June 21, 2017

9 years after the crisis - British bankers charged with fraud!

The horrible question I asked in my Audit cycle was, why has no auditor, even by accident, spotted a dodgy bank? When we know that in the crisis, pretty much all were. It's a mystery, and the only answers just deepen the mystery - what good an audit if we have no idea if it's representative of a sound bank?

What does it even mean to say "a sound bank"? Folks, today, we're about to find out.

An ancillary question was, why have no bankers gone to jail? Well, Iceland answered the call and jailed a lot of bankers. But no other country. So, in some sense that excludes Iceland, no bankers committed crimes, but the banks were all insolvent, and nobody spotted it?

It's not clear to me, and I smell a rat.

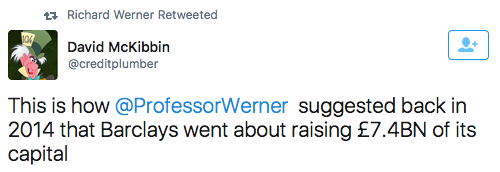

And now, yesterday, the UK's Serious Fraud Office has announced charges against Barlays. For a related crime - what amounts to using fraud to boost their equity in the post-crash turmoil. OK, so I think that's what it is, and as criminal charges have been laid, we the public are somewhat left in the dark, and even the charges have to make their way through court.

So maybe it's something else or maybe it's nothing.

