July 25, 2018

Zooko buys Groceries...

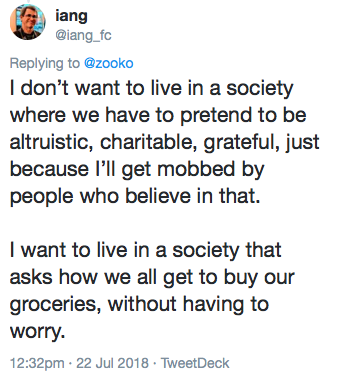

Zooko's tweet got me thinking, and it wasn't the flood of rejection he received.

I have been in that state, and I knew exactly what he meant. Been there, done that experience where you have to add each item, you have to shop for value, drop the things you want, and live on rice & beans.

I have been in that state, and I knew exactly what he meant. Been there, done that experience where you have to add each item, you have to shop for value, drop the things you want, and live on rice & beans.

Like billions of people.

Let me share an anecdote. Once upon a time I lived in Amsterdam. We had a sort of student or groupie house with some of us on the ground floor apartment and some of us on the next floor up. It was one of those places where the crazy landlady wanted crazy non-locals because we paid in cash and didn’t cause trouble.

My startup had just failed - in 1998 nobody wanted to issue hard cryptographically-protected secure instruments that could describe any money at all. Go figure. But those weren’t my worries then, what I was worried about then was … money.

Of the sort that purchased groceries, not the sort that the cypherpunks dreamed of and had but didn’t have. I would take the money to the grocery store and buy stuff. It was my job to do chilli con carne once in a while, like every few weeks. The money was someone else’s. Therefore my actual job was like taking a little money to the grocery store, buying 6 cans of tomatoes, 3 cans of beans, 1kg of minced meat, 3 chillies, onions and a lot of rice. Then cooking it and serving it.

That could feed about 5 adults for about 4 days.

That could feed about 5 adults for about 4 days.

For about 6 months I was in this state of poverty. It wasn’t the first time, nor the last, nor the worst - but it meant several things. I really had to watch the money. And wash clothes and iron shirts and cook chilli con carne and feed the group. I couldn’t make decisions because I couldn’t afford to make decisions. I couldn’t vary the menu because that was the cheapest.

Until I picked up a contract doing "requirements" for a local smart card money firm, I was stuck in this state. Every week or two, one of the guys from upstairs would invite me to the Bagel's 'n Beans (I think it was called) at the corner and we'd do breakfast in the sunshine and talk about financial cryptography and how to issue eCash and how to save the planet. Then he’d pay, and he’d go off to work because his startup hadn’t collapsed yet, and he still had a paycheck.

I was very conscious of the fact that if I hadn't had good friends, I'd be screwed. I was basically living for free while they were working their day jobs. It's hard to explain to those who have never faced it but there is a special hell for those who've had good paying jobs and then they get shut out. Of course, this happens to millions or billions, I'm not special.

The guy who liked Bagels was @zooko. Ever since that period I've tried to invite my poorer friends. Money didn’t matter, except when it did. Money was for living, not for making. Money was for doing, not for counting.

And I have thought a lot about what that time meant to me. It was that experience, and later experiences that led me to understand that the fabric of society isn't commerce, it isn't capitalism, it isn't profit and it very much isn't the dollar or the euro or the yen. The fabric of society is relationships. I didn't know it then, but I slowly found myself in the search for community. Not because I needed it, or not only, but because I thought that in community was the answer.

To the problem, and in 2008 I found myself again in deep poverty in the rich country of Austria. This time I had a job doing community auditing, which worked out at about €1 per hour, comfortably well below the poverty line, but alive. But, while we were building that community, we were watching the world’s financial community get into gridlock. Banks failing, countries on the verge, etc.

Since around 2000 - the dotcom crash - a lot of us had expected a real hard recession. It never happened, and we were mystified. Then in 2008 the answer was revealed. The man they called the magician, Alan Greenspan, had led bailout after bailout. Not of banks, but of the entire world system: the dotcom crash, 9/11, mutual funds scandal, fannie mae, something else... had all been rewarded with monstrous injections in liquidity. The banks or Alan Greenspan or someone had turned the entire western financial system into a bubble or a Ponzi or something.

