November 08, 2014

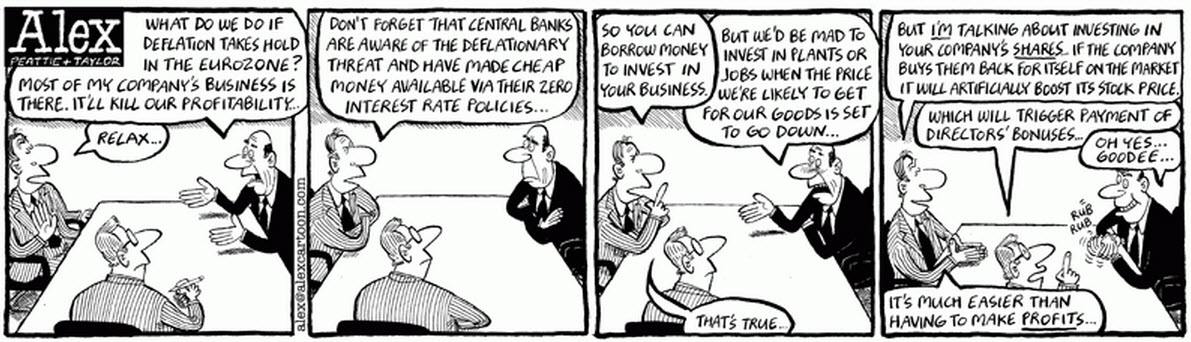

Alex explains ZIRP -- why 7 years of easy central bank money didn't go far

For those who missed out on why the world's combined 7 year money splurge achieved nothing, here's an answer.

ZIRP = zero interest rate policy, as conducted by Federal Reserve and ECB.

Alex's view above is not so far from the truth. The money primarily went into direct speculation into all manner of financial assets, creating a markets bubble that all large financial players benefited from. The easy money went via hedge funds into stock markets, and then into each other's stock price. Hence, financial markets reflected nicely the 'recovery' that was not seen outside the numbers machine.

What is the case is that all the money went into the banks, but did not come out in the form of loans to industry; thus showing that the central bank's interest rate monetary tool is broken in the current financial depression.

Note at one point Bernanke says that he assumed that the "too big to fail" would turn around and lend the FED "free" money to mainstreet ... but they didn't and he had no way to force them to. Note that something similar happened after the '29 crash ... so Bernanke should have known better since one of the qualifications that he supposedly had for FED chairman was expert in the '29 crash.

Posted by: Lynn Wheeler at November 8, 2014 02:53 PMYes, you're absolutely right in that the big question is, why didn't the money move past the banks? Answers I have seen include these:

* the role of ZIRP was directly to float the stock market and not the economy because Fed was paranoid about the value of baby boomer's retirement schemes locked into market valuation.

* the free money handout was a deliberate re-capitalisation of the TBTFs, which were (are) to all intents and purposes insolvent.

But, I suppose, as we don't have our hands on the money pump, it matters rather less what we think about the reasons...

Posted by: Iang at November 8, 2014 03:14 PMNot mentioned as often was that the sellers of "toxic CDOs" were paying the rating agencies for "triple-A ratings" (when they both knew they weren't worth triple-A, from Oct2008 congressional hearing testimony). A big reason for getting the "triple-A" ratings was to open the market for "toxic CDOs" to ('loot') the large institutional retirement funds that were required to only deal in "safe" investments.

Over $27T was done during the bubble:

http://www.bloomberg.com/apps/news?pid=newsarchive&refer=home&sid=a0jln3.CSS6c

During the hearings, business news commentators were saying the rating agencies would avoid federal prosecution because they were able to blackmail the gov. with rating downgrade.

summer/fall of 2008, toxic CDOs were going for 22cents on the dollar. Besides ZIRP for the "too big to fail" ... the FED then starts buying toxic CDOs for 98cents on the dollar.

disclaimer: Jan2009 I was asked to HTML'ize the Pecora Hearings (30s senate hearings into the '29 crash; had been scanned the fall before at Boston Public Library) with extensive internal x-refs and URLs between what happened this time and what happened then (some comment that the new congress might have an appetite to do something). I worked on it for awhile and then got a call saying that it wouldn't be needed after all (some reference to enormous piles of wallstreet money totally burying capital hill).

securitized mortgages had been used during the S&L crisis to obfuscate fraudulent mortgages (but w/o "triple-A rating" ... which limited their market). In the late 90s, we were asked to look at improving the integrity of the supporting documents (as a countermeasure).

