October 22, 2015

Iceland puts more bankers in jail... what's your solution to the financial crisis?

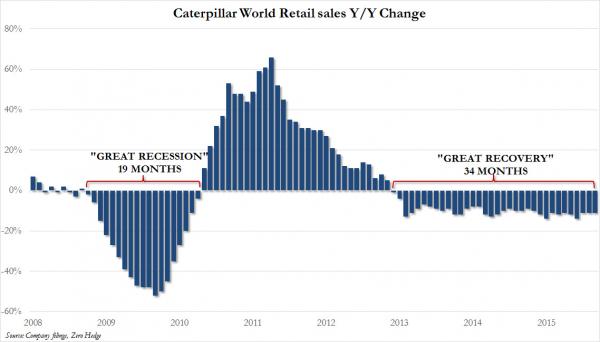

In the crisis that just won't go away - we're effectively in depression but no politician can stay elected on that platform - one of the most watched countries is Iceland.

Iceland sentences 26 bankers to a combined 74 years in prison James Woods October 21, 2015 Unlike the Obama administration, Iceland is focusing on prosecuting the CEOs rather than the low-level traders.In a move that would make many capitalists' head explode if it ever happened here, Iceland just sentenced their 26th banker to prison for their part in the 2008 financial collapse.

In two separate Icelandic Supreme Court and Reykjavik District Court rulings, five top bankers from Landsbankinn and Kaupping ó the two largest banks in the country ó were found guilty of market manipulation, embezzlement, and breach of fiduciary duties. Most of those convicted have been sentenced to prison for two to five years. The maximum penalty for financial crimes in Iceland is six years, although their Supreme Court is currently hearing arguments to consider expanding sentences beyond the six year maximum.

Now, my argument here is the same as with the audit cycle: if so much was so wrong, surely some bankers in USA and Europe should have been prosecuted and put in jail even by accident?

But, no, nothing. A few desultory insider trading hits, but on the whole, a completely clean pass for the major banks. Coupled with direct bankrupcy bailouts, and the follow-on enormous bailout of QE* which transferred capital into the banks under deception plan of "re-inflating industry", we have a rather unfortunate situation:

No punishment means no sin, right?

It is no wonder that the public at large are unhappy with banking in general and are willing to entertain such way out ideas as blockchain. Credibility is a huge issue:

When Iceland's President, Olafur Ragnar Grimmson was asked how the country managed to recover from the global financial disaster, he famously replied,"We were wise enough not to follow the traditional prevailing orthodoxies of the Western financial world in the last 30 years. We introduced currency controls, we let the banks fail, we provided support for the poor, and we didnít introduce austerity measures like you're seeing in Europe."

A great time to be an economic historian. A middling time to be an economist. Terrible time to be a regulator?

Posted by iang at October 22, 2015 06:54 AM