December 26, 2005

GP4.2 - Growth and Fraud - Case #2 - e-gold

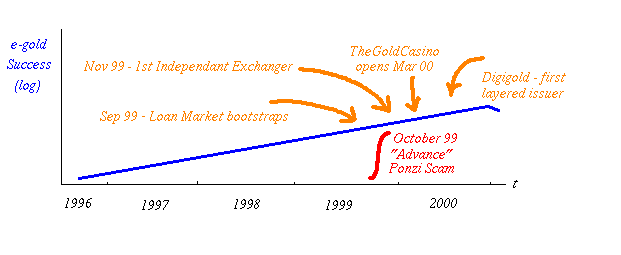

e-gold rocketed to success in late 1999 in a classical exponential growth curve that took everyone by surprise. Why the mathematics of growth continue to shock and awe has never been explained to me, but when you've just taken a technically bankrupt firm to a paper value of half a bill inside a year, such academic trivia has little import.

For all that, at one point on the curve from second half of 1999 to first half of 2000, the e-gold payment system experienced in rapid succession:

- rapidly growing exchange orders,

- the first independent exchanger, albeit small and unwelcome, but followed by dozens more

- a small group of vendors of supporting software services

- a casino and a lottery game

- investment from J.W.Zidar, later revealed as the owner/operator of a $72 million scam

- bootstrap super-issues over the top of e-gold

- a rash of fraudulent transactions from mainstream American online banks with swiss cheese ACH interfaces, and

- a rampage of scams!

Not necessarily in clear and consise order, and it should be recognised that those were turbulent, exciting and stressful times!

The arisal of scams on e-gold bears studying. The first one identified was called Advance and it was a classic Ponzi scheme. In this model, new members join, advancing funds for investment, but the the supposed investments are used to pay off old investors. As long as new investors come in, older investors could be paid off, and could then perpetuate the myth of great returns. Sometime the music stops, though, and then the scam falls apart.

fig 7. e-gold hits the GP point 1999 Q3

There is some definitional discussion due around whether the scams that hit e-gold were attacks on the system or the members, and much debate as to whether it is e-gold's responsibility to treat it or not. But for the present purposes, the result is clear: e-gold was worth stealing and thus GP was achieved. The security of the system (bog-standard SSL) was, during the time of interest, adequate to the task of stopping hackers from stealing directly; so fraudsters simply moved to stealing from each other.

Even as Advance was being unwound by e-gold, there were others in the pipeline. It is salutory that e-gold and other digital gold issuers took substantial and diverging steps to avoid the fate of scams. In contrast, the mutual funds industry hunkered down for a year or two ($3,000,000,000 in fines or so hardly scratched the surface), and now the signs are that it's business as usual - get your late orders in as slowly as you like! That's the difference between open governance and regulatory fiat, but that's the topic of other rants.

And finally, that old favourite: Phishing.

Posted by iang at December 26, 2005 07:57 PM | TrackBackMy favorite fraud using WebMoney was an attack on the users masquerading as an attack on the system:

A guy was selling (for webmoney) a program that supposedly cracked the system. It generated account numbers and corresponsing keys using a convoluted algorithm, and checked whether there's money in there. Sometimes, it succeeded. Some people got a lot more money, than what they invested. Those that didn't kept quiet. In reality, it was just gambling with very bad odds and a huge cut: the guy selling the program was using part of the earnings to place some money where the program found it.

As this scam was seriously damaging WebMoney's reputation, they fought it long and hard.

Ponzi schemes are done by governments as well: it's called mandatory pension insurance, with pension funds given government guarantees in exchange for keeping a huge chunk of their money in government bonds.

Posted by: Daniel A. Nagy at December 26, 2005 10:53 AMyes, webmoney is reliable !

Posted by: e-gold at January 24, 2007 09:33 PM