November 19, 2013

Bitcoin and how to integrate it into society

Notwithstanding all the bad news I reported yesterday, Bitcoin moves from strength to strength. It hit $1000 in turbulent trading today -- more in China -- and recently surpassed an exaFLOPS in capacity. It's important to analyse both sides of the coin, so to speak, unless one has resigned ones intellectual fate to being an unremitting fan or unrepentant opponent.

Notwithstanding all the bad news I reported yesterday, Bitcoin moves from strength to strength. It hit $1000 in turbulent trading today -- more in China -- and recently surpassed an exaFLOPS in capacity. It's important to analyse both sides of the coin, so to speak, unless one has resigned ones intellectual fate to being an unremitting fan or unrepentant opponent.

(This essay is written to help me get my thoughts in order for Wednesday's Afrikoin conference, where I'm speaking at a panel on Bitcoin and cryptocurrencies in the African context.)

As an economy, the major problem with Bitcoin is trust. The design of a new money system always lives or dies on whether the end-user can trust the results of a transaction. Technically, we can see that Bitcoin does a single transfer of value from Alice to Bob with some sort of aplomb, but this is not enough to gain the trust of the end-user.

A transaction is generally bi-directional. In this case, Bitcoin moves from Alice to Bob, but something also comes back. And it is in the something coming back that Bitcoin struggles.

Let's talk about classical trust mechanisms so we can get a feel for this. When you walk down the street in a strange town, you know you can walk into a shop and buy things -- engage in a bidirectional trade with some currency. This works because the shop is going to be there tomorrow and the day afterwards -- if the shop rips off its customers, the customers will eventually gang up and destroy the shop. Even if you haven't visited the town before, location is a trust signal, permanence is a trust reinforcer, busy custom is a sign of others' trust.

Likewise, when you deal with greenbacks, you know that at the end of the day, there are 300 million Americans that will take them. And, those 300 million know that at the end of the day, their government will take them back in taxes.

There are many other trust mechanisms; but let's turn back to Bitcoin. What makes trade in it trustworthy? Not a lot. There is no statement of value; this is the same weakness that makes PGP's Web of Trust no more than a curiosity. There is no big brother standing behind it, it doesn't look like a national currency. There is no sense of permanence like a brick&mortar shop, and there have already occurred a hundred or so copycat competitors, many of whom have already folded. It is unlike gold with its ancient history of cross-cultural acceptance. There is no sense of the other person you're dealing with, and indeed there is a designed absence of sense -- the unit is supposed to be psuedonymous, which means you're dealing with a key not a person.

Keys don't make deals, people do.

For trust in Bitcoin, there is only supply and demand, which reduces the unit to the trials and tribulations of the market, with no "underlying" or strength. We have a name for that: speculation, as opposed to investment. Bubbles and Ponzies are other words that are bandied around, with more or less stickiness. Either way, this lack of foundation generally means that Bitcoin is not good for long term trade; you can't price ordinary goods in Bitcoin for example, because the price keeps going up, and down.

So, as a rule of the Bitcoin economy, in participating in bidirectional trades, one has to build ones own trust system in.

As a rather good example, this is exactly what the Silk Road did! Bonds were required of newcomers, and funds were held in escrow until delivery of goods were effected. Silk Road worked, trust was maintain, and deals were done.

At least in its short lifespan, before the trust was irrevocably undermined by the attention of the Feds. It's important to understand that whatever you think about the political or legal questions surrounding the capture of the owner and the closing of the market, its demise is synonymous with, or equivalent to, the end of its offer of trust -- its ability to ensure a safe bidirectional trade.

Fans would say that Bitcoin carefully separates out the trust equation from the payments equation, allowing us to build it later in markets like the Silk Road; opponents would say it is fundamentally untrustworthy, I would prefer to say that trust in Bitcoin is unfinished business.

Fans would say that Bitcoin carefully separates out the trust equation from the payments equation, allowing us to build it later in markets like the Silk Road; opponents would say it is fundamentally untrustworthy, I would prefer to say that trust in Bitcoin is unfinished business.

