February 26, 2014

How MtGox Failed the Five Parties Governance Test

This was a draft of an article now published in Bitcoin Magazine. That latter is somewhat larger, updated and has some additional imagery.

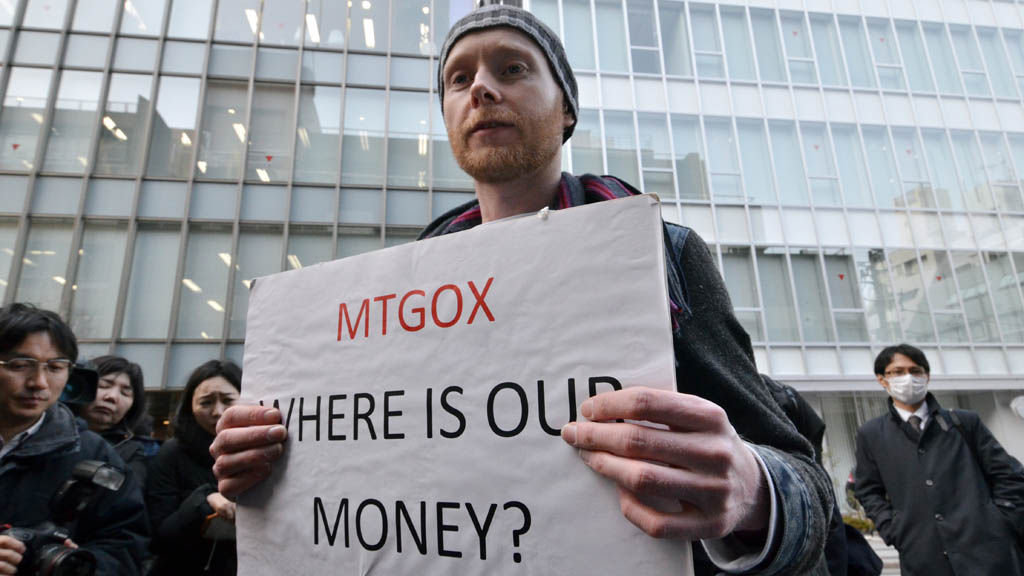

MtGox, the Bitcoin exchange, is in the news again, this time for collapsing. One leaked report maintains that MtGox may only have 2,000 Bitcoins in reserve over against 744,408 BTC in liabilities - which indicates a reserve of less than 1%.

MtGox originally claimed that their troubles stem from a long-term exploit of the evil malleability bug, which was exploited by means of repeated double spending through an algorithm. However a loss of 99.7% of their reserves cannot be attributed to some mere market timing bug. It is clear that the failure of MtGox is a failure of governance.

|

Trust Shall Not Live by Tech Alone

One of the temptations for applied cryptographers is to think that we can solve all problems with clever mathematics and inspired code. Thus there has been much discussion over the past two decades about using cryptography to build trust models that work for untrusted parties over the Internet.

This hope in cryptography is misplaced, and often dangerously so. In the first generation of the Internet, SSL was promoted to solve the trust and security problem. However, it failed to do that. Although it secured the line of communications, it left the end-points open to attack, and failed to solve the problem of knowing who the person at an end-point really is.

As history shows, and MtGox confirms, the end-point security question is by far the dominating one, and thus we saw the rise of phishing attacks, "man in the browser" attacks, and server breaches throughout the 2000's. Yet, SSL remains synonymous with Internet e-commerce security, and its very domination is a blindness that attackers benefit from.

Bitcoin can be broadly described as an attempt to solve the problem of governance of a centralised issuer of currency through technology. By using a common protocol to manage a public blockchain, we can make sure everyone follows the rules and make it technically impossible to issue more Bitcoins than the protocol has decreed shall ever exist.

However, like SSL, Bitcoin's solution to the issuance problem has left open the weaker parts of the system to continued attack. In order to provide useful Bitcoin services, businesses must hold the users' Bitcoins and/or their cash in trust. These businesses, such as exchanges, brokerages, online wallets, retail, etc, are at risk from insider theft, external hacking and loss through poor accounting.

