June 26, 2018

Shocking trade in stolen UK passports (really??)

Readers in UK obviously don't read the blog, because the Daily Mail has just published the headline of ignorance:

Shocking trade in stolen UK passports: How gangs sell them for £2,500 – so criminals and terrorists can sneak in to the country

By TOM KELLY INVESTIGATIONS EDITOR IN ISTANBUL FOR THE DAILY MAIL

PUBLISHED: 22:43 BST, 24 June 2018 | UPDATED: 07:34 BST, 25 June 2018

Shocking? This trade has been going on since forever, but because it is in the interests of practically everyone to believe that ID documents are perfect, it doesn't make it past the editor's desk. Check the Identity Cost tag.The only news is that the price might have risen - £2500 is a lot more than the £1000 we are used to.

And in case anyone forgets, here's the rest of the Mail's shocking discovery of reality.

A disturbing trade in stolen British passports is exposed today by the Daily Mail.

Swiped by criminal gangs in Western Europe, they are flown to Istanbul or Athens for sale by people smugglers.

Security experts said owning a genuine British passport was like ‘winning the lottery’ for jihadis and criminals – allowing them to slip across borders undetected.

In response to the Mail’s findings, MPs called for action to address Britain’s ‘shocking vulnerability’ to potentially dangerous illegals.

Dozens of false documents seized by an organised crime unit in Greece, including hundreds of ID cards and scores of passports

Our investigation reveals that British citizens are selling their passports to be bought by migrants of similar appearance.

And fake EU identity cards that can be used to enter the UK are also being made to order within three days in the Balkans.

The Mail bought a UK passport for £2,500 from Abu Ahmad, a people-smuggling kingpin in Turkey. It had been stolen from a Milton Keynes man working in Brussels.

It was one of five passports that Ahmad, who is known as ‘The Doctor’, offered to the Mail.

The others included one stolen from an Oxford graduate visiting Paris and another taken from a 28-year-old Manchester woman who was on holiday in Spain.

Ahmad boasted that seven in ten of his clients succeed in duping immigration staff and making it to the UK.

He is on bail while he appeals against an eight-year sentence for spiriting thousands of migrants into Europe, including suspected jihadis. At its peak, his ‘business’ was bringing in £110,000 a month.

Europol, an EU police agency, warned yesterday that people smugglers operating in Turkey and Greece were ‘frequent’ offenders in the trade in black market documents, which is an ‘important enabler’ of organised crime.

Ahmad said all the passports he sold were genuine – otherwise they would be no use at border control.

They are either stolen or sold by their owners, who agree not to report them as missing for a few months, by which time they have been used by Ahmad’s customers.

He said: ‘Most British passports are stolen. Except if the passport was in the name of someone Arabic or Pakistani or something, that could have been sold.’

Ahmad said he had no qualms about profiting from stolen passports and, despite boasting he has smuggled thousands of people into Britain, insisted he was certain none of them were jihadis or criminals.

Abu Ahmad, who is known as ‘The Doctor’, helps smuggle people across the world by selling them stolen passports

But another Syrian immigrant in Turkey told the Mail at least two people Ahmad helped get into Europe were known Islamists operating in Damascus.

The German authorities were alerted about them after their arrival, he said.

Interpol, an international police agency, has a stolen and lost travel documents database, known as SLTD, which it says was searched more than 1.2billion times in the first nine months of 2016, providing 115,000 ‘hits’.

But on its website, it admits: ‘Interpol is not automatically notified of all passport thefts occurring worldwide, and the SLTD database is not connected to national lists of stolen or lost passports.

‘Despite the potential availability of the SLTD database, not all countries systematically search the database to determine whether an individual is using a fraudulent passport.’

For £7,000 Ahmad books his client a hotel room, gets them food and hands over a stolen passport. This is the full-service package, with the cheapest being just the passport for £2,500

In 2014, the head of the agency said just four in ten passports used for international flights were checked against the database.

Labour MP John Woodcock, a member of the Commons home affairs committee, said: ‘At a time when several hundred potentially highly dangerous jihadis have fled when Islamic State has been deposed it’s highly alarming to learn that this way of entering the UK illegally seems to be so readily available.’

