November 21, 2011

Audit redux - KPMG reveals... FRAUD? You be the Jury!

I like a guy who picks a fight. Especially, if he's an auditor!

I like a guy who picks a fight. Especially, if he's an auditor!

New KPMG global chairman Michael Andrew says global regulators are hell-bent on breaking the dominance of large global audit firms without regard for the impact on stability of financial makerts and employment. "This is the worst time to be reforming the profession. You want financial stability. You want large employers in the marketplace taking on graduates. Why an earth is this an imperative right now?"

Australian Financial Review's article, "Global Chief blasts audacious attack on audit" of 21st November 2011, brings us some of the worst sort of self-serving excuses - saying that Auditors are part of the solution, not part of the problem.

I'm not buying it. Back in February of 2009 I asked of the auditors:

Let's check the record: did any audit since Sarbanes-Oxley pick up any of the problems seen in the last 18 months to do with the financial crisis?No. Not one, not even a single one!

KPMG's Chairman is going to need a better set of excuses. Indeed, belatedly, it seems that others are asking too. From the same article, behind a paywall it seems:

The move against the big four is a backlash to the global financial crisis. The whole premise of audit is to inform capital markets. So why didn't they foresee, or prevent, the financial crisis and Europe's currency problems?

Now, I'm not going that far. I don't think audit could or should have prevented the GFC1 or GFC2, and it is the economist that foresees crises, not auditors. Rather, I'm saying:

Yet, the basic failures in the financial crisis are so blatant that surely, even by accident at least one audit should have picked up at least one pending failure, and fixed it?

Surely an easier test: not a single auditor has rung the bell on a single bad bank, that we know of. So what went wrong? I suggest the cause of failure by examination of the basic product of audit, and I conclude, in short words, you the public cannot rely on it. To you, the public, audit is an unknown unknown, you don't even know enough to know what it is. And in that environment, auditors shifted it somewhere else.

However, Michael Andrew brings a new causality to the court of public appeal:

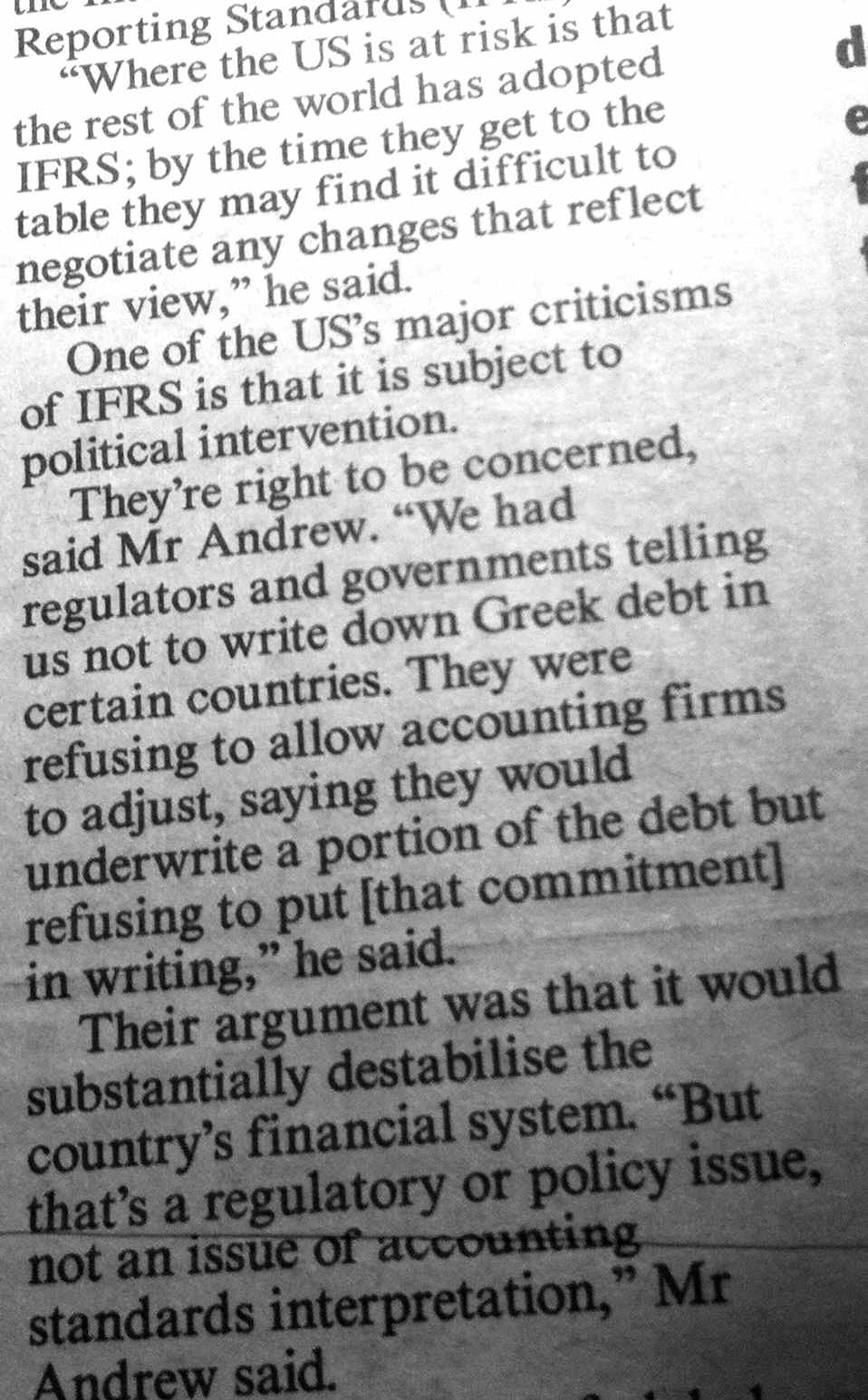

One of the US's major criticisms of IFRS (International Financial Reporting Standards) is that it is subject to political intervention.They're right to be concerned, said Mr Andrew. "We had regulators and governments telling us not to write down Greek debt in certain countries. They were refusing to allow accounting firms to adjust, saying they would underwrite a portion of the debt but refusing to put [that commitment] in writing," he said.

Whoa! Did he just say that? Did I just write out those words, taken from a scrappy photocopy of a print-only article? Yes indeed, word for word.

Haven't we seen that before? Let's ask Joseph T. Wells for the definition of fraud:

Under common law, three elements are required to prove fraud: a material false statement made with an intent to deceive (scienter), a victim's reliance on the statement and damages.

Now, I don't want to be sued back into the dark ages by accusing auditors of fraud, so let's test it in the court of the informed observer:

- Intent?!

- Was failing to write down the greeks a bad?

- Did the Auditors deliver reports saying the banks' accounts were good?

- Would good reports over bad greeks be materially false?

- Was there an intent to deceive the audit-relying public?

- Who by?

- Did the victims of the worlds financial markets rely on rosy audit reports? and

- Were there damages?

Now, I'm no lawyer. And, the Auditor's defence will clearly be "the government told us to do it!" Which might even get them off, who knows? Or it might just bring the governments in on the act -- have they defrauded the entire planet by some act of conspiracy or abuse? Or, or or...

I don't know. But this is a question that simply must be answered.

I call for a jury of victims! Over to you. What is your verdict?

PS: before the papparazzi and the bureaucrats get too excited: Michael Andrew did the right thing by blowing the lid on the intervention. We need more facts, more causes, not more coverups.

PPS 2017: finally 6 years later, the system may be brought to trial.

Posted by iang at November 21, 2011 02:18 PM | TrackBackas mentioned before ... GAO apparently didn't believe auditors or SEC was doing anything, even in the wake of SOX

http://www.gao.gov/new.items/d061053r.pdf

http://www.gao.gov/special.pubs/gao-06-1079sp

shows uptick in public company financial filings that had serious audit errors and/or were fraudulent ... even after SOX. choose: 1) SOX had no effect on fraudulent filings, 2) SOX encouraged fraudulent filings, 3) if it weren't for SOX, all filings would be fraudulent.

Posted by: Lynn Wheeler at November 22, 2011 10:02 AM...

For Hugh McLernon, boss of litigation funder IMF, this is the true contagion. He argues that during the global financial crisis, governments worldwide (with the obvious exception of Australia) began eroding financial laws in relation to the requirement that companies mark their assets to market. Those governments didn't change the laws - they ignored them because to enforce them would have sent many companies into oblivion. "Ignoring one law leads inexorably to the ignoring of others. If the regulators turn a blind eye to the breach of one law, how can they then justify the enforcement of other, closely related, laws?" he asks.

Contempt for the law or its non-enforcement begets fear of the law. In this regard, witness the fallout from the failure of MF Global after that company ignored the requirement to keep its money segregated from that of its clients. In the absence of swift regulatory intervention, the law falls further into disrepute.

...

Posted by: Contagion! Mortality! at November 27, 2011 10:55 AMOn a related note, there's this: http://www.bloomberg.com/news/2011-11-25/mf-s-lost-cash-makes-you-wonder-about-goldman-commentary-by-jonathan-weil.html

Posted by: Chris at November 27, 2011 01:18 PM