Bitcoin's brilliant design for issuance governance may have obscured a complete lack of protection for end-point governance.

How can a user trust a person to protect his or her value?

This is not a new problem for finance. It is called the "agency problem" in reference to the fact that an agent acts for the user as a trusted intermediary. Institutions in the finance space have been dealing with the issue of trusted intermediaries for millennia. This field is broadly called "governance" and has many well known methods for achieving accountability and reliability for fiduciary institutions.

Drawing from "Financial Cryptography in Seven Layers," Governance includes the following techniques:

- Escrow of value with trusted third parties. For example, funds underlying a dollar currency would be placed in a bank account.

- Separation of powers: routine management from value creation, authentication from accounting, systems from marketing.

- Dispute resolution procedures such as mediation, arbitration, ombudsman, judiciary, and force.

- Use of third parties for some part of the protocol, such as creation of value within a closed system.

- Auditing techniques that permit external monitoring of performance and assets.

- Reports generation to keep information flowing to interested parties. For example, user-driven display of the reserved funds against which a currency is backed.

As technologists, we strive to make the protocols that we build as secure and self-sustaining as possible; our art is expressed in pushing problem resolution into the lower layers. This is an ideal, however, to which we can only aspire; there will always be some value somewhere that must be protected by non-protocol means.

Our task is made easier if we recognise the existence of this gap in the technological armoury, and seek to fill it with the tools of Governance. The design of a system is often ultimately expressed in a compromise between Governance and the lower layers: what we can do in the lower layers, we do; and what we cannot is cleaned up in Governance.

The question then is how to bring those practices into a digital accounting and payment system.

To address this weakness of customer escrowed funds, back in the late 1990's we developed a governance technique for digital currency that we called the "Five Parties Governance Model." (This model was built into the digital currency platform that we designed for exchange, called "Ricardo".)

The five parties model shares the responsibility and roles for protection of value amongst five distinct parties involved in the transactions. Although originally designed to protect an entire digital issuance, a problem that Bitcoin addressed with its public blockchain and its absence of an asset redemption contract, this technique can be broadly applied to many problems such as that which has brought MtGox down.

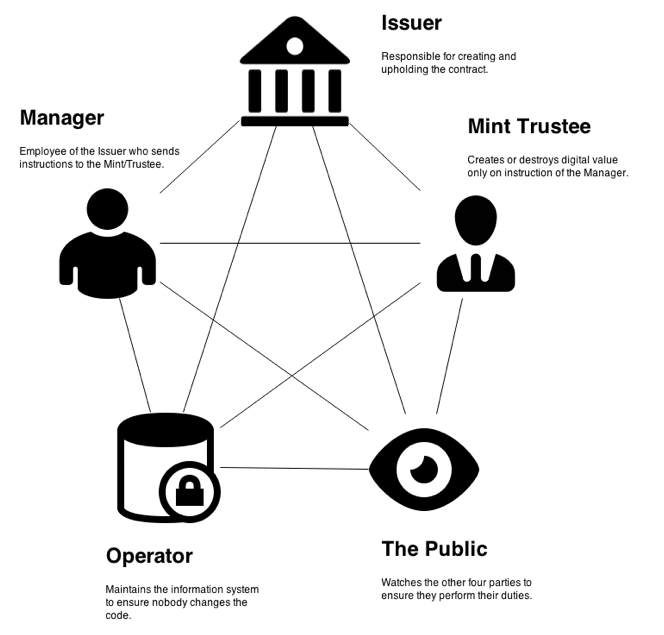

The Five Parties Model (5PM)

In terms of a cryptocurrency issuance with a single issuer (Ricardo model), the Five Parties Model looks like this (Figure 1).

|

Issuer. The Issuer is the institution guaranteeing the contract with the User. This is the person or entity ultimately responsible for the assets and whether the governance succeeds or fails.