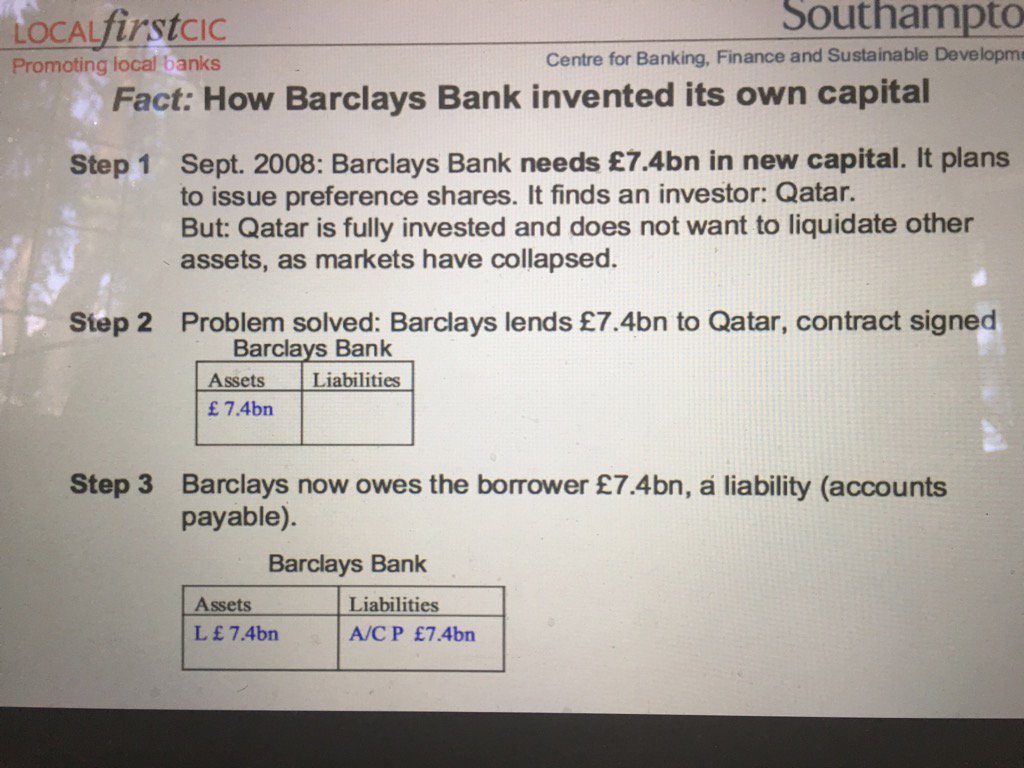

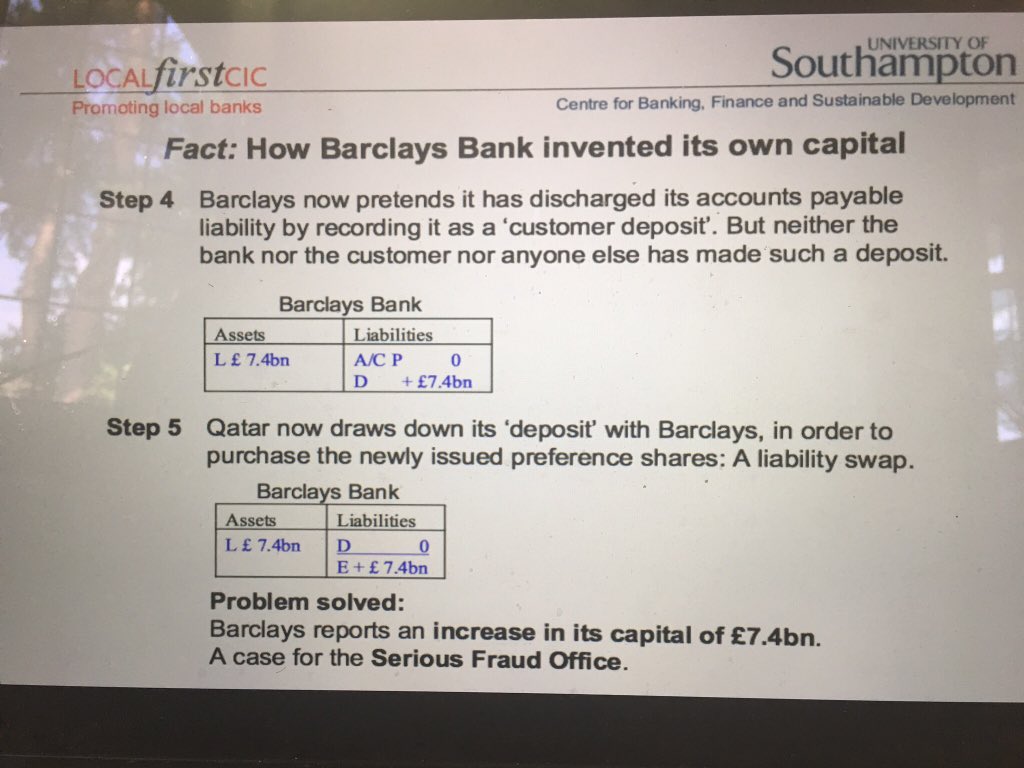

However, unusually, one man thinks he knows what it is, and has written extensively about it. Prof Werner, a noted anti-establishment economist, taught the fraud:

Prof Werner's account retweeted these, so that's good enough to accept that they are real slides. It's for the courts to figure out the facts, but note the careful use of the phrase in the slides - Fact.

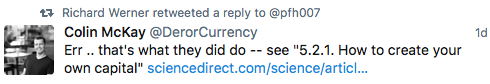

Then, to add more colour, another poster said:

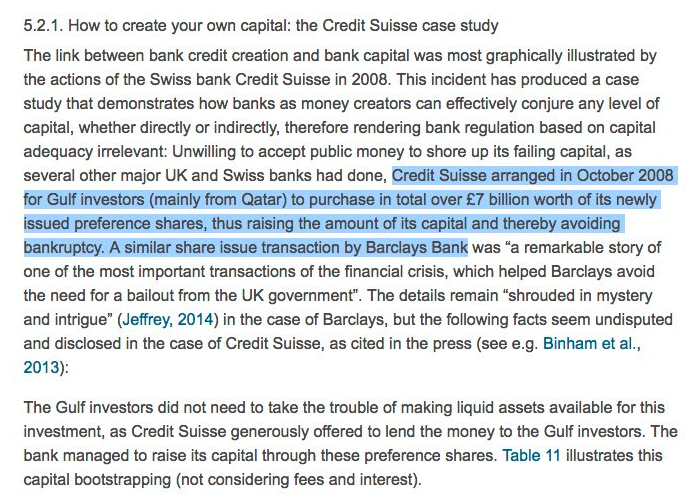

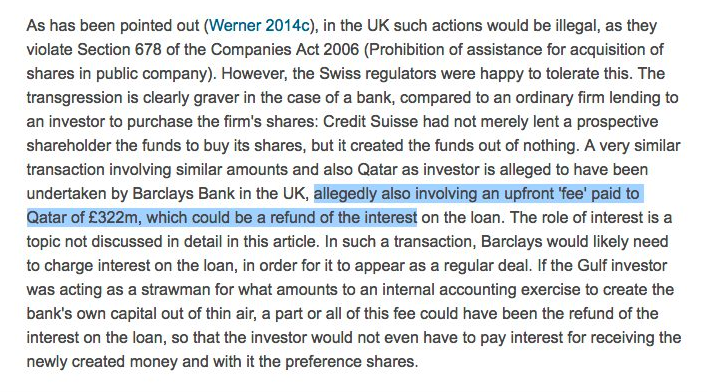

And conveniently copied the relevant sections from Prof Warner's 1996 paper "A lost century in economics: Three theories of banking and the conclusive evidence":

