March 18, 2013

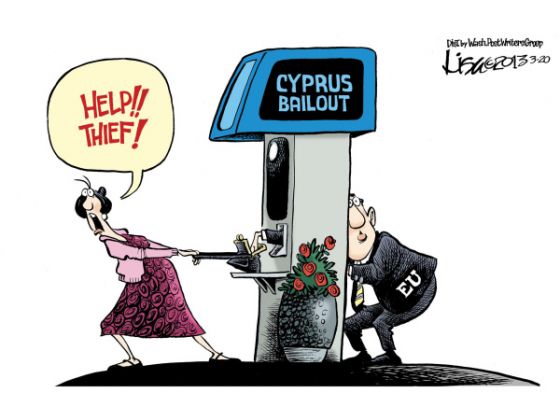

Cyprus deposit holders to take a 7-10% loss -- perversely this the right Cure, and it may Kill the Patient

News over the weekend has it that Cyprus has agreed to a bailout, but in exchange for the most terrible of conditions: Cypriot depositors are to be taxed at rates from 6.75% to 9.9% of their deposits.

News over the weekend has it that Cyprus has agreed to a bailout, but in exchange for the most terrible of conditions: Cypriot depositors are to be taxed at rates from 6.75% to 9.9% of their deposits.

This is utter madness, and the reasons are legion. Speaks the Economist:

EVERYONE agrees that taxpayers should be protected from the cost of bailing out failing banks. But imposing blanket losses on creditors is still taboo. Depositors have escaped the financial crisis largely unscathed for fear of sparking panic, which is why the idea of hitting uninsured depositors in Cypriot banks has caused policymakers angst.

You muck around with deposit holders or your own people at your peril. There is now a fair chance of a bank run in Cyprus, and a non-trivial chance of riots.

Further, the bond holders don't get hit. Not even the unprotected ones!

Worse, yet, the status of deposit is enshrined in a century of law, decisions and custom. It is not going to be clear for years whether the law will sustain ahead of legal challenges. Consider the mess about Greek bonds in London, and that allegedly big powerful Russian oligarchs are involved? A legal challenge is a dead certainty.

Finally, and what is the worst reason of all - the signal has been sent. What happened to the Cypriots can and will happen to the Spanish. And the Italians. And if them, the French. And finally, those safe in the north of Europe will now see that they are not safe.

The point is not whether this will happen or not: the point is whether you as an individual saver wish to gamble your money in your bank that it won't happen?

The direction of efforts to improve banks’ liquidity position is to encourage them to hold more deposits; the aim of bail-in legislation planned to come into force by 2018 is to make senior debt absorb losses in the event of a bank failure. The logic behind both of these reform initiatives is that bank deposits have two, contradictory properties. They are both sticky, because they are insured; and they are flighty, because they can be pulled instantly. So deposits are a good source of funding provided they never run. The Cyprus bail-out makes this confidence trick harder to pull off.Other than that, it is a really good deal.

In short words, Cyprus bail out means: start a run on European banks. Only time will tell how this goes on.

What's to take solace? Perversely, there is an element of justice in this decision. Moral hazard is the problem that has pervaded the corpus bankus for a decade now, and has laid low the financial system.

Moral hazard has it that if you fully insure the risk, then nobody cares. And indeed, nobody in the banking world cares, it seems, since they've all acquired TBTF status. None of the people care, either, as they happily deposited at those banks, even knowing that the financial sector of Cyprus was many times larger.

Go figure ... here comes a financial crisis, and our banks are bigger than our country? What did the Cypriot people do? Did they join the dots and wind back their risk?

However the figures are massaged down, the nub of the problem will remain: a country with a broken banking model. Unlike Greece, brought low by its unsustainable public finances, Cyprus has succumbed to losses in its oversize banks. By mid-2011 the Cypriot banking sector was eight times as big as GDP; its three big commercial banks were five times as large.

No. Moral hazard therefore has it the stakeholders must be punished for their errors. And the stake holders of last resort are the Cypriot people, or at least their depositors. And their pensioners, it seems:

In practice the main answer will be to dragoon Cyprus’s pension funds and domestic banks into financing the €4.5 billion of government bonds due to be redeemed over the next three years.

It is highly likely that Cypriot pensioners will lose the lot, as it worked for Spain.

Which does nothing to obviate the other arguments listed above. Regardless of this sudden and surprising display of backbone by the Troika, it is still madness. While we may actually be on the cusp of cure to the disease, the patient might die anyway.

European leaders could at long last bite the bullet and insist on a bail-in of bank creditors to cover expected losses. The snag is that any such action would set alarm-bells ringing for investors with serious money at stake in banks elsewhere in the euro area. Mario Draghi, the ECB’s president, said on March 7th that “Cyprus’s economy is a small economy but the systemic risks may not be small.”

Watch Cyprus with interest, as if your future depends on it. It does.

Posted by iang at March 18, 2013 07:02 AM | TrackBackOn writing this rant, I had thought I had figured it out. Then, on re-reading the Economist articles that I'd read last night, I reached another conclusion: the Economist had nailed it, and I'd just absorbed their arguments without noticing.

Hat tip to them. Read all 4 articles.

Posted by: Iang (the Economist nails Cyprus) at March 18, 2013 07:30 AM