June 12, 2016

Where is the Contract? - a short history of the contract in Financial Cryptography systems

(Editor's note: Dates are approximate. Written in May of 2014 as an educational presentation to lawyers, notes forgotten until now. Freshened 2016.09.11.)

Where is the contract? This is a question that has bemused the legal fraternity, bewitched the regulator, and sent the tech community down the proverbial garden path. Let's track it down.

Within the financial cryptography community, we have seen the discussion of contracts in approximately these ways:

- Smart Contracts, as performance machines with money ,

- Ricardian Contract which captures the writings of an agreement ,

- Compositions: of elements such as the "offer and acceptance" agreement into a Russian Doll Contracts pattern, or of clause-code pairs, or of split contract constructions.

Let's look at each in turn.

a. Performance

a(i) Nick Szabo theorised the notion of smart contracts as far back as 1994. His design postulated the ability of our emerging financial cryptography technology to automate the performance of human agreements within computer programs that also handled money. That is, they are computer programs that manage performance of a contract with little or less human intervention.

At an analogous level at least, smart contracts are all around. So much of the performance of contracts is now built into the online services of corporations that we can't even count them anymore. Yet these corporate engines of performance were written once then left running forever, whereas Szabo's notion went a step further: he suggested smart contracts as more of a general service to everyone: your contractual-programmer wrote the smart contract and then plugged it into the stack, or the service or the cloud. Users would then come along and interact with this machine, to get services.

a(ii). Bitcoin. In 2009 Bitcoin deployed a limited form of Smart Contracts in an open service or cloud setting called the blockchain. This capability was almost a side-effect of a versatile payments transaction of smart contracts. After author Satoshi Nakamoto left, the power of smart contracts was reduced in scope somewhat due to security concerns.

To date, success has been limited to simple uses such as Multisig which provides a separation of concerns governance pattern by allowing multiple signers to release funds.

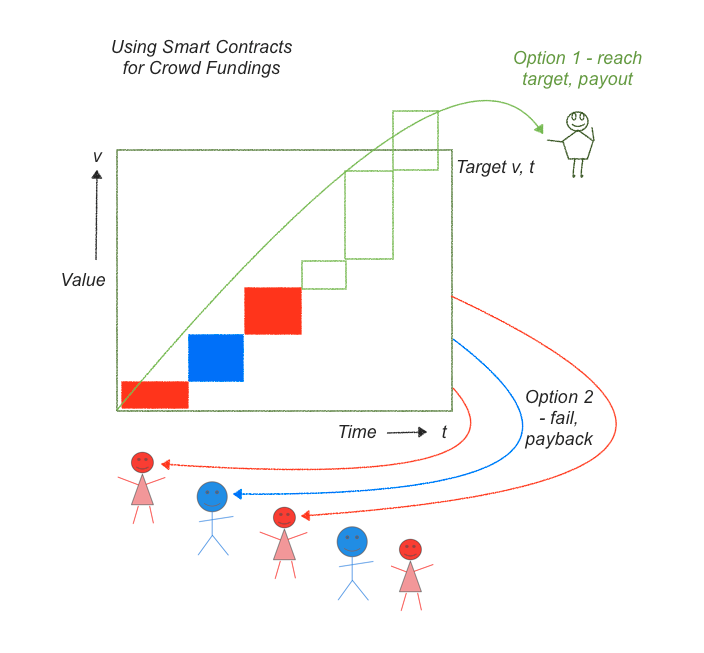

If we look at the above graphic we can see a fairly complicated story that we can now reduce into one smart contract. In a crowd funding, a person will propose a project. Many people will contribute to a pot of money for that project until a particular date. At that date, we have to decide whether the pot of money is enough to properly fund the project and if so, send over the funds. If not, return the funds.

To code this up, the smart contract has to do these steps:

- describe the project, including an target value v and a strike date t.

- collect and protect contributions (red, blue, green boxes)

- on the strike date /t/, count the total, and decide on option 1 or 2:

- if the contributions reach the amount, pay all over to owner (green arc), else

- if the contributions do not exceed the target v, pay them all back to funders (red and blue arcs).

A new service called Lighthouse now offers crowdfunding but keep your eyes open for crowdfunding in Ethereum as their smart contracts are more powerful.

b. Writings of the Contract

Back in 1996, as part of a startup doing bond trading on the net, I created a method to bring a classical 'paper' contract into touch with a digital accounting system such as cryptocurrencies. The form, which became known as the Ricardian Contract, was readily usable for anything that you could put into a written contract, beyond its original notion of bonds.

