June 27, 2013

Did Alan Greenspan blow the bubble that blew up the world?

If you, like me, are a fan of Alan Greenspan, you'd also be wondering what went wrong in the 2000s. His book is enlightening, but not conclusive. Observations that there were a series of heart-starting adrenalin injections into the economy -- the dotcom crash, 9/11, Fannie Mae, Bear-Stearns and Lehman Brothers, 2007, etc -- are illuminating but again not conclusive.

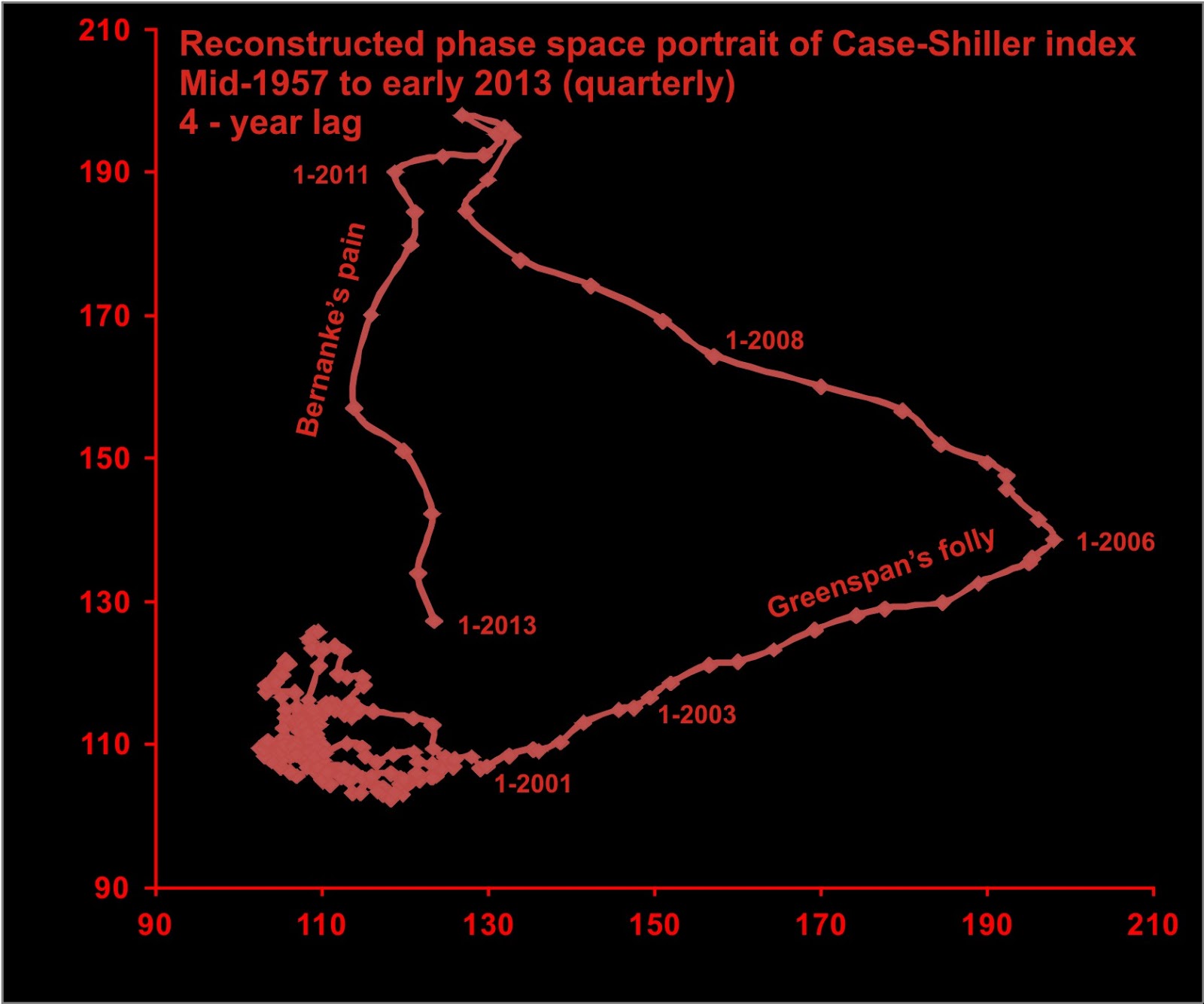

Even to establish that the train ran off the tracks is hard. Here comes a graph from WorldComplex blog (h/t to Zerohedge) that pretty much nails it:

The train not only ran off the tracks, it left the reservation. The beauty of these graphs is that you don't even have to understand them to realise that something really crazy happened after 2000.

But that said, let's try and interpret them. The graph shows accelerating USA housing prices beyond the norm. The pre-2000 blob(s) on the bottom left corner shows stability over the long run, which is to say that housing prices were stable across the USA, over time. For the norm, housing prices were a direct reflection of the rest of the economy, and in stability.

Then, movement to the right shows rapidly increasing prices, as it measures the index of prices for a given year over 4 years before. Movement to the left shows rapid collapse, the reverse. Movement up&right shows overall (sustained?) increase in prices, movement down& left shows overall (sustained?) lowering.

I think then, this is compelling evidence. There was a bubble blown from the year 2000 to 2006 of epic proportions. It then collapsed between 2006 and 2013, still on-going (we're still 20 points above long run stability).

I think then, this is compelling evidence. There was a bubble blown from the year 2000 to 2006 of epic proportions. It then collapsed between 2006 and 2013, still on-going (we're still 20 points above long run stability).

Only the Federal Reserve could blow such a bubble. And, it was done on Alan Greenspan's watch.

I'm still a fan of the magician. He did, overall, a far better job than Bernanke is doing right now. But, there is no doubt that the Federal Reserve lost the plot while under Greenspan's watch.

Which, for future economic historians, leaves a compelling research project: what went wrong? And for the rest of us, a mess.

Posted by iang at June 27, 2013 05:29 AM | TrackBackreference to the greenspan put/bubble starts before 2000

Deutsche Bank: If The Fed Is Concerned About Popping Its Asset Bubbles, It Is 15 Years Too Late

http://www.zerohedge.com/news/2013-06-27/deutsche-bank-if-fed-concerned-about-popping-its-asset-bubbles-it-15-years-too-late

Lot of the Greenspan cheap money the last decade went to private equity companies, allowing them borrow for corporate take-over, plunder the victim and then IPO the victim ... with the victim carrying the original loan (analogous to real-estate speculation flipping ... except in real-estate flipping the original loan is payed off ... in reverse-IPO/re-IPO, the new "buyer" not only takes out a new loan for the purchase, but also assumes existing mortgages).

Lot of the real-estate market was enabled by being able to pay for triple-A ratings (when the rating agencies knew they weren't worth triple-A). This unlocked huge amount of money in places like large retirement & sovereign funds (restricted to dealing in triple-A) ... significant enabler in the over $27T in toxic CDOs done during the bubble.

Posted by: Lynn Wheeler at June 27, 2013 09:15 AMI'm curious: why, at this point, would you be a fan of Alan Greenspan?

He's the epitome of everything that went wrong with our financial system: a demagogue who substituted ideology for critical thought. He spoke as if he were an entrepreneur who understood the creation of real wealth by use of the free market, but whose real power and influence came from being a bureaucrat with the keys to the largest fiat money machine in the history of mankind.

Basically the man's one saving grace, as I see it, is that he ultimately had the humility to admit to the world that the guiding principle of his administration was wrong. But a public repentance is barely even a start on repairing the damage he did.

Given your own rather hard-nosed and quantitative approach to financial problems, I'm really curious about what would make you a fan. It would be nice to see a future post about this: maybe there's something in Greenspan's history that I'm not aware of.

Posted by: Glyph at June 27, 2013 11:20 AMFigures get the credit and the blame for being in the path of trends that were already in motion.

Posted by: Joe Bob at July 11, 2013 02:33 AM