In the present case, MtGox is the contractual party that is guaranteeing to deliver an exchange of value, and in the mean time keep those values secure. In Ricardo the Issuer is the party who defines and offers the contract for a particular issuance, which contract creates the rules that govern the five parties.

As can be seen from the following screen capture taken from the Internet Archive, MtGox did in fact have a contract with the users to fully reserve their internal Bitcoin and currency accounts:

|

However, as an Issuer, MtGox appears to have failed to implement internal controls to put the other four parties into place.

Trustee. In a digital value scenario, there is always a Trustee role that controls creation or release of long-term funds. For MtGox, this Trustee might be the person who signs off on outgoing wires and outgoing Bitcoin payments, or it might be the person who creates or deletes the derivative monetary units (BTC,LTC,EUR,USD,etc) inside the exchange's books.

For a cryptocurrency that contracts to an underlying asset, the Trustee's account, sometimes known as the Mint account, is the only one that has the ability to create or destroy digital units of value, as that underlying asset pool increases or decreases. For a cryptocurrency without a contractual underlying, the protocol itself can stand in the person's stead by employing an algorithm such as Bitcoin's mining rewards program.

Manager. The manager is the person or entity, usually an employee of the Issuer, who asks the Trustee to perform the big controlled operations: create or destroy digital assets, or deposit or withdraw physical ones, in order to reflect the overall pattern of trading activities.

The Manager typically works on a daily trading basis. As funds come in and go out, some of these request match each other. For a perfect balance, nothing needs to be done, but normally there is an overall flow in one direction or another. As trading balances build up or draw down, the Manager asks the Trustee to authorise the conversion of daily trading assets against the long-term reserves.

In the MtGox context, when BTC is flowing out and cash is flowing in, the Manager would ask the Trustee to release the BTC from the cold wallets, and would deliver cash into the long-term sweep accounts held at bank under the Trustee's control. The Trustee would control that action by looking at the single transfer into the sweep account to confirm the transaction is backed by assets.

In the context of an issuance of digital gold, the Manager might receive an inflow of a 1kg physical bar. The Manager must bail the physical gold into the vault, and present the receipt to the Trustee. With that receipt in hand, and any other checks desired, the Trustee can now release 1kg of freshly-minted digital gold to the Manager's Account.

The Manager is in this way guarded by the Trustee, but it works the other way as well. In a well-governed system, the Trustee can only direct value to be sent to the Manager. In this way, the Trustee cannot steal the value under trust, without conspiring with the Manager; a well-run business will keep these two parties at a distance and bound to govern each other by various techniques such as professional conduct codes.

For example, Ricardo has an ability to lock the Mint's account together with the Manager's account in this fashion. Bitcoin lacks account-control features, but there is no reason that MtGox could not have implemented account-control for their internal Bitcoin accounts.

Operator / Escrow / Vault. For a cryptocurrency, the operator is the part of the business ensuring that the servers and the software are running and properly doing their job. By outsourcing this to a third party, we add another degree of separation of powers to the governance model.

In the case of Ricardo and similar contractually-controlled issuances, there is generally a single server cluster that maintains the accounts. The sysadmin for this server controls the accounts and ensures that no phantom accounts or transactions are let in; software designs assist by including techniques such as triple entry accounting, which guarantees that only original users can create signed instructions to transfer value with their private keys.

For the physical side of a digital issuance such as gold, a vault fills the operator role. In the case of GoldMoney.com the vault operator is ViaMat. They don't do anything with the client's gold unless they receive a signed instruction from the Trustee. They just keep thieves from physically stealing it.

Bitcoin is very different in this respect in that it creates the public blockchain as the accounting mechanism. In this case, the operator role is not outsourced to one party, rather it is spread across the miners, the software and the development team, presenting a very strong governance equation over operator malfeasance.

