October 12, 2014

In the Shadow of Central Banking

A recent IMF report on shadow banking places it at in excess of $70 trillion.

"Shadow banking can play a beneficial role as a complement to traditional banking by expanding access to credit or by supporting market liquidity, maturity transformation and risk sharing," the IMF said in the report. "It often, however, comes with bank-like risks, as seen during the 2007-08 global financial crisis."

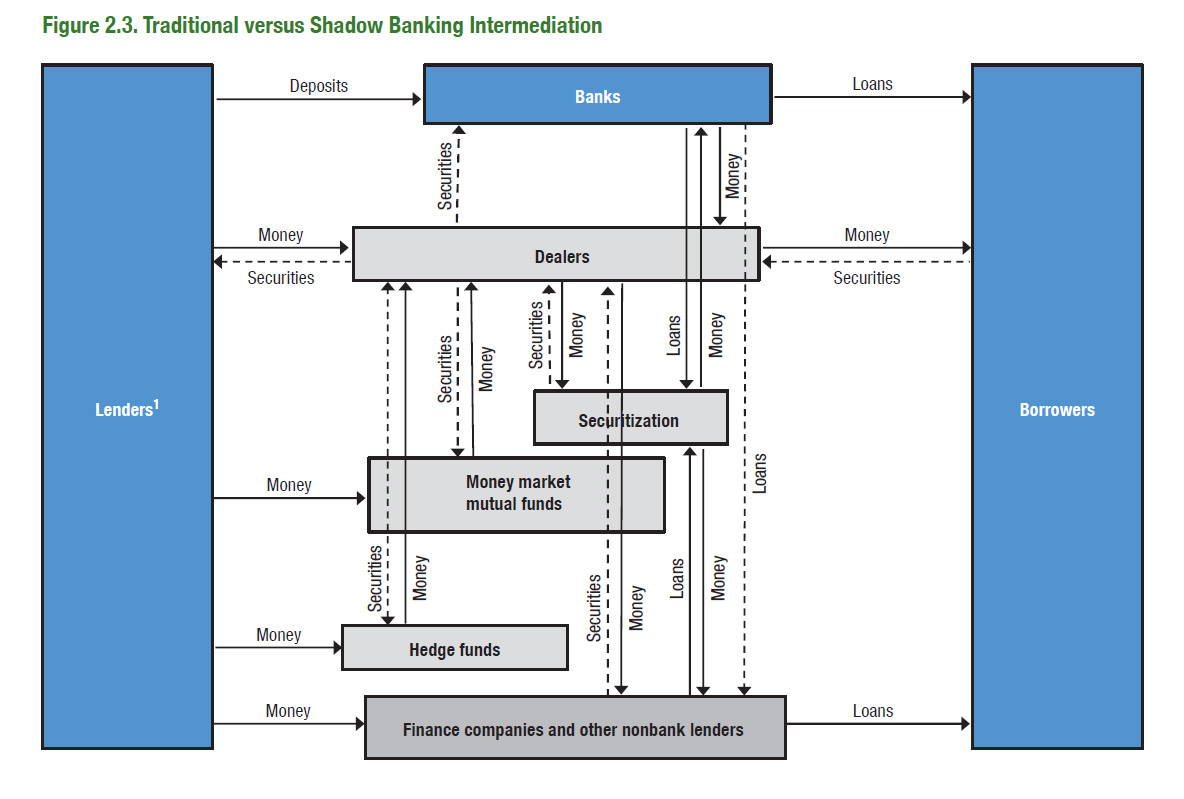

It's a concern, say the bankers, it keeps the likes of Jamie Dimon up at night. But, what is it? What is this thing called shadow banking? For that, the IMF report has a nice graphic:

Aha! It's the new stuff: securitization, hedge funds, Chinese 'wealth management products' etc. So what we have here is a genie that is out of the bottle. As described at length, the invention of securitization allows a shift from banking to markets which is unstoppable.

In theoretical essence, markets are more efficient than middlemen, although you'd be hard pressed to call either the markets or banking 'efficient' from recent history.

Either way, this genie is laughing and dancing. The finance industry had its three wishes, and now we're paying the cost.

Posted by iang at October 12, 2014 09:18 AMHi Ian,

Long time no see! How are things?? Lots has been going on here including Cmabridge University joining the Bitcoin Community with a newly formed Cryptographic Currency Society. Which brings me to my question...would you have the time to pay us a visit and give a presentation on digicash, egold or actually any aspect of cryptocurrency, just grace us with your presence and talk about any of the awesome topics you know so much about?

Freya