January 20, 2014

Digital Currencies get their mojo back: the Ripple protocol

I was pointed to Ripple and found it was actually a protocol (I thought it was a business, that's the trap with slick marketing). Worth a quick look. To my surprise, it was actually quite neat. However, tricks and traps abound, so this is a list of criticisms. I am hereby going to trash certain features of the protocol, but I'm trying to do it in the spirit of, please! Fix these things before it is too late. Been there, got the back-ache from the t-shirt made of chain mail. The cross you are building for yourself will be yours forever!

I was pointed to Ripple and found it was actually a protocol (I thought it was a business, that's the trap with slick marketing). Worth a quick look. To my surprise, it was actually quite neat. However, tricks and traps abound, so this is a list of criticisms. I am hereby going to trash certain features of the protocol, but I'm trying to do it in the spirit of, please! Fix these things before it is too late. Been there, got the back-ache from the t-shirt made of chain mail. The cross you are building for yourself will be yours forever!

Ripple's low level protocol layout is about what Gary Howland's SOX1 tried to look like, with more bells and whistles. Ripple is a protocol that tries to do the best of today's ideas that are around (with a nod towards Bitcoin), and this is one of its failings: It tries to stuff *everything* into it. Big mistake. Let's look at this with some choice elements.

Numbers: Here are the numbers it handles:

1: 16-bit unsigned integer

2: 32-bit unsigned integer

3: 64-bit unsigned integer

6: Currency Amount

16: 8-bit unsigned integer

17: 160-bit unsigned integer

Positive. One thing has been spotted and spotted well: in computing and networking we typically do not need negative numbers, and in the rare occasions we do, we can handle it with flags. Same with accounting. Good!

Now, the negatives.

First bad: Too many formats! It may not be clear to anyone doing this work de novo, but it is entirely clear to me now that I am in SOX3 - that is, the third generation of not only the basic formats but the suite of business objects - that the above is way too complicated.

x.509 and PGP formats had the same problem: too many encodings. Thinking about this, I've decided the core problem is historical and philosophical. The engineers doing the encodings are often highly adept at hardware, and often are seduced by the layouts in hardware. And they are often keen on saving every darn bit, which requires optimising the layout up the wazoo! Recall the old joke, sung to the Monty Python tune:

Every bit is great,

If a bit gets wasted,

God gets quite irate!

But this has all changed. Now we deal in software, and scripting languages have generally pointed the way here. In programming and especially in network layouts, we want *one number*, and that number has to cope with all we throw at it. So what we really want is a number that goes from 0 to infinity. Luckily we have that, from the old x.509/telco school. Here's a description taken from SDP1:

Compact Integer A Compact Integer is one that expands according to the size of the unsigned integer it carries. ...

A Compact Integer is formed from one to five bytes in sequence. If the leading (sign) bit in each byte is set, then additional bytes follow. If a byte has the sign bit reset (0) then this is the last byte. The unsigned integer is constructed by concatenating the lower order 7 bits in each byte.

A one byte Compact Integer holds an integer of 0 to 127 in the 7 lower order bits, with the sign bit reset to zero. A two byte Compact Integer can describe from 128 to 16383 (XXXX check). The leading byte has the sign bit set (1) and the trailing byte has the sign bit reset (0).

That's it (actually, it can be of infinite length, unlike the description above). Surprisingly, everything can be described in this. In the evolution of SOX, we started out with all the above fields listed by Ripple, and they all fell by the wayside. Now, all business objects use CompactInts, all the way through, for everything. Why? Hold onto that question, we'll come back to it...

Second bad: Let's look at Ripple's concept of currencies:

Native CurrencyNative amounts are indicated by the most-significant bit (0x8000000000000000) being clear. The remaining 63 bits represent a sign-and-magnitude integer. Positive amounts are encoded with the second highest bit (0x4000000000000000) set. The lower 62 bits denote the absolute value.