Ed Davey, the Lib Dem home affairs spokesman, said: ‘Criminals who capitalise on the vulnerability of tourists and then profit off refugees and immigrants in desperate need of help must not be allowed to operate so freely.’

David Lowe, a former Special Branch counter-terrorism officer now based at Leeds Beckett University, said: ‘For terrorists and criminals getting a new passport is like winning the lottery.

‘It’s a significant concern with fighters coming from Islamic State or returning British fighters. Once you get in with somebody else’s passport you are very difficult to trace.’

One of the stolen passports used to help get people through passport control and across borders. The Daily Mail bought one from Ahmad in Istanbul for £2,500

Immigration minister Caroline Nokes said: ‘One hundred per cent of passports are inspected at the border.

‘Border Force officers are rigorously trained to prevent the holders of fraudulent documents from entering the country and between 2010 and March 2018, we denied entry to over 144,000 people.

‘Immigration Enforcement constantly monitors and identifies emerging threats in relation to the production and supply of false travel documents, including the use of the internet to facilitate the trade in passports and identity cards.

‘We have a range of interventions to target the criminals involved, including criminal prosecution of crime groups in the UK and overseas.’

June 25, 2018

FCA on Crypto: Just say no.

Because it's Sunday, I thought I'd write a missive on that favourite depressing topic, the current trend of the British nation to practice economic self-immolation. I speak of course of the FCA's letter to the CEO.

Some many may be bemused and think that this letter shows signs of progress. No such. What the letter literally is, is the publication of a hitherto secret order sent to CEOs of banks to not bank crypto.

The instruction was delivered some time ago. Verbally. And deniably. The banks knew it, the FCA knew it, but all denied it unless under condition of confidentiality or alcohol.

Which put the FCA, the banks, and Britain into considerable difficulties - the FCA could neither move forward to adjust because there was no position to adjust, the British banks could not bank crypto because they were under instruction, and the British crypto-using public either got screwed by the banks or they left the country for Europe and places further afield.

(Oddly, it turns out that Berlin is the major beneficiary here, but that's a salacious distraction.)

After some pressure as the 'star chamber' process of business policy, it transpires a week ago that the FCA has come out of the cold and issued the actual instruction in writing. This is now sufficient to replace the secret instruction, so it represents a movement of sorts. We can now at least openly debate it.

However the message has not changed. To understand this, one has to read the entire letter and also has to know quite a lot about banks, compliance and the fine art of nah-saying while appearing to be encouraging.

The tone is set early on:

CRYPTOASSETS AND FINANCIAL CRIMEAs evidence emerges of the scope for cryptoassets1 to be used for criminal purposes, I am writing regarding good practice for how banks handle the financial crime risks posed by these products.

There are many non-criminal motives for using cryptoassets.

It's all about financial crime. The assumption is that crypto is probably used for financial crime, and the banks' job is to stop that happening. Which would logically set a pretty high bar because (like money, which is also used for financial crime) the use of crypto (money) by customers is generally opaque to the bank. But banks are used to being the frontline soldiers in the war on finance, so they will not notice a change here.

The problem is of course that it simply doesn't work. The bank can't see what you are doing with crypto, so what to do? When the banks ask customers what they do with the money, costs sky rocket, but the quality of the information doesn't increase.

There is therefore only one equilibrium in this mathematical puzzle that the FCA has set the banks: Just say no. Shut down any account that uses crypto. Because we will hold you for it and we will insist on no failures.

Now, if it was just that, a dismal letter conflating crime with business, one could argue the toss. But the letter goes on. Here's the smoking gun:

Following a risk-based approach does not mean banks should approach all clients operating in these activities in the same way. Instead, we expect banks to recognise that the risk associated with different business relationships in a single broad category can vary, and to manage those risks appropriately.

The risk-based approach!

Once that comes into play, what the bank reads is that they are technically permitted to use crypto, but they are strictly liable if it goes wrong. Because they've been told to do their risk analysis, and they've done their risk analysis, and therefore the risks are analysed which conflates with reduced to zero.

Which means, they can only touch crypto if they know . This knowledge being full knowledge not that other long-running joke called KYC. Banks must know that the crypto is all and totally bona fide.

But they generally have no such tool over customers, because (a) they are bankers and if they had such a tool (b) they wouldn't be bankers, they would be customers.

