December 23, 2010

Ernst & Young called to account -- should Audit firms be investigated for their role in the crisis?

In a long series of essays on the topic of Audit, I asked the question, why didn't the Audit firms pick up the disasters of the global financial crisis? Not all of those failed firms, as that would be too much to ask, but not even one?

In a long series of essays on the topic of Audit, I asked the question, why didn't the Audit firms pick up the disasters of the global financial crisis? Not all of those failed firms, as that would be too much to ask, but not even one?

As far as I know, no audit firm rang any alarm for any impending disaster for any business that consequently ran into trouble in the GFC. Not a single one!

Which raises the question: not even accidental combinations of misfortunes are being noticed by Auditors? What would it take to get an auditor to ring the alarm bell?

We have a statistically significant sample -- all the world's big firms. By some statistical hypothesis, either some alarm bells should have rung, or, no alarm bells were ever going to ring.

Some might be asking the same thing. Ernst & Young have now been sued by the New York Attorney General, Andrew Cuomo:

NEW YORK (Reuters) – Accounting firm Ernst & Young was sued by New York prosecutors over allegations it helped to hide Lehman Brothers' financial problems, in the first major government legal action stemming from the Wall Street company's 2008 downfall.The civil fraud case contends that Ernst & Young stood by while Lehman used accounting gimmickry to mask its shaky finances. The lawsuit says Lehman ran "a massive accounting fraud," but it did not name as defendants any former top executives at the investment bank whose September 2008 collapse helped spark the global financial crisis.

You can read the indictment here. Now, it's hard to speculate reliably as to where this will go, other than to a quiet settlement. What is more interesting to me at the systemic level is that an audit firm is being brought to account.

People close to Cuomo said one factor in bringing the case was that he knows that the U.S. Securities and Exchange Commission already is investigating former Lehman chief Richard Fuld and other former top Lehman executives.Cuomo "wants to go after the one party he knows isn't being sued," said John Coffee, a professor of corporate law at Columbia University.

Whatever that means. Ernst & Young predictably say they did nothing wrong and all transactions were "by the book." Could well be, and the court will no doubt audit that very statement, as well as the statements of the bankrupcy court:

The lawsuit comes nine months after a court-appointed examiner in the Lehman bankruptcy concluded that Ernst & Young was "professionally negligent" in its audit duties.The report by examiner Anton Valukas also said that Lehman could also have claims against Fuld and former chief financial officers Chris O'Meara, Erin Callan and Ian Lowitt for negligence or breach of fiduciary duty related to the use of Repo 105 transactions.

For me, the big question remains: if we can't expect an audit firm to pick up any signs of trouble, what can we expect of them? Perhaps we could save our money and do our due diligence another way?

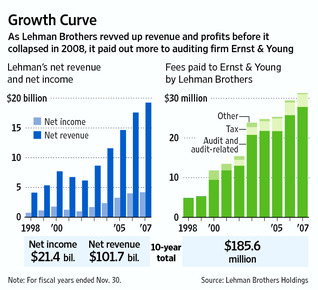

The lawsuit seeks more than $150 million in fees that Ernst & Young received from 2001 to 2008 as Lehman's outside auditor -- less than 1 percent of its global annual revenue -- plus other unspecified damages.

However it turns out, the result will be important.

Posted by iang at December 23, 2010 06:08 PM | TrackBackas been referred to many times, the person that had tried for a decade to get SEC to do something about Madoff, testified in congressional hearings that tips turn up 13 times more fraud than audits.

also has been mentioned several times in the past, congress passed Sarbanes-Oxley in the wake of Enron ... in theory requiring stricter audit requirements. However, possibly because GAO didn't believe it had any affect, GAO started doing reports of public company financial filings ... showing uptick in fraudulent filings even after SOX; so SOX (audits)

* have no effect on fraudulent filings

* encouraged the uptick in fraudulent filings

* if it hadn't been for SOX, all filings would be fraudulent

There were comments that motivation was fraudulent filings enabled significant boost in executive compensation and even if filings were later corrected, the executive compensation wasn't reclaimed.

SOX also had provision that SEC look at the rating agencies ... who played pivotal roles in the financial crisis. One of the comments during the fall2008 congressional hearings into the role played by rating agencies, there was comment that the rating agencies could blackmail the federal gov. into taking no punitive action with the threat of credit rating downgrade.

There are recent news items that the rumors about new wikileaks (giving substantial information about US financial institutions activity leading up to the crisis), has federal agencies "apprehensive", since it could also expose the lack of agency diligence.

not this is anyway new, Lehman, Ernst & Young references from last spring

Lehman autopsy throws Ernst & Young into spotlight

http://www.marketwatch.com/story/lehman-autopsy-throws-ernst-young-into-spotlight-2010-03-12

from above:

Ernst & Young came under fresh public scrutiny after a report on the Lehman Bros. collapse alleged that the accounting firm's audit failed to challenge transactions that essentially hid $50 billion of the investment bank's assets.

... snip ...

a few others

Lehman, Ernst & Young and accounting

http://insider.accountancyage.com/2010/03/lehman-ernst-yo.html

Will Ernst & Young Survive The Lehman Fiasco?

http://www.businessinsider.com/will-ernst-and-young-survive-the-lehman-fiasco-2010-3

Ernst & Young faces legal action over Lehman collapse

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article7059469.ece

Lehman Fraudulently Cooked Its Books, Accounting Giant Ernst & Young Helped, Geithner and Bernanke Winked and Slapped Them on the Back

http://www.prisonplanet.com/lehman-fraudulently-cooked-its-books-accounting-giant-ernst-young-helped-geithner-and-bernanke-winked-and-slapped-them-on-the-back.html

and from Dec2008:

Corporate Fraud and Misconduct Risks Driven by Pressure to do 'Whatever It Takes'; Fewer episodes reported by companies with ethics and compliance programs

http://www.financetech.com/news/showArticle.jhtml?articleID=212501185

from above:

Of more than 5,000 U.S. workers polled this summer, 74 percent said they had personally observed misconduct within their organizations during the prior 12 months, unchanged from the level reported by KPMG survey respondents in 2005. Roughly half (46 percent) of respondents reported that what they observed "could cause a significant loss of public trust if discovered," a figure that rises to 60 percent among employees working in the banking and finance industry.

... snip ...

With overall industry avg. of 46% ("could cause a significant loss of public trust if discovered") and the financial industry specific avg. of 60%, which should place the non-financial industry avg. below 40%. That would make the financial industry avg. somewhere between 50% and 100% worse than other industries.

Posted by: Lynn Wheeler at December 23, 2010 03:08 PM