March 09, 2015

Auditors grow a pair - Heta Bank to be wound up after external audit found a hole

Maybe, after many long years, something has finally happened in the sleepy audit world:

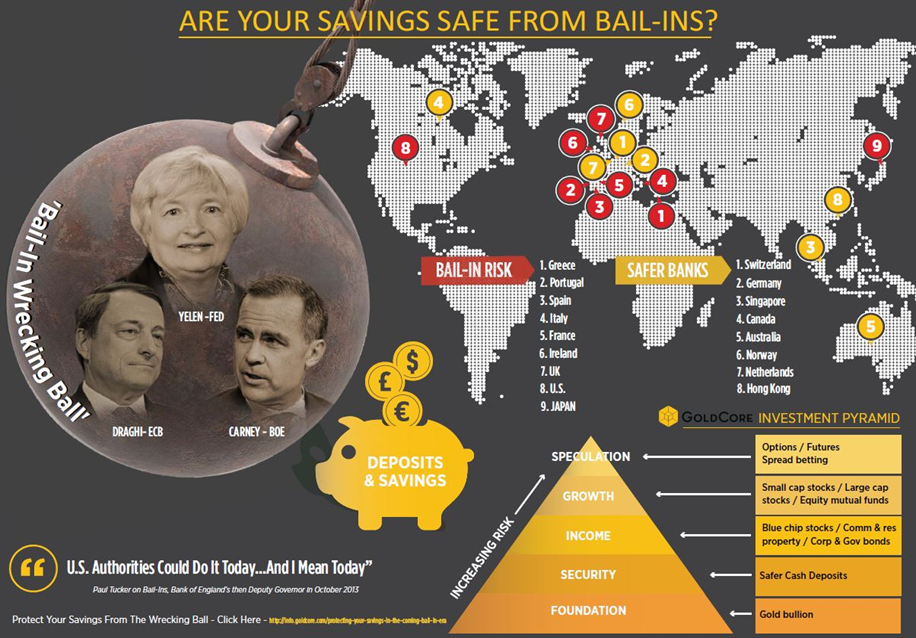

The rating action follows the decision of the Austrian Financial Market Authority (FMA) on 1 March 2015 to initiate resolution measures on Heta Asset Resolution AG (wind-down entity of former Hypo-Alpe-Adria), in accordance with the Federal Banking Restructuring and Resolution Act (BaSAG). BaSAG is the national implementation law of the European Bank Recovery and Resolution Directive (BRRD), effective since 1 January 2015. The FMA also imposed a temporary payment moratorium on Heta's liabilities until 31 May 2016. This follows the disclosure of Heta's recent asset review by external auditors, which indicated an additional shortfall of assets of up to EUR7.6 billion, compared to the EUR4 billion expected before.

Is this an outlier? Response to the worst cut of them all, indifference? Austrian values? An accident? We'll have to wait and see - for now, I'm happy to signal that the drought has ended:

What is also perhaps interesting is the painful causality of the new world of bank guarantees. Because (allmost of) the governments have now passed legislation-on-the-sly to wind back the 100 year rein of complete backstopping and depositor guarantees, the government of Austria declares itself clean hands.

Carinthia provides a statutory deficiency guarantee on a very high portion of Heta's senior debt; the total guarantees are equivalent to nearly EUR10.2 billion, or nearly five times the state's 2014 operating revenue.

Alley-oops! Not so fast, Austria, you may be able to ditch a bank, but an entire province is another thing. So this is Cyprus all over again -- which went down because the rule there was that banks had to hold Greek debt. When that went into haircut mode, Cyprus sunk.

This is no small thing. It is somewhat of a surprise that the media isn't in overload mode. Maybe the perception is that all the banks are in trouble, and the collapse of one is already factored into media finances? Who knows. But one thing we know, many billions' worth of assets held by other parties are now turning to mush.

Who holds this stuff? Austrian banks, and ...

German banks yesterday also emerged as major Heta bondholders. Dexia's Dexia Kommunalbank Deutschland AG said it owns 395 million euros of Heta bonds and will take an unspecified charge in the first quarter. Deutsche Pfandbriefbank AG also owns 395 million euros of Heta bonds and said it will write them down by 120 million euros, cutting its expected pretax profit by two-thirds.NRW Bank confirmed it owned Heta bonds, declining to specify the size of its exposure. WDR TV station reported the bank owns 276 million euros of them.

German banks! As an unintended consequence of cleaning up their exposure to Greek tissue paper, the Germans had loaded up on 100%-risk-adjusted Austrian wood. Only to fall to ... Swiss peg collapse. Which fell to ...

Can you say, contagion?

Posted by iang at March 9, 2015 12:33 AMNot SIFIs but PIFIs - a bank bailout lesson from Austria

http://www.bruegel.org/nc/blog/detail/article/1585-not-sifis-but-pifis/

Why are Top Tier Audit Failures so Common?

http://neweconomicperspectives.org/2015/03/why-are-top-tier-audit-failures-so-common.html

In the congressional madoff hearings they had the person that had tried unsuccessfully for a decade to get SEC to do something about Madoff. Part of his testimony was that whistleblowers expose 13 times more fraud than audits.

Congress also asked him if new regulation was needed and he replied that while new regulation might be needed, much more important would be transparency and visibility (in part because existing regulations weren't being enforced)

Posted by: Lynn Wheeler at March 10, 2015 11:53 AM