For a business such as MtGox, the operators or escrows are two-fold. On the one part is the bank providing accounts, and especially the primary account holding long term cash reserves. On the other part, as an exchange provider, is the set of cold wallets holding long term BTC.

The Fifth Party - The Public as Auditor. The final and most important element of the Five Parties Model is the role of the Public as auditor.

Typically, the role of audit is to examine the books to validate that the other parties are indeed doing their job. As is covered elsewhere (Audit), paid auditors have a long-term conflict of interest, which has been at the root of several notable disasters in the last decade - the failure of Enron, the wholesale bankruptcy of banking in 2007 financial crisis, the collapse of AIG, none of which auditors rang the bell for.

Auditors, as well as being conflicted, are also expensive, which leads to the search for alternates. Once we have mined the cryptographic techniques available to us, we are still left with a set of things we cannot control so easily. What then?

Introducing you, the user, or the Public. You do not have a conflict of interest, in that it is your value at risk, and you have a strong interest in seeing that the other four parties are doing their job properly. Which then begs the question of how you, the public, can audit anything, when audit almost by definition means seeing that which cannot be seen?

The answer is to make that which was previously unseen, seen. Some examples of digital currencies that have supported audit by you the Public include:

- e-gold.com published a real time balance sheet of their digital issuance.

- Goldmoney.com publishes their physical gold as held by their vault operators, and auditors publish the monthly report.

- Bitcoin publishes the blockchain.

- Ricardo publishes the balances of the Trustee and Manager accounts.

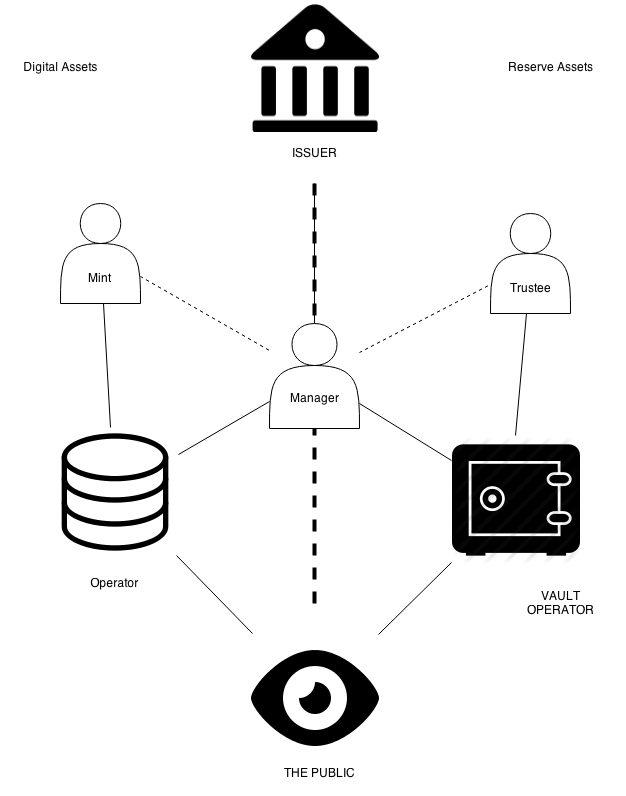

Two-Sided Variation on the Five Parties Model

The Five Parties Model is just and exactly that - a model. Which means there are variations and limitations, and a business must modify it to suit. For example, many businesses in the space have not one but two bases of value to control: an underlying asset and a digital issuance. Bitcoin Exchanges fall into this category, for example.

When an Issuer is backing the digital currency with a reserve asset, both of these assets need to be protected. To do this, we utilise two instances of the Five Parties Model in a mirrored pair. In each, the Issuer and the Public act as parties on both sides, whereas the Trustee, the Operator and the Manager may be duplicated (or not). Figure 3 shows an arrangement where a single Manager works with mirrored Operators and Trustees.

|

An exchange such as MtGox would have had an even more complicated regime. For every one of their assets - BTC, Altcoins, USD, EUR, JPY, etc, they would have needed to delegate operators, trustees and managers. We as users expect they did that, which then leaves us with a question -- what went wrong?

