November 13, 2009

FC: better than freedom?

Better than freedom?Nov 12th 2009 | BAGHDAD

From The Economist print edition

Why Iraqis cherish their mobile phonesASKED to name the single biggest benefit of America’s invasion, many Iraqis fail to mention freedom or democracy but instead praise the advent of mobile phones, which were banned under Saddam Hussein. Many Iraqis seem to feel more liberated by them than by the prospect of elected resident government.

In the five years since the first network started up, the number of subscribers has soared to 20m (in a population of around 27m), while the electricity supply is hardly better than in Mr Hussein’s day....

Good news for them! It gets better:

During recent years of civil strife, when many stayed indoors, mobile phones were the lifeline. They also became a tool of commerce. Reluctant to risk their lives by visiting a bank, many subscribers transferred money to each other by passing on the serial numbers of scratch cards charged with credit, like gift vouchers. Recipients simply add the credit to their account or sell it on to shops that sell the numbers at a slight discount from the original. This impromptu market has turned mobile-phone credit into a quasi-currency, undermining the traditional informal hawala banking system.

Practically every financial cryptographer I know has made this observation. Phones can be used to ship money. Mobile minutes are a fantastic demand base for money. They've been traded at face value for a long time. And, visiting banks is dangerous in some contexts, something we rich fat&happy westerners often forget.

This is pure financial cryptography: the turning of a simple technical architecture based on some security (some crypto) into a network capable of moving value for people. If there is any doubt left...

The market’s growing size is making some bankers wonder if phone credit should be traded on a public exchange. This may not be practical, but more regulation would be welcome. ... Prostitutes get regular customers to send monthly retainers to their phones, earning them the nickname “scratch-card concubines”, while corrupt government officials ask citizens for $50 in phone credit to perform minor tasks.

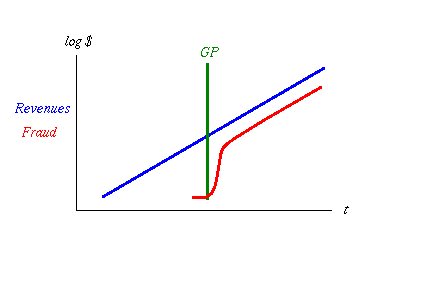

We got it all: markets to trade phone credit, crime, so we've crossed that GP thing, and booming trade where the worry-worts in government would normally blush and ban.

We got it all: markets to trade phone credit, crime, so we've crossed that GP thing, and booming trade where the worry-worts in government would normally blush and ban.

Of course, those same people will rant on about how this is promoting crime, and it must be banned.

Criminal rings are among the parallel currency’s busiest users. Kidnap gangs ask for ransom to be paid by text messages listing a hundred or more numbers of high-value phone cards. ... Viewed as cash substitutes, scratch cards have also drawn the attention of armed robbers. In one case, a gang emptied out the card storage of Iraq’s biggest mobile operator, Zain, which is based in neighbouring Kuwait.

Serious architects of money systems know that *all* such electronic systems also work to seriously track the crook (even the much-hyped DigiCash was not exactly as it seems). The notion that you can send a ransom over a phone is just press-headlines and FUD. Remember, the cell towers can track the phone bearer to 10m or so, so if you do that, it's because the police aren't doing their job.

Still, it remains popular political policy to shoot the messenger, as was done in Europe in the 1990s, and now is popular in other countries. But we've also learnt that when a need is big enough, even the normal worries are swept away:

Not to be left out of the bonanza, Iraq’s cash-strapped government now says it will sell a fourth mobile-operating licence, after raising $1.25 billion from each of the last three. That is less than its vast oil reserves promise to put into the state’s coffers but a lot easier to negotiate. And Baghdad is not the only place where mobile-phone commerce thrives. The UN says it has plans to deliver aid to Iraqi refugees in Syria in the same way.

Is the mobile phone better than freedom? Only when free enough to allow freedom to develop. In this case, financial cryptography is the general rubik, but economists would recognise the real linkage here: Free trade is freedom; the ability of Iraqis to avoid "going to the bank" when there's shooting outside is a life saver.

Literally, phone money saved their lives. In our fat&content western society, freed up payments won't save anyone's life, we're not in Mexico yet. But financial cryptography can shave a percentage point or two off of the price of *everything* because payments cost money and FC delivers those same things for a fraction of the costs.

And that you can take to the bank, or more importantly, back to the economy. Got a problem with growth? Install an FC plugin into your economy, and watch.

Posted by iang at November 13, 2009 03:29 PM | TrackBack