(NB., to those who know their history, anglo-world banks used to know their customers' business quite well. But that went the way of the local branch manager and the dodo. It was all replaced by online, national computer networks, and now AIs that do not manifestly know anything other than how to spit out false positives. NB2 - this really only refers to the anglo world being UK, USA, AU, CAN, NZ and the smaller followers. Continental banking and other places follow a different path.)

Back to today. The upshot of the relationship for regulator-bank in the anglo world is this: "risk-based analysis" is code for "if you get it wrong, you're screwed." Which latter part is code for fines and so forth.

So what is the significance of this, other than the British policy of not doing crypto as a business line (something that Berlin, Gibraltar, Malta, Bermuda and others are smiling about)? It's actually much more devastating that one would think.

It's not about just crypto. As a society, we don't care about crypto more than as a toy for rich white boys to play at politics and make money without actually doing anything. Fun for them, soap opera for observers but the hard work is elsewhere.

It's not in the crypto - it's in the compliance. As I wrote elsewhere, banks in the anglo world and their regulators are locked in a deadly embrace of compliance. It has gotten to the point where all banking product is now driven by compliance, and not by customer service, or by opportunity, or by new product.

In that missive on Identity written for R3's member banks, I made a startling claim:

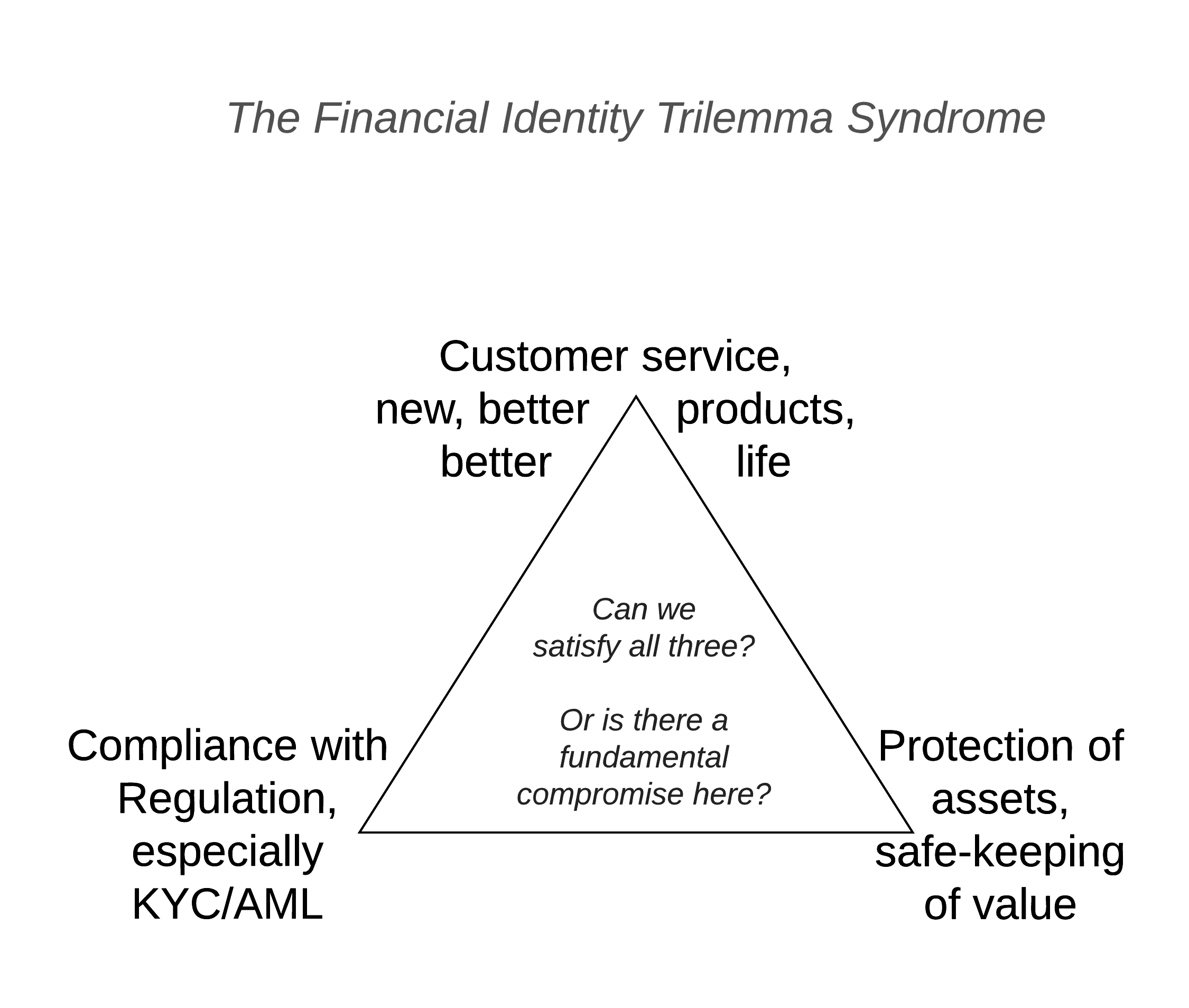

FITS – the Financial Identity Trilemma SyndromeIf you’re suffering from FITS, if might be because of compliance. As discussed at length in the White Paper on Identity, McKinsey has called out costs of compliance as growing at 20% year on year. Meanwhile, the compliance issue has boxed in and dumbed down the security, and reduced the quality of the customer service. This is not just an unpleasantness for customers, it’s a danger sign – if customers desert because of bad service, or banks shed to reduce risk of fines, then banks shrink, and in the current environment of delicate balance sheets, rising compliance costs and a recessionary economy, reduction in bank customer base is a life-threatening issue.

For those who are good with numbers, you'll pretty quickly realise that 20% is great if it is profits or revenues or margin or one of those positive numbers, but it's death if it is cost. And, compliance is *only a cost*. So, death.

Which led us to wonder how long this can go on?

