March 19, 2013

How much for an island in the sun, Mr Putin?

The Cyprus news flows in, thick and fast. There are only a few major points. As expected from any nation made of /ellos con cajones/, the Cypriots slapped down the European offer, 36 to nothing (much). The problem here can be seen as the curse of a small democratic nation -- which is to say, the representatives probably still have to answer to their constituency, unlike their more sophisticated northern counterparts.

Meanwhile, the Europeans are perhaps left bemused at the fail of the bid. They gave it their best shot, non? What now?

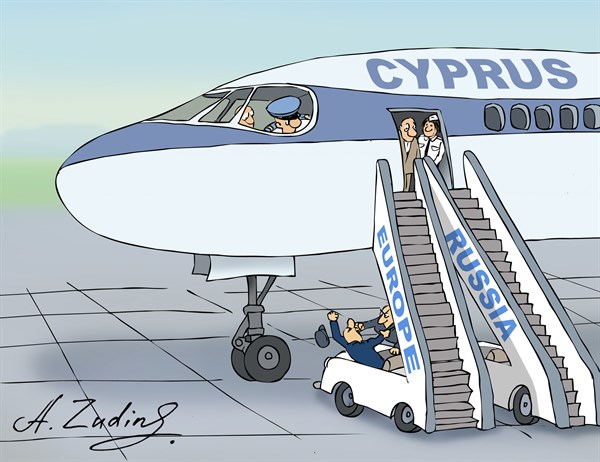

There is another offer on the table.

Cypriot Finance Minister Michael Sarris flew to Moscow on Tuesday to seek Russian financial assistance. He denied by text message reports that he had resigned, which rattled nerves as lawmakers were poised to vote.

Let's sum up the friendship. The Russians already loaned in 2.5bn, sans Eursury. They're hopping mad at being excluded from the conference of debtors. They're also a bit red faced -- slap slap -- at repeated allegations of hot money. Further, although the media plays shy on this one, it turns out that Cyprus has become a nice little center for serious, legal, solid Russian business. As well as a destination for that soon to be listed endangered species: English common law.

The din of criticism from Moscow signaled the importance of Cypriot offshore financing for the Russian economy. The island has long served as an escape valve for Russian businessmen. Some are surely dodging local taxes. Others, paradoxically, are seeking better courts in the British law system practiced in Cyprus.Offshore domiciles are so ingrained in the post-Soviet way of doing business in Russia that Cypriot shell companies are linked not only with money launderers and organized crime, but well-established companies like the metals giant Norilsk Nickel.

H/T to naked capitalism and Lynn in comments on that one. Naked capitalism does not go so far on this, but I wonder: This is one hell of a friendship.

For some number around 10bn, plus/minus, perhaps the Russians get to buy into Europe. As long as they (a) respect the english common law tradition, (b) leave the islanders to live out their happy sun-kissed lives, and (c) sort out the banks, what objection could there be, nyet?

Not to mention, Nota bene to students of long Russian strategy & short Middle Eastern futures, pay no attention to the hands,... Cyprus is a warm weather port.

Posted by iang at March 19, 2013 11:41 PM | TrackBackMy thoughts exactly !

Posted by: Simon at March 20, 2013 04:41 AMCyprus Banking Crisis: Will Russia Ride to the Rescue?

http://business.time.com/2013/03/19/cyprus-banking-crisis-will-russia-ride-to-the-rescue/

Cyprus Bailout: Stupidity, Short-Sightedness, Something Else?

http://www.nakedcapitalism.com/2013/03/cyprus-bailout-stupidity-short-sightedness-something-else.html

"This post from Cyprus.com addresses some important misperceptions about the background leading up to the bank bailout impasse in Cyprus, including the alternatives that were available that were perversely bypassed. I also have a separate post due to launch shortly, but this article is an important stand-alone piece and debunks quite a lot of conventional wisdom."

... snip ...

Posted by: Lynn Wheeler at March 20, 2013 06:16 PMvarious scenarios from the Cyprus situation

Banks Lose Public Trust, Run on Banks Looming

http://www.phibetaiota.net/2013/03/rickard-falkvinge-banks-lose-public-trust-run-on-banks-looming/

The Fed Has Already Imposed A "Cyprus Tax" On U.S. Savers

http://www.zerohedge.com/news/2013-03-21/fed-has-already-imposed-cyprus-tax-us-savers

Whose Insured Deposits Will Be Plundered Next?

http://www.zerohedge.com/news/2013-03-21/guest-post-whose-insured-deposits-will-be-plundered-next

Cyprus: Will the Mouse That Roared be Gored? (Updated)

http://www.nakedcapitalism.com/2013/03/cyprus-will-the-mouse-that-roared-be-gored.html

Cyprus Bailout: What to do Now?

http://www.nakedcapitalism.com/2013/03/cyprus-bailout-what-to-do-now.html

ECB to Push Cyprus Over the Brink