That paper is more formerly, Richard A. Werner, "A lost century in economics: Three theories of banking and the conclusive evidence", International Review of Financial Analysis Volume 46, July 2016, Pages 361-379. Which is to say, it's a serious paper, and will be presented as such in court.

But this is no isolated case. The next two paras from the paper are even better:

According to analysts at Italian bank Mediobanca, such bank loans to new bank share investors were a "fairly common practice... during the crisis", whereby Credit Suisse may have been unusual in disclosing this and obtaining regulatory approval. Either way, banks in this way created their own capital out of nothing, thus making nonsense of capital adequacy regulations.

What can we conclude from this, other than that prosecution by the public has moved from the editor's letters page to twitter?

A lot. To review: The SFO has charged Barclays with a crime. The clear accusation is that they paid for their own equity. A company that pays for its own equity cannot be sound, a priori. A fundamental tenet of the corporate system is that the shareholders are separate from the company, and violating that violates the very meaning and essence of shareholdings.

So, in banking, Barclays and Credit Suisse may be doing well, but as corporations they are no longer sound. The hypothetical extreme of this would be that Barclays could simply purchase its entire own stock, and then what? Ridiculous! Only on the blockchain could you imagine such a ridiculous thing!

But back to serious. How could they purchase their own stock in the first place? Prof Wagner also states this is a violation of Section 678 of the Act as above, and "Prohibition of assistance for acquisition of shares in public company" sounds like a pretty clear violation to me.

Several things are interesting to me. Firstly, if an ordinary company could do this, in theory, then it would have limits: it would have to spend cash on doing that, and it only has so much cash, and typically, it would run out. So there is a natural control for ordinary corporations.

But banks don't have that control. Why not? Because according to the "new theory of banking" banks can write loans against nothing. In the good old days, under what is now euphimistically called the financial intermediation theory of banking, banks could only intermediate: they could write loans by moving deposits loaned to them to others. No more.

But banks don't have that control. Why not? Because according to the "new theory of banking" banks can write loans against nothing. In the good old days, under what is now euphimistically called the financial intermediation theory of banking, banks could only intermediate: they could write loans by moving deposits loaned to them to others. No more.

