April 05, 2015

Yanis Varoufakis proposes Greek tax receipts in Ricardian Contracts on a blockchain

The answer is yes: They can create their own payment system backed by future taxes and denominated in euros. Moreover, they could use a Bitcoin-like algorithm in order to make the system transparent, efficient and transactions-cost-free. Let's call this system FT-coin; with FT standing for... Future Taxes.FT-coin could work as follows:

- You pay, say, €1000 to buy 1 FT-coin from a national Treasury's website (Spain, Italy, Ireland etc. would run their separate FT-coin markets) under a contract that binds the national Treasury: (a) to redeem your FT-coin for €1000 at any time or (b) to accept your FT-coin two years after it was issued as payment that extinguishes, say, €1500 worth of taxes.

- Each FT-coin is time stamped i.e. in its code the date of issue is contained and can be used to check that it is not used to extinguish taxes before two years have passed.

- Every year (after the system has been operating for at least two years) the Treasury issues a new batch of FT-coins to replace the ones that have been extinguished (as taxpayers use them, two years after the system's inauguration, to pay their taxes) on the understanding that the nominal value of the total number of FT-coins in circulation does not exceed a certain percentage of GDP (e.g. 10% of nominal GDP so that there is no danger that, if all FT-coins are redeemed simultaneously, the government will end up, during that year, with no taxes).

That first bullet point (my emphasis) is a legal issuance of new value, a.k.a., a bond, a.k.a. a contract of issuance. The offering concept is the same as the tally sticks of old - selling the pre-payment of taxes at a discount, the technicalities are simply how we get a legal contract into a digital framework that accounts for many similar values.

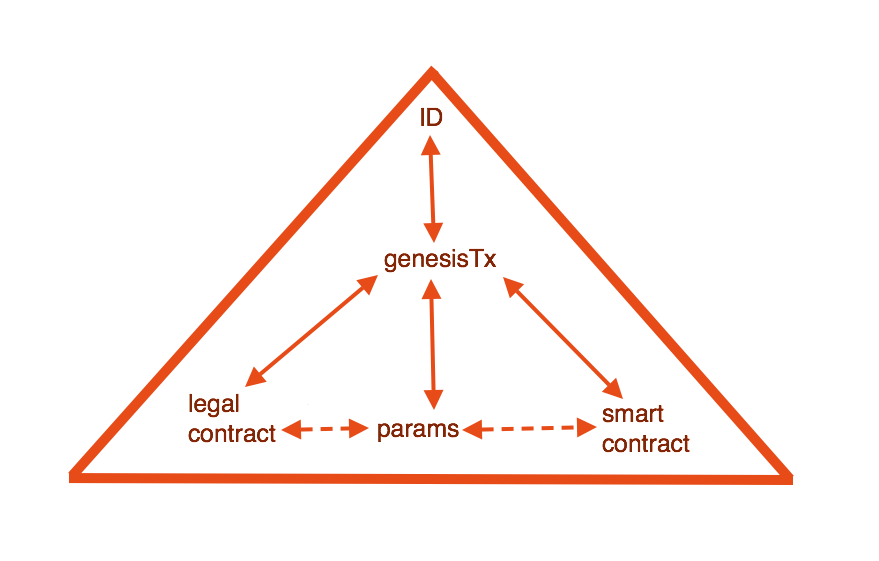

Because it's a contract in law as opposed to say a smartcontract, we need a system that can handle legal contracts. In essence, this is the Ricardian Contract -- a device that takes a human prose and encapsulates it into a hard computer-readable and human-readable document, then gives you a unique identifier in order to allow a technical system of issuance such as Bitcoin to do its job.

We're not there yet - Bitcoin directly isn't good enough, as Bitcoin is only "the one" BTC and therefore has no need to describe another. Hence no contract.

But the newer "generation 2.0" systems are more capable of including the Ricardian Contract form, and some do already while others can do so with minimal tweaking. This means that if Yanis Varoufakis is serious about his ideas, and given recent news from say IBM, there is no reason not to be, he'll be looking at a generation 2.0 system such as those described at WebFunds.

For Bitcoin itself, all is not lost, but it's more of a future deliverable: variants are looking at it but I have no definite information on that. However, there is no doubt that this will come, as Yanis Varoufakis is not the first. At least half the corporate and big players out there say "we can't use Bitcoin because it lacks a contract of issuance" or words to effect.

Posted by iang at April 5, 2015 09:04 PM