May 16, 2015

NASDAQ on the blockchain - why?

The recent announcement that NASDAQ are experimenting with putting assets on the blockchain ruffled some feathers! Amonst many question, chief was /which chain/? Now the answer to that has leaked, people are asking "why Bitcoin?"

The recent announcement that NASDAQ are experimenting with putting assets on the blockchain ruffled some feathers! Amonst many question, chief was /which chain/? Now the answer to that has leaked, people are asking "why Bitcoin?"

Two factors are strong here, being the asset-capabilities axis, and the control or "permission" axis.

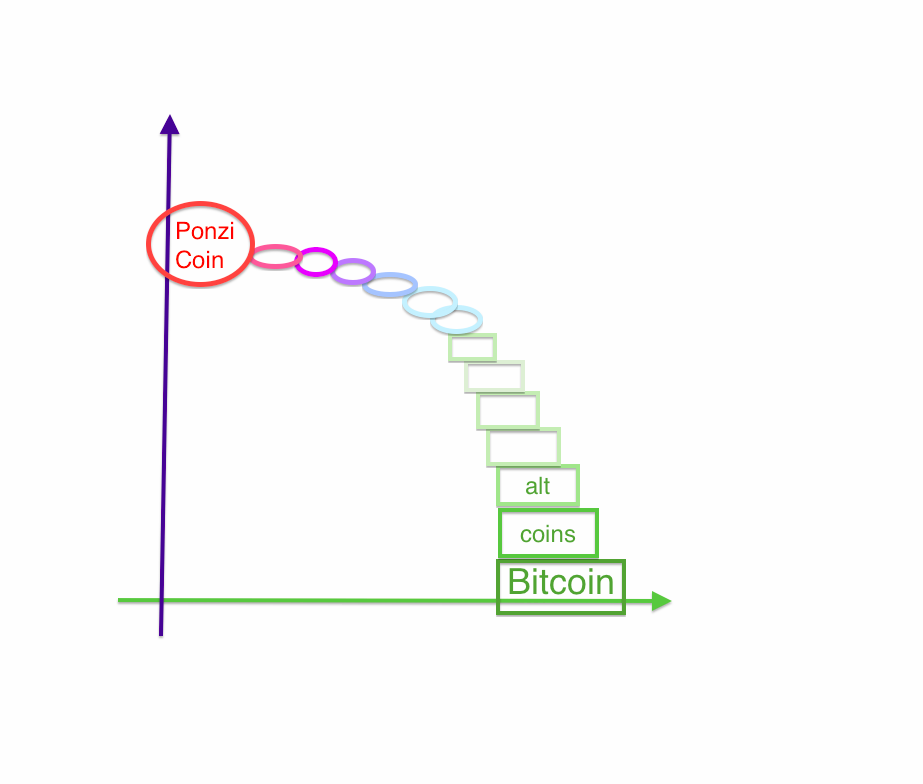

1. First the assets. As I have hummed or written or shrilled loudly, the big thing that is missing in Bitcoin is assets. Just quickly, Satoshi Nakamoto made a remarkable simplification by establishing precisely one and only one unit - the BTC. But that trick is only possible for one unit; as soon as you need two units, chaos ensues.

And the altCoins market is the proof of that, chaos. The keystone it is missing is the ability to describe an issued instrument in cohesive, rigourous terms. By that I mean, in short words, the legal or prose contract offered by an issuer.

Briefly, we need a written, prose contract that is locked into the accounting system, one-for-one -- something you can take to court. The longer story can be read in my Ricardian Contract paper, etc, but for now, we need to just fixate on how we lock a legal contract into an issuance of value.

Recently, it turns out, there was a change in Bitcoin's underlying code ("OpReturn") that allowed sufficient information in it to do just that. This is seen most clearly in colored coins and the OpenAssets project, or at CoinPrism. In essence, you can now include the Ricardian hash in the transaction so that your payment points securely to the contract you are paying.

Having a contract means you can describe equity, securely. Which means that NASDAQ can describe their issuances, securely. Which means they can do an end-to-end demonstration of their intended vision, as a proof of concept.

The takeaway for assets is that NASDAQ can now do it on bitcoin, whereas before they would have been limited to one of the gen 2 products.