(youtube, transcript) Cost to compliance now is about 30% I’ve heard, but you pick your own number. Who works at a bank? Nobody, okay. That’s probably good news. [laughs] Who’s got a bank account? I’ve got bad news: if you do the compounding, in seven years you won’t have a bank accounts, because all the banks will be out of money. If you compound 30% forward by 20%, in seven years all of the money is consumed on compliance.

As I salaciously said at a recent Mattereum event on Identity, the British banks have 7 years before they die. That's assuming a 30% compliance cost today and 20% year on year increase. You could pick 5% now and 10% by 2020 as Duff & Phelps did which perversely seems more realistic as if the load is now 30% then banks are already dead, we don't need to wait until 100%. Either way, there is gloom and doom however society looks at it.

Now these are stupid numbers and bloody stupid predictions. The regulators are going to kill all the banks? Nah... that can only be believed with compelling evidence.

The FCA letter to the CEO is that compelling evidence. The FCA has doubled down on compliance. They have now, I suspect, achieved their 20% increase in compliance costs for this year, because now the banks must double down and test all accounts against crypto-closure policy. More.

We are one year closer to banking Armageddon - thanks, FCA.

What can we see here? Two things. Firstly, it cannot go on. Even Mark Carney must know that burning the banking village to save it is going to put Britain into the mother of all recessions. So they have to back off sometime, but when will that be? If I had to guess, it will be when major clients in the City of London desert the British banks, because no other message is heard in Whitehall or Threadneedle St. C.f., Brexit. Business itself isn't really listened to, or in the immortal words of the British Foreign Secretary,

Secondly, is it universal? No. There is a glimmer of hope. The major British banks cannot do crypto because the costs are asymmetric. But for a crypto bank that is constructed from ground up, within the FCA's impossible recipe, the costs are manageable. Such a bank would basically impose the crypto-compliance costs over all, so all must be in crypto. An equilibrium available to a specialist bank, not any high street dinosaur.

You might call that a silver lining. I call it a disaster. The regulators are hell bent on destroying the British economy by adding 20% extra compliance burden every year - note that they haven't begun to survey their costs, nor the costs to society.

After the collapse there will be green shoots, and we should cheer? Shoot me now.

Frankly, the broken window fallacy would be better than that process - we should just topple the banks with crypto right now and get the pain over with, because a fast transition is better than the FCA smothering the banks with compliance love.

But, obviously, the mandarins in Whitehall think differently. Watch the next seven years to learn how British people live in interesting times.