Ripple/IOU Currencies

Amounts of non-native currencies are indicated by the most-significant bit (0x8000000000000000) being set. They are encoded as a 64-bit raw amount followed by a 160-bit currency identifier followed by a 160-bit issuer. The issuer is always present, even if zero to indicate any issuer is acceptable.

The 64-bit raw amount is encoded with the most-significant bit set and the second most significant bit set if the raw amount is greater than zero. If the raw amount is zero, the remaining bits are zero. Otherwise, the remaining bits encode the mantissa (between 10^15 and 10^16-1) and exponent.

Boom! *Ripple puts semantics into low level syntax*. Of course, the result is a mess. Trying to pack too much business information into the layout has caused an explosion of edge cases.

What is going on here is that the architects of ripple protocol have not understood the power of OO. The notion of a currency is a business concept, not a layout. The packets that do things like transactions are best left to the business layer, and those packets will define what a currency amount means. And, they'll do it in the place where limits can be dealt with:

RationaleThe Ripple code uses a specialized internal and wire format to represent amounts of currency. Because the server code does not rely on a central authority, it can have no idea what ranges are sensible with currencies. In addition, it's handy to be able to use the same code both to handle currencies that have inflated to the point that you need billions of units to buy a loaf of bread and to handle currencies that have become extremely valuable and so extremely small amounts need to be tracked.

The design goals are:

Accuracy - 15 decimal digits

Wide representation range - 10^80 units of currency to 10^-80 units

Deterministic - no vague rounding by unspecified rules.

Fast - Integer math only.

(my emphasis) They have recognised the problems well. Now come back to that question: why does SOX3 use CompactInts everywhere? Because of the above Rationale. In the business object (recall, the power of OO) we can know things like "billions of units to buy a loaf of bread" and also get the high value ones into the same format.

Next bad: Contractual form. This team has spotted the conundrum of currency explosion, because that's the space they chose: everyone-an-issuer (as I termed it). Close:

Custom CurrenciesCurrency 160-bit identifier is the hash of the currency definition block, which is also its storage index. Contains: Domain of issuer. Issuer's account. Auditor's account (if any). Client display information. Hash of policy document.

So, using the hash leads to an infinite currency space, which is the way to handle it. Nice! Frequent readers know where I'm going with this: their currency definition block is a variation of the Ricardian Contract, in that it contains, amongst other things, a "Hash of the policy document."

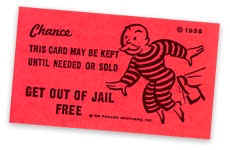

It's very close, it's almost a good! But it's not close enough. One of the subtleties of the Ricardian Contract is that because it put that information into the contract, *and not in some easily cached record*, it forced the following legal truth on the entire system: the user has the contract. Only with the presence of the contract can we now get access to data above, only with the presence of the contract can we even display to the user simple things like decimalisation. This statement -- the user has the contract -- is a deal changer for the legal stability of the business. This is your get out of jail free card in any dispute, and this subtle power should not be forgone for the mere technical benefit of data optimisation of cached blocks.

Next bad:

There are three types of currencies on ripple: ripple's native currency, also known as Ripples or XRP, fiat currencies and custom currencies. The later two are used to denominate IOUs on the ripple network.Native currency is handled by the absence of a currency indicator. If there is ever a case where a currency ID is needed, native currency will use all zero bits.

Custom currencies will use the 160-bit hash of their currency definition node as their ID. (The details have not been worked out yet.)

National currencies will be handled by a naming convention that species the three-letter currency code, a version (in case the currency is fundamentally changed), and a scaling factor. Currencies that differ only by a scaling factor can automatically be converted as transactions are processed. (So whole dollars and millionths of a penny can both be traded and inter-converted automatically.)

What's that about? I can understand the decision to impose one microcurrency into the protocol, but why a separate format? Why four separate formats? This is a millstone that the software will have to carry, a cost that will drag and drag.