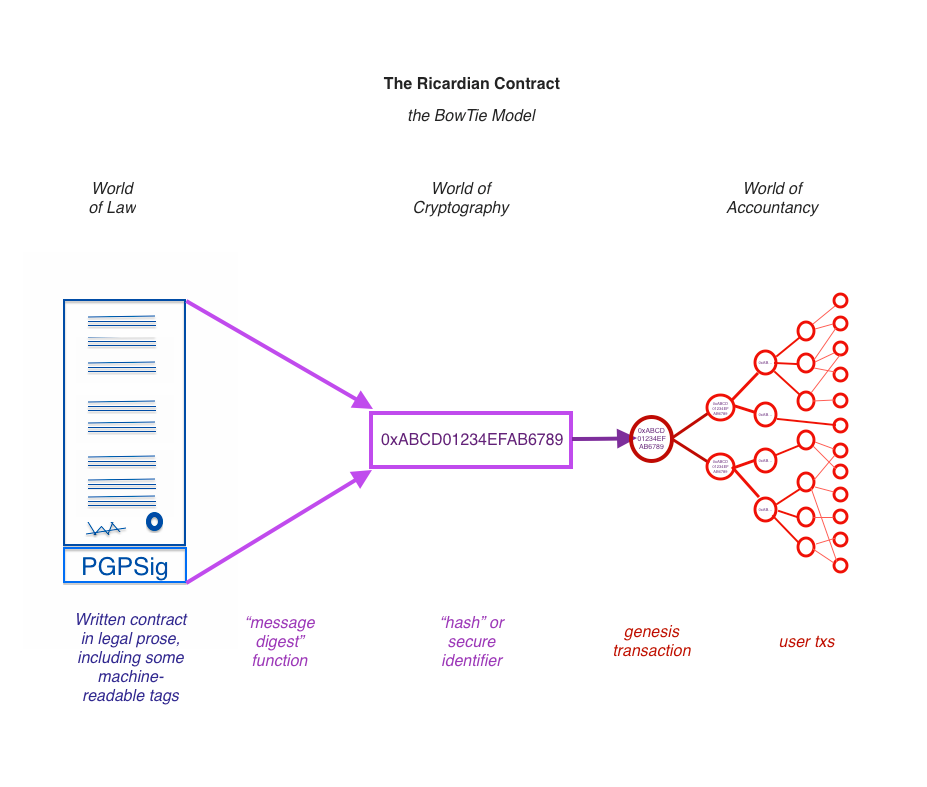

In short: write a standard contract such as a bond. Insert some machine-readable tags that would include parties, amounts, dates, etc that the program also needed to display. Then sign the document using a cleartext digital signature, one that preserves the essence as a human-readable contract. OpenPGP works well for that. This document can be seen on the left of this bow-tie diagram.

Then - hash the document using a cryptographic message digest function that creates a one-for-one identifier for the contract, as seen in the middle. Put this identifier into every transaction to lock in which instrument we're paying back and forth. As the transactions start from one genesis transaction and then fan out to many transactions, all of them including the Ricardian hash, with many users, this is shown in the right hand part of the bow-tie.

See 2004 paper and wikipedia page on the Ricardian contract. We have then a contract form that is readable by person and machine, and can be locked into every transaction - from the genesis transaction, value trickles out to all others.

The Ricardian Contract is now emerging in the Bitcoin world. Enough businesses are looking at the possibilities of doing settlement and are discovering what I found in 1996 - we need a secure way to lock tangible writings of a contract on to the blockchain. A highlight might be NASDAQ's recent announcements, and Coinprism's recent work with OpenAssets project [1, 2, 3], and some of the 2nd generation projects have incorporated it without much fuss.

c. Composition

c(i). Around 2006 Chris Odom built OpenTransactions, a cryptocurrency system that extended Ricardian Contract beyond issuance. The author found:

"While these contracts are simply signed-XML files, they can be nested like russian dolls, and they have turned out to become the critical building block of the entire Open Transactions library. Most objects in the library are derived, somehow, from OTContract. The messages are contracts. The datafiles are contracts. The ledgers are contracts. The payment plans are contracts. The markets and trades are all contracts. Etc.I originally implemented contracts solely for the issuing, but they have really turned out to have become central to everything else in the library."

In effect Chris Odom built an agent-based system using the Ricardian Contract to communicate all its parameters and messages within and between its agents. He also experimented with Smart Contracts, but I think they were a server-upload model.

