December 14, 2011

the five parties model, and SPDR GLD invites users to play spot-your-gold-bar

Back in the old days, I invented the five parties model so as to protect static assets that had to be protected. I don't have a good URL for it, because to a large extent I was still in my pre-naivete phase, in which I thought this stuff is basic engineering, don't bother me with doco.

So in brief: A repository stores the metal, on behalf of the issuer of a financial instrument. A signatory, independently to the issuer signs incoming and outgoing metal, so as to stop the secret sales of metal. A Manager receives customer metal and disburses out of a kitty, and interacts via the signatory into the repository for large amounts. Finally, all of the preceeding 4 parties publish reports in real time to the fifth party, the public, who relies on the reports to guard against fudged account and re-use of assets, a.k.a. theft and fraud.

It's as easy as 1,2,3,4,5. Or so I thought:

...just ask Gerald Celente what happened to his so-called gold held at MF Global, or as it is better known now: "General Unsecured Claim", which may or may not receive a pennies on the dollar equitable treatment post liquidation. What, however, was less known is that physical gold in the hands of the very same insolvent financial syndicate of daisy-chained underfunded organizations, where the premature (or overdue) end of one now means the end of all, is also just as unsafe, if not more. Which is why we read with great distress a just broken story by Bloomberg according to which HSBC, that other great gold "depository" after JP Morgan (and the custodian of none other than GLD) is suing MG Global "to establish whether he or another person is the rightful owner of gold worth about $850,000 and silver bars underlying contracts between the brokerage and a client."

In short, the legal titleholder of the silver (MF Global) seems to have re-used the metal of customers, in a process known as hypothecation. Apparently legal, but definately dodgy. As, when MF Global went down due to increasing margin calls on dodgy financial calls, the creditors were left to sort out the opposing positions. Which causes a crisis in faith in the system itself:

Silver positions are being liquidated by COMEX traders after the MF Global fiasco uncovered the fragility of paper assets. ... The issue has been worsened as the CME Group has been unable to refund investor money even after a month after the MF Global filed for bankruptcy. Many traders have pulled out their money from the markets while many are advising others to close their paper trading accounts and instead focus on the physical metal itself.

Now, my view on this was clear: don't do that! The metal held on trust should have been simply held with one-to-one ties between the physics and the paper. Although it is common practice with other assets to loan out customer assets ( http://www.zerohedge.com/news/shadow-rehypothecation-infinte-leverage-and-why-breaking-tyrrany-ignorance-only-solution ) that shouldn't be done with gold or arguably with silver. Precious metal's special feature is its vote against the financial system, which it only preserves when done simply. Not in complexity.

Another point of favourite polemic from those days was whether the gold was ever really there in the first place. Many observers didn't really trust the repositories, a point which was underscored when LBMA announced a few years back that for the first time in around a century, it would start assaying bars at random. How do we know the bars that have been in there for decades are really bars at all?

Auditing technique such as point-in-time spot checks are good ones for flushing out long-lived frauds: tell me right now, on the spot, which is my gold! And then I'll count it. Maybe assay it too.

My idea here in the sense of open governance was to have well known representatives of the body public come in and also audit the stuff. Unlike auditors who were hopelessly conflicted, the five parties thesis said that users could be responsible for auditing the system, *iff* they were given the tools. Then, I too would be delighted that this idea has come of age:

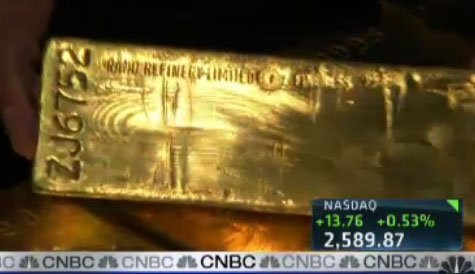

... we were delighted to see that after years of ridicule and provocations, the SPDR GLD ETF finally cracked and decided to do a wholesale PR campaign to comfort the investing public it actually does own its gold, by inviting none other than Bob Pisani in its secret warehouse which allegedly contains 40 million ounces of gold,

When an unbiased user goes in there and touches the gold, she has no particular incentive to do anything than report what is seen. All parties are incentivised to make it real. Or so we thought:

While the 4 minute PR campaign is enjoyable and we invite readers to watch it, what is amusing is that it is sure to set off another set of conspiracy theories. Here's the reason: amusingly the very gold bar that Pisani demonstrates so eagerly for the camera, Rand Refineries ZJ6752, is somehow, at last check, missing from the full barlist as posted daily by the GLD. Whose is it? Where did it go? When was this clip shot? Inquiring minds want to know...

Oops! Not their bar... At the direct level, the visit by none-other-than Bob Pisani proved *NOTHING* about the reserves of gold. It did show that the issuer SPDR GLD ETF felt that it could do a pretty marketing presentation, and that would substitute for real governance.

It did however prove everything about the five parties model and the wider question of open governance: The User closes the circle, if the circle exists and can be closed. Read the above post for the conspiracy theories and supporting analysis that the bar so displayed was not "in the vault" at all. I'll just leave you with this insight into open governance:

Our advice: please tell your client HSBC to open up its vault to general observation and assay: at that point, we are confident all conspiracies will end. Until then, be prepared to be retained by HSBC on a frequent basis as more and more ask themselves: what is really in that vault?

The users have called SPDR GLD ETF's bluff. Is there gold in the vaults? To me, this stinks, and raises a sell question over SPDR GLD. Just as you insist on real gold in your real issuance of Internet gold, don't go short on the governance. Insist on full open governance with five parties in control. Demand those reports, insist on independent visits.

Now, more than ever. Chances are good that everyone will see their governance model tested within the next 12 months.

Posted by iang at December 14, 2011 12:15 AM | TrackBack