraw their funds; which is the safety mechanism in a sound system against bad banking [1]:

Second, the commitment to the convertibility would provide an effective discipline against goldsmith-bankers who issued an excess of notes. When banks issued convertible notes, their circulation would be limited by the demand to hold them. That demand would depend on such factors as the precise features of the convertibility contract (for example, whether the depositor had to give notice when he wanted to withdraw his deposit), the bank's reputation, the familiarity of its notes, the number of branches it maintained, and so on. Any notes issued beyond the demand to hold them would be returned for redemption.

The law for banks might have changed, but the laws of banking do not.

[0] Should the insured depositors be wiped out? That is a more subtle issue. Maybe another day.

[1] This is not the end to the Cyprus story. Although the remedy is correct there are still questions to ask. Who owns the bonds? It turns out that a large part of the bonds have been put as collateral for emergency lending to the ECB. Which is then guaranteed by the national central bank. Oops. Story yet to unfold.

Posted by iang at March 25, 2013 06:06 AM | TrackBack