(NB, in the above, I'm not referring to smart contracts. For more on this distinction, see On the intersection of Smart Contracts and Ricardian Contracts.)

2. Now for Permission. To summarise the "permissionless" debate, it is industry expectation that institutions will want to be able to benefit from the innovation of bitcoin for the most part, but, at the end of the day, they will need a kill-switch. Because, we're talking the assets of the company, or the shares your client holds, or the loot the court just ordered you to seize, some control is needed. As Tim Swanson said:

2. Now for Permission. To summarise the "permissionless" debate, it is industry expectation that institutions will want to be able to benefit from the innovation of bitcoin for the most part, but, at the end of the day, they will need a kill-switch. Because, we're talking the assets of the company, or the shares your client holds, or the loot the court just ordered you to seize, some control is needed. As Tim Swanson said:

"No bank's going to want to put a billion dollars of value [on a ledger] if it can be destroyed by anonymous validators," he said in an interview.

That's the industry expectation, and obviously this goes 100% counter to bitcoin expectation. Without getting into that debate today, I agree, *in principle* this is the force that will be brought to bear. But that's only in principle. It is a given that we know the layers and principles of financial cryptography, but the art lies in knowing when to break them.

Where then can we adjust?

As NASDAQ are only experimenting at this stage, it matters not what they do. Once they are done with experimenting with the tech, they'll then have to build it - which doesn't mean the tech, it means the rest of the infrastructure. The tech is a small part of the equation, sorry guys.

Out of that conversation will come any decisions to switch tech, so in essence NASDAQ are building one to throw away.

Thusly, their choice of technology is totally open. Why then not go with technology that more closely approximates their market, which might be Ethereum, Eris, Hyperledger, Open Transactions or even my own Ricardo? Again, the answer is the same: using permissionless technology such as Bitcoin gives them ... permissionlessness!

Why is this necessary or even slightly useful? Isn't NASDAQ a huge institution with incredible power?

They are. But this doesn't mean they are not subject to influence, power, pressure, bribery, corruption, rotating doors and favours. Directly above them, as an SRO, they have the SEC, and the Fed. To the side, the other exchanges, clearing houses, banks, DTCC, OTC markets, etc. Underneath many thousands of brokers. And then, swimming like sharks around a wounded whale, NASDAQ is surrounded by 50 direct state regulators, probably 10 national regulators in addition to the SEC and the Fed, and hundreds of other interested agencies, armed and ready to have their say. And we haven't even mentioned the insiders...

Telling those parties that they are working on the open blockchain is a very powerful signal. It basically stops everyone of those parties in their tracks. It means none of them can form an opinion, issue a letter, insist on a rule, start the power game, phone in favours, etc etc. Because bitcoin is permissionless, then it needs no permission for even NASDAQ to play. E.g., if FinCEN phones up, NASDAQ can respond, "by all means, come play with us, what's your bitcoin address?"

Or as gendal put it, come along and play in our permissionless innovation sandpit:

Permissionless InnovationBecause it turns out that censorship-resistance implies an even more interesting property: permissionless innovation.

"Permissionless innovation" -- the general freedom to experiment with new technologies and business models -- has been the secret sauce that fueled the success of the Internet and the digital economy.

This story is as important to a huge organisation such as NASDAQ as it is to the SV techie in a basement.

In the alternate, we can compare that story to the sad sorry debacle of Ripple. Although they said all the right words to anyone that would listen, at the end of the day, they were just words. Actions are the issue. Ripple had a permissioned system, and when push came to shove, they just didn't have enough of it.

By choosing the permissionless system, NASDAQ has bypassed all that. For now. Which is just what they need to ... experiment, innovate, play.

Posted by iang at May 16, 2015 10:50 AMThe question yet to be answered after reading this, is what will/should NASDAQ choose when it comes time to implement for real? There are still advantages even at that stage to not needing to ask anyone else for permission, lest their innovation be mired in bureaucracy. Do you think the Bitcoin blockchain is useful to them only for experimentation, or will it lure them for the real thing?

Posted by: Paul O'Keeffe at May 19, 2015 10:56 PM