So how do we finish that which is missing? How do we add the trust back into Bitcoin, or in more accepting terms, how do we augment it with the missing pieces?

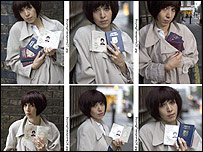

One normal trust mechanism that businesses do is an old and boring one: collect the details of who the person is, commonly by looking at their passports/national Ids. There are many pros & cons to this method. For many sectors and trades, it is a waste of money, and an invitation to deception, whereas for others it is a leveraging of the state's identity-trust model, for near-free. And, as we've seen, this method leads to the death of privacy as thousands of marketing businesses and dozens of intelligence agencies aggregate your personal life, starting with your ID.

Bad as identity is, it's worth mentioning because for every finance business that needs to make its peace with a nearby government, this is likely what has to be done, whether they like it or not. It is a trust mechanism, or enough of one for many milder purposes, and it is going to be imposed over Bitcoin to a large extent if & when governments figure out what to do.

Pros and cons! How would we then mitigate the many cons to mass identity collection? What about localised circles of trust -- instead of a global facebook for money, perhaps a google-circles for shared wealth? We could share the information locally in small enough circles such that the trust can be vectored to where it is needed, but there is no necessary or single weakness that can be attacked, that inevitably brings the system down.

This is indeed what I'm doing in my business right now. Building a pure transaction system like Bitcoin (which I called Ricardo) was what I did a long time ago; for many years now I've been building trust systems, which is proving to be far more challenging because people are directly involved in ways that they aren't with mere transactions.

Which leads me to my final point: *Trust is people-centric*. Payment systems aren't, they are transaction-centric. Bitcoin takes this separation to new levels by reducing even the Issuer to a non-person called a block-chain, in a sense it is pushing further and further

Which leads me to my final point: *Trust is people-centric*. Payment systems aren't, they are transaction-centric. Bitcoin takes this separation to new levels by reducing even the Issuer to a non-person called a block-chain, in a sense it is pushing further and further

In contrast, the same process I took in building this trust system, which is now in place, applies both to my Ricardo and to Satoshi's Bitcoin. If you meld a payment system with a trust system, what you get is a working economy. But the challenge is not the payment system, it's definitely the trust system.

Adding Bitcoin to our system then will be fairly easy -- and *worthy of trust*. Which might propose yet another benchmark to Bitcoin. When you hear about us offering Bitcoin, that might signal that there is sufficient demand *in mainstream marketplace* for it. We can do it easily because we have the trust. Watch this space?

Posted by iang at November 19, 2013 03:33 PM | TrackBackTrust requires a protocol which is where the 'Guarantee Society' (people-based credit) and 'Capital Partnership' (asset-based credit) agreements may come in.

Within the above trust protocol the Bitcoin blockchain may be based - through a suitable Ricardian instrument (Prepay) - upon 'use value over time' (Utility). This enables the creation of undated prepay credits capable of being objectively priced against a meaningful unit of account.

In my analysis the use over time of Location, Energy, Intellect are all valuable in exchange by reference to a standard unit of energy.

ie an Energy Standard

But there are other types of value, with different metrics: eg Care, and Reputation.

Posted by: Chris Cook at November 19, 2013 06:42 AMYou say *Trust is people-centric*, which is true as far as it goes. I would rather say say *Trust is relationship-centric* within a network of people. This is the same as in physics, in which it is understood that matter may be described both as particles (e.g. atomic nuclei) and as waves (e.g., shared electrons forming molecular bonds); particles correspond to people and waves correspond to relationships. This perspective makes visible a broader range of shared values-in-action that build these relationships. Generalized wealth-in-relationship is the capacity and strength of these relationships, based upon shared principles and values, which may include include property & demand-power, reciprocity & solidarity, reputation & trust, identity & sovereignty, etc. So trust is one of many kinds of wealth, and it inheres in the network of relationships. When we rely upon the transparency of the network in order estimate its inherent overall trust-as-wealth, then privacy becomes a serious issue, as you point out. However, if we focus more on building our personal relationships within the network, then we may consider trust more locally, and then I think privacy remains possible.

Posted by: Geoff at November 19, 2013 12:16 PM