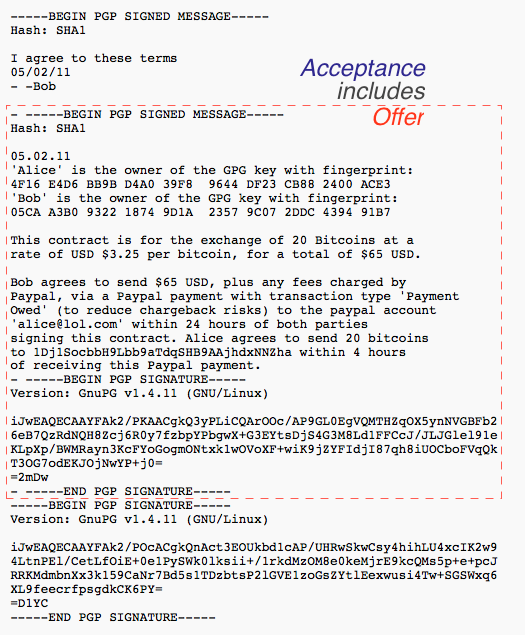

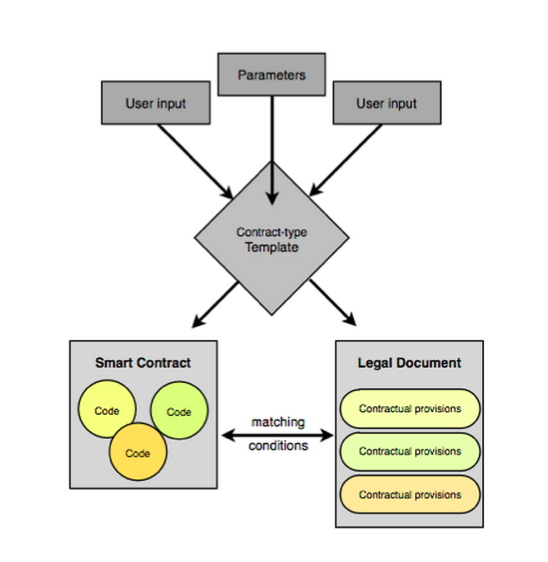

c(ii). CommonAccord construct small units containing matching smart code and prose clauses, and then compose these into full contracts using the browser. Once composed, the result can be read, verified and hashed a la Ricardian Contracts, and performed a la smart contracts.

c(iii) Let's consider person to person trading. With face-to-face trades, the contract is easy. With mail order it is harder, as we have to identify each components, follow a journey, and keep the paper work. With the Internet it is even worse because there is no paperwork, it's all pieces of digital data that might be displayed, might be changed, might be lost.

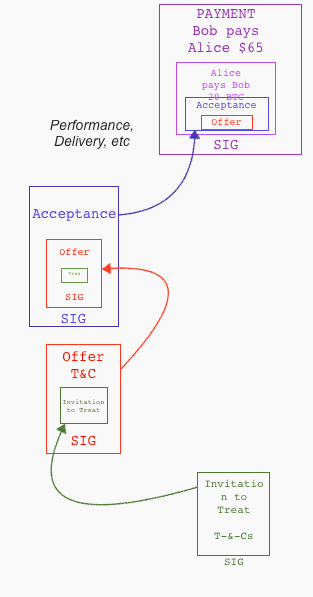

Shifting forward to 2014 and OpenBazaar decided to create a version of eBay or Amazon and put it onto the Bitcoin blockchain. To handle the formation of the contract between people distant and anonymous, they make each component into a Ricardian Contract, and place each one inside the succeeding component until we get to the end.

Let's review the elements of a contract in a cycle:

Let's review the elements of a contract in a cycle:

✓ Invitation to treat is found on blockchain similar to web page.

✓ offer by buyer

✓ acceptance by merchant

✓ (performance...)

✓ payment (multisig partner controls the money)

The Ricardian Contract finds itself as individual elements in the formation of the wider contract formation around a purchase. In each step, the prior step is included within the current contractual document. Like the lego blocks above, we can create a bigger contract by building on top of smaller components, thus implementing the trade cycle into Chris Odom's vision of Russian Dolls.

Conclusion

In conclusion, the question of the moment was:

Where is the contract?

So far, as far as the technology field sees it, in three areas:

- as performance - the Smart Contract

- as writing - the Ricardian Contract

- as composition - elements packaged into Russian Dolls, clause-code pairs and convergance as split contracts.

I see the future as convergence of these primary ideas: the parts or views we call smart & legal contracts will complement each other and grow together, being combined as elements into fuller agreements between people.

For those who think nothing much has changed in the world of contracts for a century or more, I say this: We live in interesting times!

(Editor's reminder: Written in May of 2014, and the convergence notion fed straight into "The Sum of all Chains".)

Posted by iang at June 12, 2016 07:35 PM