MtGox Failed Because Nobody Was Watching Them

We can now measure MtGox against the governance picture drawn above. Although originally developed for an issuance, the model applies wherever there is an important asset to protect.

As a business, the role of Issuer is relatively easy to identify - the company MtGox itself. Their terms and conditions constituted a clear contract between themselves and the users, where MtGox would hold the user's Bitcoin assets in reserve.

Likewise, the Operator for cash is clear: the banks holding the long-term value are presumably identifiable via incoming and outgoing wires. MtGox had transactions going in and out for some time, so Managers are in evidence. The Operator for the long-term BTC cold wallets is the Bitcoin network itself.

What about Trustees? Although MtGox has repeatedly placed blame on their in-house operations team for various hacks and bugs, it is rather more likely that they fell short on the appointment and management of Trustees.

Somehow, the Management created for themselves 744,408 BTC on their internal books against an underlying reserve of only 2,000 actual Bitcoins, which should have been an obvious disaster to all. If this is the case, this suggests that no Trustees were appointed at all, and Managers were essentially uncontrolled.

Finally, the Public as auditor is not in evidence. MtGox on their website did not show the balances of any of their major asset classes, nor provide any easy way to ensure that their parties are doing their job.

Ideally, MtGox would have displayed a balance sheet with references to cold wallets on one side, and their internal Bitcoin/Altcoin balances on the other side. The former is checkable via the blockchain, the latter could be made available by the operator, and periodically audited to ensure the code providing the balance query was accurate.

With this information, you the Public as individuals or as media or other observers can verify that things are as they should be, and if not, sound the alarm! That's what Twitter is for, that's what sites such as DGCMagazine.com, CoinDesk.com and Bitcoin Magazine are for.

Under such circumstances failure might be expected and indeed may be inevitable. As MtGox did not have a sufficient governance model in place, we might have been disconcerted to learn that more than $300 million worth of Bitcoin managed to disappear, but we should also be aware that we may ultimately blame our own failure to insist on good governance.

What other players in the Bitcoin world will fall for the same lack of care? You, the fifth party, the auditing Public would be well advised to review all of your Bitcoin partners to see what forms of governance they use, and to choose wisely. It is your value at risk, and demanding quality governance such as is outlined above is your right.

Posted by iang at February 26, 2014 04:56 PM | TrackBackWith Bitcoin rapidly gaining an increasing amount of global exposure and use, it is imperative that its community and user base are given peace of mind in knowing that the many beloved services and exchanges that they use everyday are fully solvent and transparent.

Our API has been updated to include proof of our reserves, now displaying each escrow address that is currently in use. Users can now verify for themselves that BitQuick.co has all listed funds accounted for, and is not running a fractional reserve.

We strive to offer a quick, convenient, and safe service for buyers and sellers to trade Bitcoin. We believe that by being able to view our escrow addresses, users will be able to feel confident that they are using a legitimate and professional platform.

...

The world's biggest Bitcoin exchange recently declared bankruptcy, with close to $400M in Bitcoins missing. There has been much talk about what may have happened at Mt.Gox, with speculations running wild. I want to quickly go over what did not happen at Mt. Gox, and how to avoid that which did happen in the future. ....

Posted by: What didn't happen... at March 4, 2014 06:34 AMYou wrote:

"MtGox Failed Because Nobody Was Watching Them"

You are right. But Wall Street could not care less about supervision because all regulatory bodies consistantly look elsewhere, before, during, and after the fraud.

What you are trying to address here is TRUST.

Cryptography SHOULD be used in a way to ENFORCE UNBREAKABLE TRUST rather than to delegate it to "trusted" but untrustworthy people.

Failure to do so will inevitably cast a false sense of security and a justified shadow of doubt on the system after it has been abused again.

Posted by: trust at March 7, 2014 11:44 AM