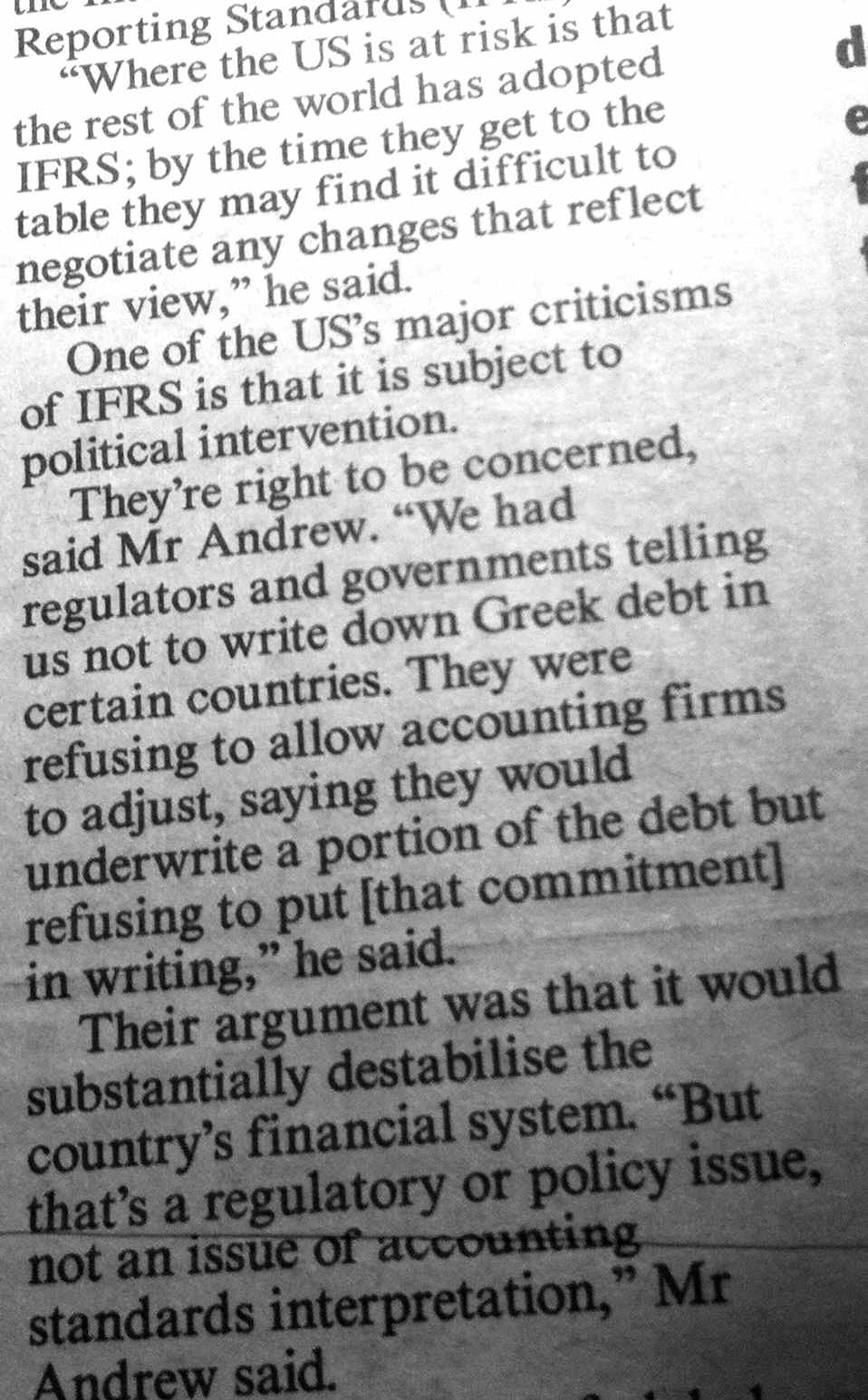

So there are no controls on the bank doing this other than Section 678. So what happened to allow Barclays to circumvent the law? We don't know but I'm going to make a suggestion: the regulators allowed it. Adding to Credit Suisse, my evidence for this is the extraordinary claim made by auditors that the regulators refused them to allow the write-down of Greek Debt, and thus exacerbated the crisis.

Remember, I asked, why didn't the auditors ring the bell? The alarm bells of society were silenced, and in the end, the only evidence we've seen was that it was the regulators.

Back to Prof Werner.

We learn from this that under the right circumstances it is possible even for an individual bank to show almost any amount of capital to regulators. It is even more easily possible for the whole banking system collectively to do likewise, without directly contravening the Companies Act. Since during boom times an increasing amount of money is created by banks (hence the boom), some of that can be siphoned off by banks to bolster their capital by issuing new equity. The regulators seem unaware of this fact, as their descriptions of banking reveal them to be adherents of the erroneous financial intermediation theory of banking.

Read that carefully. What Prof Werner is stating is that Section 678 isn't important. What's important is that even if you ban it, the financial system is sufficiently complicated that you can't stop it. E.g., "It is even more easily possible for the whole banking system collectively to do likewise, without directly contravening the Companies Act."

Systems engineers will tell you that unless there are negative feedback controls on the system, the system blows up. By allowing the banks to lend from nothing, that negative feedback control is removed. The system will blow up. Hence 2008. And as nothing has been fixed, no new negative feedback control has been added, the future is clear: the financial system must blow up again.

The financial system isn't sound. So the final conclusion of this is that the SFO isn't trying Barclays. It's trying the financial system - all the banks and all the regulators are in the dock, named or not.

Posted by iang at June 21, 2017 12:16 PMHi iang

You know, one of the founders of the bank of England, William Paterson, said that the bank created money out of nothing back in the 1690s, this is quoted in one of Ezra Pound's Cantos; viz Canto XLVI,

_Hath benefit of interest on all

the moneys which it, the bank, creates out of nothing._

Interestingly, a couple of lines further on Pound tells us that this is "Denied by five thousand professors," which will be a lot more than 5000 by now.

I suppose Prof Werner is kicking against the pricks.

Posted by: gyges at January 24, 2018 05:58 AM