There is no reason to believe that XRP or Natives or Nationals can be handled any differently from Customs. Indeed, the quality of the software demands that they be handled equivalently, the last thing you want is exceptions and multiple paths and easy optimisations. indeed, the concept of contracts demands it, and the false siren of the Nationals is just the journey you need to go on to understand what a contract is. A USD is not a greenback is not a self-issued dollar is not an petrodollar, and this:

Ripple has no particular support for any of the 3 letter currencies. Ripple requires its users to agree on meaning of these codes. In particular, the person trusting or accepting a balance of a particular currency from an issuer, must agree to the issuer's meaning.

is a cop-out. Luckily the solution is simple, scrap all the variations and just stick with the Custom.

Next: canonical layouts. Because this is a cryptographic payment system, in the way that only financial cryptographers understand, it is required that there be for every element and every object and every packet a single reliable canonical layout. (Yeah, so that rules out XML, JSON, PB, Java serialization etc. Sorry guys, it's that word: security!)

The short way to see this is signing packets. If you need to attach a digital signature, the recovery at the other end has to be bit-wise perfect because otherwise the digital signature fails.

We call this a canonical layout, because it is agreed and fixed between all. Now, it turns out that Ripple has a canonical layout: binary formats. This is Good. Especially, binary works far better with code, quality, networking, and canonicalisation.

But Ripple also has a non-canonical format: JSON. This is a waste of energy. It adds little benefit because you need the serialisation methods for both anyway, and the binary will always be of higher quality because of those more demanding needs mentioned above. I'd say this is a bad, although as I'm not aware of what they benefit they get from the JSON, I'll reserve judgement on that one.

Field Name Encodings -- good. This list recognises the tension for security coding. There needs to be a single place where all the tags are defined. I don't like it, but I haven't seen a better way to do this, and I think what we are seeing here in the Field Name Encodings' long list of business network objects is just that: the centralised definition of what format to expect to follow each tag.

Another quibble -- I don't see much mention of versions. In practice, business objects need them.

Penultimate point, if you're still with us. Let's talk layering. As is mooted above, the overall architecture of the Ripple protocol bundles the business information in with the low level packet stuff. In the same place as numbers, we also have currencies defined, digital signing and ledger items! That's just crazy. Small example, hashes:

4: 128-bit hash

5: 256-bit hash

And then there is the Currency hash of the contract information, which is a 160-bit encoding... Now, this is an unavoidable tension. The hash world won't stay still -- we started out with MACs of 32 bytes, then MD5 of 128 bits, SHA1 of 160 bits, and, important to realise, that SHA1 is deprecated, we now are faced with SHA2 in 4 different lengths, Keccak with variable length sponge function hashes, and emerging Polys of 64 bits.

Hashes won't sit still. I've also got in my work hash truncations of 48 bits or so, and pretend-hashes of 144 bits! Those latter are for internal float accounts for things like Chaumian blinded money (c.f., these days ZeroCoin).

So, Hashes are as much a business object decision as anything else. Hashes therefore need to be treated as locally designated but standardised units. Just setting hashes into the low layer protocol isn't the answer, you need a suite of higher level objects. The old principle of the one true cipher suite just doesn't work when it comes to hashes.

One final point. In general, it has to be stressed: in order to do network programming *efficiently* one has to move up the philosophical stack and utilise the power of Object Oriented Programming (used to be called OOP). Too many network protocols fall into a mess because they think OOP is an application choice, and they are at a lower place in the world. Not so; if there is anywhere that OOP makes a huge difference it is in network programming. If you're not doing it, you're probably costing yourself around 5 times the effort *and reducing your security and reliability*. That's at least according to some informal experiments I've run.

Ripple's not doing it, and this will strongly show in the altLang family.

(Note to self, must publish that Ouroboros paper which lays this out in more detail.)

Posted by iang at January 20, 2014 03:31 AM | TrackBackDid you send any/all of this commentary to the Ripple Labs people? They've been fairly responsive to me asking dumb questions so I would hope they might be able to respond to some of this if you asked them about it? Certainly I'm curious if they'd thought about this and what answers they arrived at.

Posted by: Russell at March 23, 2014 02:25 PM