However, when they discovered that they could pay the rating agencies for "triple-A rating" ... they found that "triple-A rating" trumps documentation and could do "no-documentation" mortgages ... and of course "no-documentation" mortgages eliminates the requirement for supporting document integrity.

And from the law of unintended consequences ... later they have to setup the document mills in order to fabricate the (fraudulent) documents required for foreclosures.

Posted by: Lynn Wheeler at November 8, 2014 07:26 PMStockman has "stock buybacks" as a mini-form of (private equity) LBOs with hundreds of billions (in stock buybacks) done since start of the century. Private equity LBOs has been compared to house flipping, except the "mortgage" is placed on the books of the sold company (they can even sell for less than they paid and still walk away with boat load of money).

Cheap money for propping up stock market, private equity LBOs and stock buybacks date back at least to "Greenspan PUT" from the late 80s through the 90s.

Bubble bursts in 2008 and then Federal Reserve gives out additional bank charters to wallstreet "too big to fail" (that don't already have them), starts buying trillions in toxic CDOs at 98cents on the dollar and pumping in an additional $6T-10T ZIRP into wallstreet "too big to fail" which turn around and buy US treasuries, taking possibly $200B/annum or more, for the last six years.

GLBA is now better known for repeal of Glass-Steagall and enabling "too big to fail", but rhetoric on floor of congress at the time was its primary purpose was to limit banking competition by not allowing new banking charters (which Federal Reserve theoretical violates giving out new banking charters to some wallstreet "too big to fail").

"too big to fail" also spawns "too big to prosecute" and "too big to jail", which now appears to result in condoning even money laundering for terrorists and drug cartels.

The baseline budget had all federal debt retired in 2010. In 2002, congress allows the fiscal responsibility act to expire (required spending not exceed revenue). In middle of last decade, the comptroller general is including in speeches that nobody in congress is capable of middle school arithmetic for how they are savaging the budget. 2010 CBO report has tax revenues reduced by $6T and spending increased by $6T (compared to baseline) for $12T budget gap (since grown to $17T; which is part of the slight of hand fueling "too big to fail", if there was no federal debt, where would "too big to fail" get their guaranteed income). 2010 report also has $2+T (of the $6T spending increase) going to DOD, $1+T going for the two wars and $1+T that they can't account for.

"too big to fail" during the bubble cleared possibly $4T-$5T in fees and commissions on the $27+T in transactions that flowed through wallstreet. They also get trillions more out of designing (triple-A rated) toxic CDOs to fail, selling them to their customers and then making gambling CDS bets that they would fail.

And The Biggest "Source Of Equity Demand In Recent Years", According To Goldman Sachs, Is...

http://www.zerohedge.com/news/2014-11-09/and-biggest-source-equity-demand-recent-years-according-goldman-sachs

In other words, not only has the Fed made a mockery of fundamentals, the resulting ZIRP tsunami means that corporations can issue nearly-unlimited debt to yield chasing "advisors" managing other people's money, and use it to buyback vast amounts of stock, which brings us to the latest aberation of the New Abnormal: the "Pull the S&P up by the Bootstaps" market, in which the only relevant question is which company can buyback the most of its own stock.

... snip ...

From Stockman (The Great Deformation) pg447/loc9844-46:

The leader was ExxonMobil, which repurchased $160 billion of its own shares during 2004-2011. It was followed by Microsoft at $100 billion, IBM at $75 billion, and Hewlett-Packard, Proctor & Gamble, and Cisco with $50 billion each. Even the floundering shipwreck of merger mania known as Time Warner Inc. bought back $25 billion.

... snip ...

Posted by: Lynn Wheeler at November 9, 2014 08:15 PM