July 22, 2014

How Central Banking magnifies the Crisis and ensures Depression

he current times are fantastic opportunities for a new generation of economists to cut their teeth, albeit in studying the misery of us all. Here's some of that, cutting of teeth or gnashing, you decide. H/t to Arthur, here is the punchline from "Banks, government bonds, and default: What do the data say?" from Nicola Gennaioli, Alberto Martin, Stefano Rossi:

The transmission mechanismOur results support the notion that banks’ holdings of public bonds are an important transmission mechanism from sovereign defaults to bank lending. These findings are broadly consistent with the following narrative. Public bonds are very liquid assets (e.g. Holmstrom and Tirole 1998) that play a crucial role in banks’ everyday activities, like storing funds, posting collateral, or maintaining a cushion of safe assets (Bolton and Jeanne 2012, Gennaioli et al. 2014a). Because of this, banks hold a sizeable amount of government bonds in the course of their regular business activity, especially in less financially developed countries where there are fewer alternatives. When default strikes, banks experience losses on their public bonds and subsequently decrease their lending. During default episodes, moreover, some banks deliberately hold on to their risky public bonds while others accumulate even more bonds. This behaviour could reflect banks’ reaching for yield (Acharya and Steffen 2013), or it could be their response to government moral suasion or bailout guarantees (Livshits and Schoors 2009, Broner et al. 2014). Whatever its origin, this behaviour is largely concentrated in a set of large banks, and is associated with a further decrease in bank lending.

There you have it. In short human words, the need for banks to hold the bonds of their government becomes a limit on their lending activity. As they enter crisis (the banks, the government or the economy), the banks are incentivised to hold more bonds. As they hold more bonds, their lending decreases.

Reducing lending confirms the recession, and indicates why we now see full depression in Southern Europe.

I've oft ruminated on the failure of economics that is central banking; it works until it doesn't. Central banking works thusly:

- the government wants someone to hold their bonds.

- it needs a central bank to regulate the banks,

- to insist that the banks hold their bonds.

- The quid pro quo for this is that central banks will backstop the banks.

- So, happily, the government can now issue more bonds than is good for it,

- force the banks and itself into trouble, and

- pass the cost onto the public (inflation or bailouts).

Notice that part 7 -- the cost of central banking always ends up with the citizen through either bailout (taxpayer) or inflation (money-holder). One destroys the middle classes, the other penalises the poor through their cash holdings. (The rich know that the safe money is now in owning and running the banks, who win always because they are rarely forced into real bankruptcy.)

One thing that strikes from that is the history of banking (c.f. Dowd especially) suggests that the requirement to hold state bonds is what brought the end to free banking in the USA. Now fast forward to Europe, and what brought the end was banks and governments over-extended in a deadly embrace.

The common factor is the lack of ability to inflate. The individual states in the USA weren't able to issue their own dollar, because money was competitive. The individual states in Europe are likewise unable to inflate away their trouble, because they gave that up to ECB.

What's left is bailouts.

Postscript, adding the graph that Patrick refers to in comments:

Yes, and this bailout syndrome goes way back, long before 2008. You can read about the endless bailouts in the '70s in G. Edward Griffin's "Creature from Jekyll Island" (http://www.amazon.com/Creature-Jekyll-Island-Federal-Reserve/dp/091298645X/ref=sr_1_1?s=books&ie=UTF8&qid=1406030788&sr=1-1&keywords=creature+from+jekyll+island).

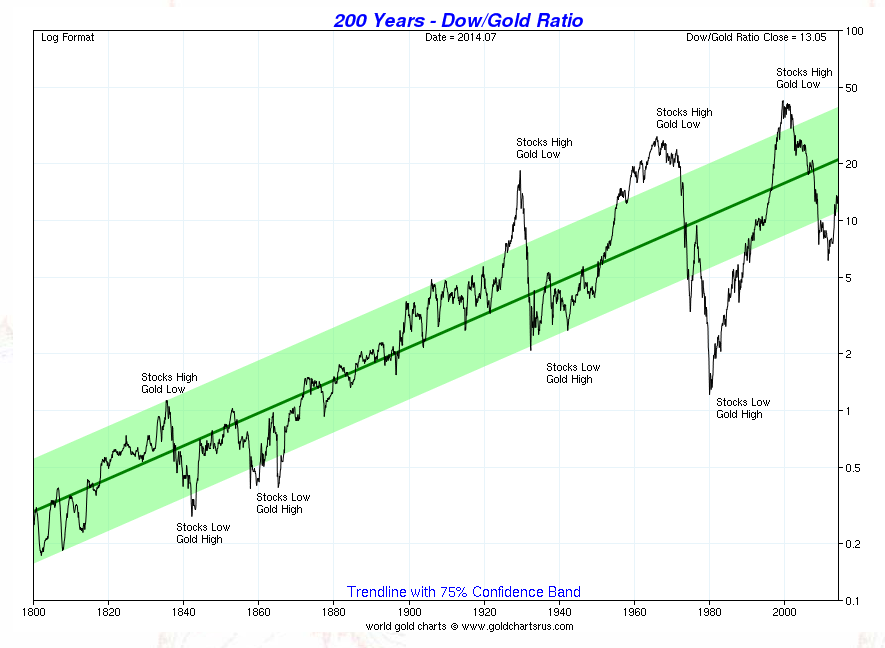

Also, take a look at the following chart of the Dow Jones measured in terms of gold:

http://www.sharelynx.com/chartstemp/DowGoldRatio.php

Note that's a logarithmic chart, so the huge swings you see there accurately reflect the real volatility.

If you scroll down to the second chart, you can see that 1913, i.e. the institution of the Fed, was a big turning point. The entire character of the chart changes after that point.

The Fed's monopoly on money financed all sorts of government misdeeds, starting primarily with the their involvement in World War I, and the subsequent booms and busts in the money supply have profoundly affected financial markets, leading to a cascade of alternating cycles of manic malinvestment followed by depressive corrections.

Also, by the looks of things, those cycles are getting larger, not smaller. It's like a self-amplifying feedback loop with no dampening factor whatsoever.

Just as a footnote, I once did a rough measurement of that central trendline, and it corresponds to a 2% compounded annual rate of increase.

So, very roughly speaking, the investments represented by the Dow Jones have tended to appreciate 2% per year against gold. Gold is a physical commodity whose purchasing power over millenia has been as constant (flat) as one can reasonably expect of any commodity. So the 2% rate of return is essentially a real rate of return in terms of actual purchasing power. I'm sure one could use other baskets as a denominator, but I doubt the 2% figure would change very much.

If there is some feedback loop leading to those lower lows in 1930 and 1980, it is important to note that no feedback loop can amplify to infinity. The laws of physics, and the x-axis itself, guarantee that the cycle *will* be broken. I think the deciding factor is the advent of free market money, along the lines of what Ian Grigg and others are working on.

Posted by: Patrick at July 22, 2014 08:12 AMJust on that last point:

>> If there is some feedback loop leading to those lower lows in 1930 and 1980, it is important to note that no feedback loop can amplify to infinity. The laws of physics, and the x-axis itself, guarantee that the cycle *will* be broken.

I strongly recommend readers to grab a copy of Peter Senge's _The Fifth Discipline_ which is how feedback loops work in business.

Posted by: (Iang) The Fifth Discipline by Peter Senge at July 22, 2014 08:47 AM