And this last decade has been the mother of all bailouts - Quantitative Easing is nothing more than a gift to the financial system.

The problem I'm looking at then takes on a new aspect. What happens when the mother of all bubbles pops? When, not only can we not afford the groceries, but when there aren’t any grocery stores? We know something of this from Greece, from Puerto Rico, from Venezuela. How is it that people survive?

I knew it was relationship but I didn't know how. I knew people would save people, but how? My experiences in Amsterdam and Vienna and a few other episodes gave me no clear pattern - I knew that people saved people, but who, when and why in each circumstance?

Until, after a few more years skidding along the planetary row I found the how in Kenya - the chamas. It wasn’t that Kenyans were smarter than the westerners (they can be, and they’re definitely smarter than NGOs and aid workers who come to help) but it was clearer that there were two environmental factors that led them to work smarter, better, safer: poverty and corruption. It was out of these twin forces - I theorise - that they augmented their family and local trust lines into chamas.

Finding the how was pretty exciting. It was the lightbulb moment - the Eureka thing. Enough for me to quit my really safe and boring job in Australia and go to Kenya to build the first generation of chamapesa. It wasn’t because our technology spoke to chamas and chamas listened. It wasn’t because I loved Africa and the people were wonderful, it wasn’t because the business plan gasped an exponential curve to the moon. And it wasn’t because we could put a billion Africans on the blockchain, or a million blockchains on Africans.

It was because here was the solution, to everything I had not been able to work out before.

Like Zooko and a billion other people I’d spent many years in the grocery accounting trap. Like Zooko and millions of other people I’d lived the life of intelligent comfortable wealth and didn’t really care how much things cost.

Like Zooko and a billion other people I’d spent many years in the grocery accounting trap. Like Zooko and millions of other people I’d lived the life of intelligent comfortable wealth and didn’t really care how much things cost.

But like Zooko and a much smaller group of people, I've lived both those lives. That shock of poverty was burnt into our rich, educated privileged brains. And it matters. It drives us. It owns us, it changes us. I went to Kenya not for them but for all of us. To be nauseous, Chamapesa is our plan to get everyone to the grocery store so they don't care about the cost. And it is the rich west as well as the entrepreneurial Africans who'll need this.

So when Zooko posts on his experiences, and gets attacked for lack of humility or lack of gratefulness, I understand the angst that these people have, but honestly, they’ve missed the point. Having lived on both sides of the tracks, it isn’t gratefulness or humility or charity that we find or care for or should exhibit, it is clarity of thought.

And this is where we separate from those in Silicon Valley or the NGO armies or the twitter social justice warriors or regulators or other oligopolists. They’ll never understand because those people have only lived on one side of the tracks.

You can't "fight poverty" when you work for a family wealth fund. You can't "save the poor" when you live in Silicon Valley and whiteboards & google are the extent of your knowledge. You can't blockchain your way to understanding. You can't "bank the unbanked" when your entire worldview is driven by the World Bank. You can't "give charitably" and expect that money to be spent wisely by those who receive charitably.

You get your degree in poverty by living it, not by going to University and studying IMF reports. So when Zooko exhibits his particular penchant for unfiltered thought, it is not going to fit in with people's polite ways of ignoring problems - humility, gratefulness, charity are all comforting techniques to avoid the problem.

The problem that Zooko is being daily reminded of and is highlighting to a de-sensitised readership is this: at some point poverty becomes a trap such that no amount of normal or routine activity can extract you out of it. Only a serious and literally life-changing intervention can fix that problem.

And here's where I can add: chamas are the routine & normal activity that can address the trap, because they were designed to do exactly that. Which is a solution available to some, and not to others. We had it in Amsterdam in some pre-formative sense. The long term outlook for those with access to these societal techniques is far better than those without. Working to a stronger society then is why I'm working on chamas, with Africans, and not on blockchain with silicon valley types.

I understand that the cost of that is I will be called all sorts of things. But, in this game, it is more important to have clarity of thought than to be liked.