December 23, 2005

GP4.1 - Growth and Fraud - Case #1 - Mutual Funds

As the final part of this rant-in-four-parts, I'd like to leave you with a view that this is of relatively broad significance, if it works at all (previous parts: GP1, GP2, GP3). I attempt this by putting it in context of several case studies, which are chosen for their breadth as well as their topicality. In each, I try and draw out some of the implications of the theory, but I do not especially state when GP is reached. Rather, that is left as an exercise for the reader.

First off, the mutual funds scandal, one of the bigger frauds of recent times. This fraud happened because managers were in control of assets, but were not compensated as to how those assets performed. Rather, they are compensated according to the total size of assets. So not only do they have no incentive to perform, they are incentivised to not do so in a big way. This classical agency problem is also at the core of the recent Refco collapse. Brief digression on Refco:

Refco were offering, so the scuttlebut went, a facility to lose a bad order on demand. It worked this way. A dodgy manager could place, say, ten good orders into Refco, and then agree with her counterpart over at Refco to call one of them a bad debt. In a sense, a pre-ordained fake trade. The insider would then send the money off somewhere, and the two conspirators would split the profits. Meanwhile, the trade would get stuck on Refco's books as a bad debt and be dealt with some other time, including being traded back and forth for its tax advantages. Of course, over time this build up of bad debt would rise to strike, but by then it was someone else's problem.

So, how does all this happen? I suggest it is a case of post-GP insider fraud, something I first mused on when writing the testimony given by Jim before the U.S. Senate's finance subcommittee.

When a mutual fund first starts up it faces large upfront security costs. These are similar to those we discussed earlier, but this time it is more often termed governance, and they are more by regulatory fiat than the common sense of open governance. Included are separation of roles, audits, special purpose entities, accounting systems and best practices. We put all these in place before the fund gets off the ground, and we do it properly and in the best tradition of trying to make us look squeaky clean.

Add to that, the dramatic attention paid to every new fund! Who is it? Do they have a track record? Is there room for more funds, more ideas? Etc etc. Which results that the combined weight of all this attention both internal and external means that the security-to-value ratio is very high in the beginning.

Ludicrously high! But over time, much of the hard external scrutiny disappears as the reputation of the fund grows. New members hear it from old members, who are very happy with returns. Glowing reports are purchased from the press and rating agencies, who have nothing to fear and everything to gain. Insiders get used to believing in their impeccable reputation, which eventually becomes the axiom to be stressed, not the result of care and diligence. Brand replaces skepticism, and observation of the Bezzle-reducing kind is diverted and neutralised.

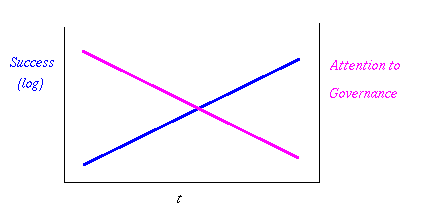

fig 6. Value Grows as Attention diminishes

And, of course, value under management climbs. From the first few millions, some funds reach into the billions. All the while, as value grows the internal attention to governance decreases. Inevitably, desire for profits means aggressive attention to controlling of costs. When directed at governance, a pure cost centre, the inevitable result is that the security-to-value ratio switches from ludicriously high to ludicrously low.

Why is it GP-apropos? Because the protection was put in place before it was needed. By the time it was needed, the protection had withered away and the fund no longer had the capability to govern itself.

All the mutual funds that were hit by market timing were older, established funds. Their reputation was impeccable, and that should be seen as a core symptom of the underlying syndrome - when the cat went away, the mice started to play.

Next case study: e-gold

Posted by iang at December 23, 2005 07:36 PM | TrackBackThe presence of unwritten rules and Non-Competitive Trade Barriers to Entry for new participants into a transactional system are the two human engineering signs that fraud is likely and suspect. The need to have an unofficial base of rules for transactions that require an interpretation outside the body of the rules themselves suggest fraud is present and is being conducted by the more senior members of the group that comprises the participants of the transactional system.

Take for example the status assigned by the SEC to a national rating agency. It implies that the standards and usage of the information provided by this entity is clear cut and easily explained, but the unwritten rules determine the real effect not the written rules. The same can be said of any entity that governs or assist in governance where Non-competitive trade barriers to entry exist. NTBs are there to protect a monopoly nothing more which means there are secrets and unregistered usage events that take from unequal participates and ingratiate the more powerful entities. The Rocco labyrinth of regulations compounded by the autoimmunization via software increases the frequency of the fraud and the dollar amount.

For example the systemic failure of an online gold currency increases daily due the failure to implement satisfactory governance models. The phony organization that rates digital and gold currencies fails to address the shortfall in audited reports of the actual backing of gold to the issuance and in turn has not the means of validating the activities of the issuers.

Another tell tail sign that fraud is present is the preponderance of blame rest on the weaker parties to prove the more powerful parties have injured them. The lack of an even playing field due to the assumption that the interest of the stronger party serves the greater good evades logic. We have constructed within the online community a Victorian regime of politically correct morality that allows the unbridled pillaging of the user base by the larger party for the greater good. This privilege has been assigned because the core of Western ideology is that we want something for nothing, a free ride. By acting in a so called arena of cooperation we have deferred our obligation to align our own self interest with others that share the same interest and amalgamated and polarized the true greater good for one of a lesser variety. We have made ourselves willing participants in tyranny. Merry Christmas friends of the gulag of self incarceration.

Posted by: Jim Nesfield at December 24, 2005 10:34 AM